Ethereum price explodes past $1,900, will ETH climb higher before Shanghai upgrade

- Ethereum network’s upcoming blockchain upgrade, the Shanghai hard fork could likely be a “sell-the-news” event or non-event.

- Ethereum price hit a new yearly high at $1,911, a week ahead of the hard fork.

- ETH price could retrace to support at $1,800 level, or plummet lower in the correction post the hard fork.

Ethereum hit a new yearly high as the price climbed above the $1,900 level for the first time in a year. ETH holders await the Shanghai hard fork scheduled for April 12 and a rally in the altcoin close to the event signals the likelihood of the upgrade being a “sell-the-news” event.

Also read: Ethereum Improvement Proposal EIP-4844 turns experts bullish, will ETH price rally?

Ethereum price rallies ahead of Shanghai hard fork

Ethereum, the second-largest altcoin by market capitalization witnessed a spike in its price earlier today. ETH price climbed consistently since mid-December 2022, pushing the altcoin to a new yearly peak of $1,911, based on data from CoinGecko.

ETH/USD 4H price chart

The ETH holder community is waiting for the launch of the Shanghai and Capella upgrades, together known as the Shapella, on April 12. Given that the altcoin rallied in the week leading up to the event, it is likely that crypto market participants view the Shanghai hard fork as a “sell-the-news” event.

Ethereum exchange balance declines while non-exchange climbs

Based on data from crypto intelligence tracker Santiment, when the largest Ethereum addresses are split into exchange v. non-exchange, their balances are moving in opposite directions. The Ethereum balance in the ten largest exchange addresses has hit all-time low levels while for non-exchanges, it has continued its climb, as seen in the chart below.

Ethereum exchange v. non-exchange balances

This signals accumulation by non-exchange players and a decline in selling pressure on Ethereum across crypto exchange platforms. A decline in selling pressure is a bullish sign for the altcoin's price.

What to expect from Ethereum price

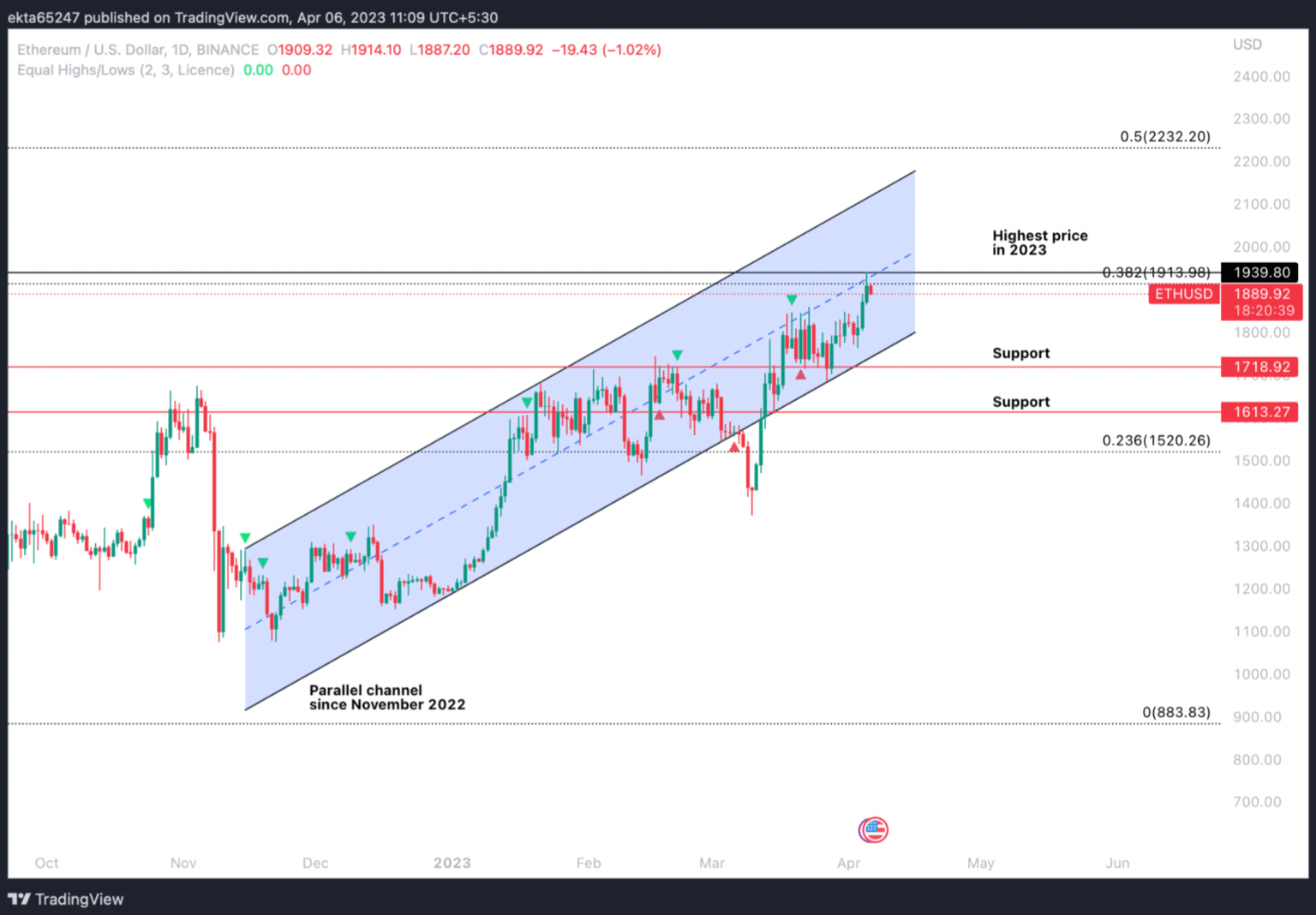

Ethereum price has been in an ascending parallel channel since November 2022 with one significant break to the downside in March 2023. As seen in the price chart below, in the event of a decline, Ethereum price could nosedive to support at the $1,718 and $1,613 levels respectively.

ETH/USD 1D price chart

If Ethereum price climbs consistently above the midpoint of the parallel channel, towards the 50% Fibonacci Retracement at $2,232, it could invalidate the bearish thesis. A decline below the lower trendline of the channel is expected in the event the Shanghai hard fork turns out to be a “sell-the-news” event.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.