Why Ethereum price is still in trouble despite the recent crash

- Ethereum price in distress as firm rejection unfolds.

- More pain to come as ETH price looks for support which could mean a break below $1,000.

- Expect to see another 30% devaluation in the making.

Ethereum (ETH) price is set to drop another 30% as bulls got burned in the ASIA PAC trading session after a firm rejection triggered another downside move. After this, morale amongst investors looks to be broken, and more cash outflow is expected, putting more pressure on the sell-side. That broken equilibrium will and can only be mended if ETH price tanks further in search of a new level where bulls will want to buy, which could be below $1,000.

ETH price already said goodbye to $2,000, next goodbye is $1,000

Ethereum price has been trading at the whim of a storm raging through global markets, where repricing has been happening since last Thursday. The ECB’s weak rate path message going forward triggered a cold shower for investors. From its policy statement it became clear that a big trading zone in the Northern hemisphere is set to enter a recession with high inflation, PIGS sovereign crisis back from the dead and a central bank that is in no shape to deal with both at the same time. All eyes are on the FED this week as they will have to come out even more hawkish to convince markets – but anyway you look at it, it's the dollar that wins against every cryptocurrency.

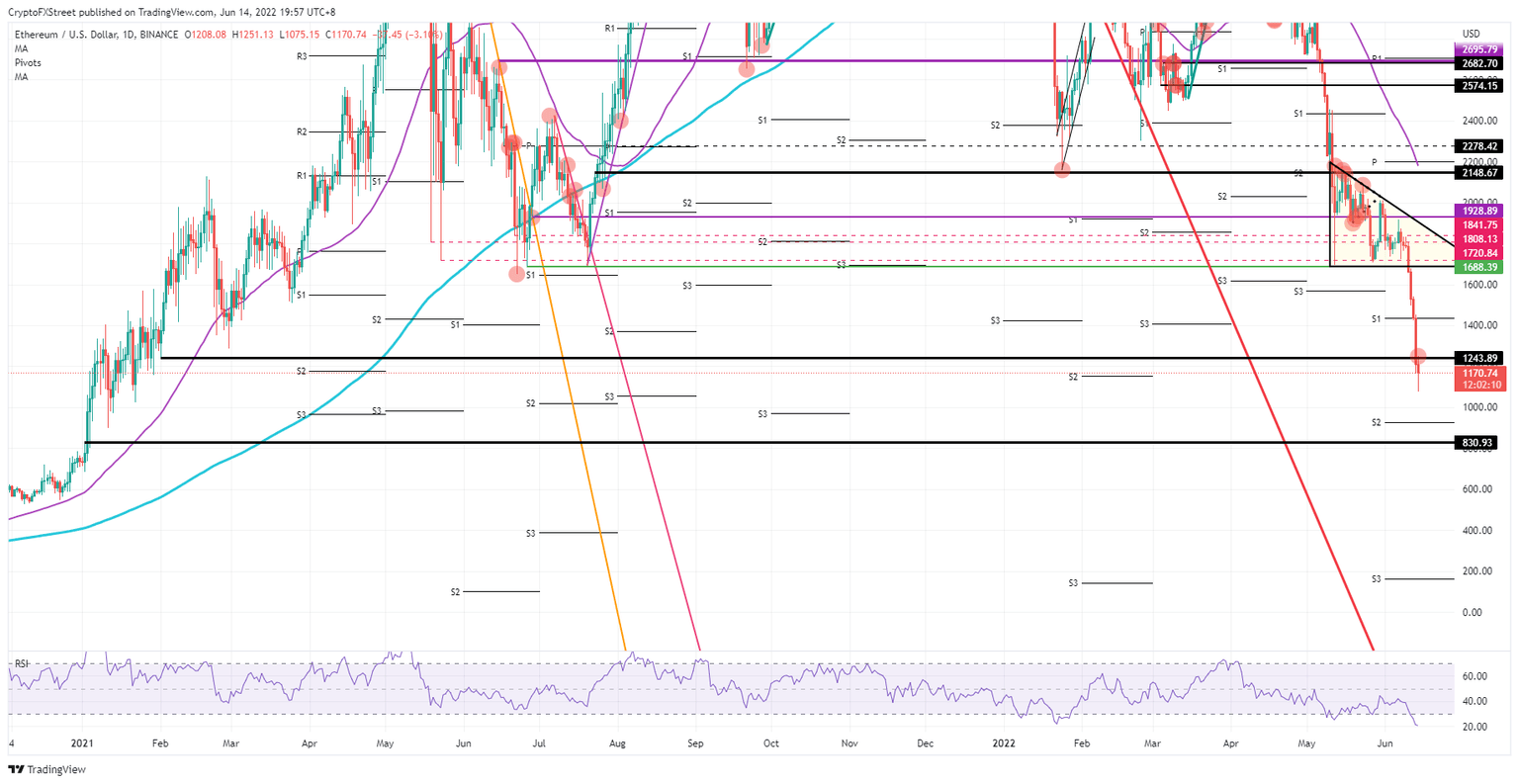

ETH price saw some dip buying in early morning trade, but bulls got a firm rejection at $1,243.89, the low of January 31, 2021. To the downside, the monthly S2 support is the first to slow down the decline at around $926.63. A more convincing line of defence looks to be $830.93, which is the high of January 02, 2021, and would mean that the gains from the past 18 months have been completely erased.

ETH/USD daily chart

Any break above $1,243.89 could only come from either economic data that suddenly surprises to the upside or inflation that surprises to the downside and suggests a recession can be avoided, and global growth will pick up again. That would see investors back to buying into risk assets. In such a scenario, the Relative Strength Index (RSI) will probably shoot up together with price action, which will quickly run back up to $1,688.39.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.