Week Ahead: Buy the dip or sit on your hands?

- Bitcoin price slips below $30,000 after a relatively stationary weekend.

- A look at the big picture reveals investors need to be cautious in the third quarter.

- Long-term investors must look for buy-the-dip opportunities as bears will likely take over in the third quarter.

With June nearing its end, we need to take another look at the big picture to remind us that we’re in it for the long run. So, in this newsletter, I will give you a perspective of what to expect from Bitcoin in the next two quarters and to better prepare for the same.

Also read: Is Bitcoin’s 2023 bull rally at an end?

Bitcoin’s monthly and quarterly returns

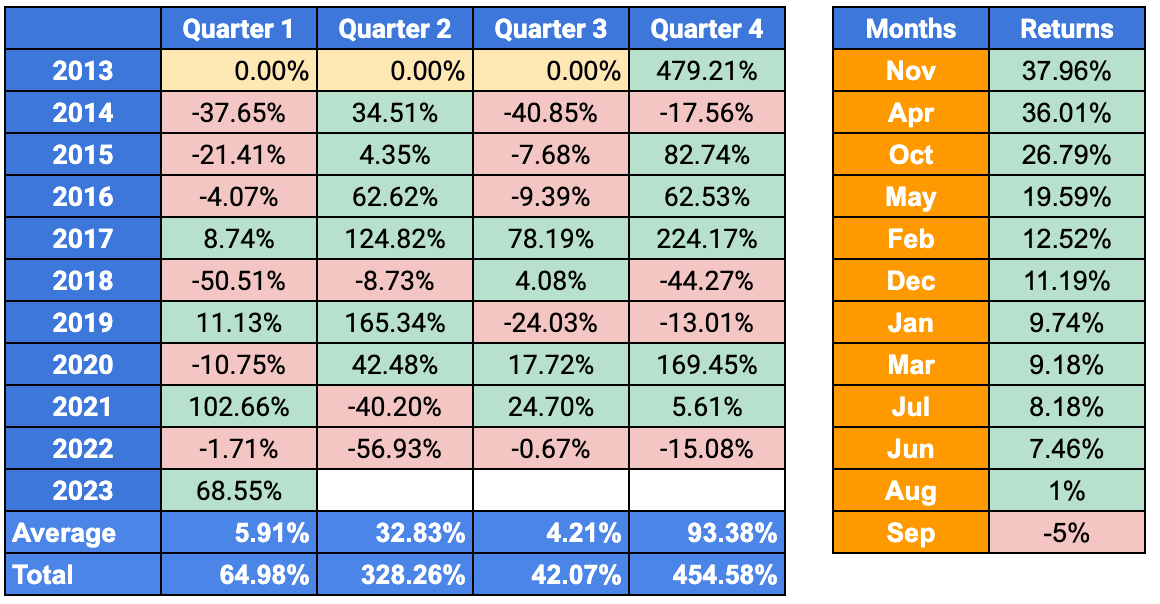

As mentioned in a previous publication, historical returns are key to identifying what comes next. Like clockwork, Bitcoin price returned 68.55% in quarter 1 and 6.55% in the second quarter.

Read More: Bitcoin likely to remain in red through the next quarter if history is any indication

Again, from a historical standpoint, the third quarter is favorable for bears, with an average return of only 4.21%. To make matters worse, July, August, and September are the months with the least average BTC returns, as seen in the chart below.

Lastly, the fourth quarter has an average return of 93.38%, with the highest average return observed in November.

So, the takeaway is simple, sit on your hands or accumulate BTC on the dips for the next three months. After the dreadful third quarter is completed, Bitcoin price is likely to embark on a journey that will shun the first quarter returns and potentially attempt a move to retest the all-time highs at $69,000.

Bitcoin quarterly and monthly returns

Top three Bitcoin reads

Three reasons why Bitcoin’s 2023 rally is just starting

Bitcoin dominance hits two-year high at 51%, jeopardizing altcoin gains

Recent Bitcoin price crash triggers whales to scoop BTC at discount

The top three altcoins read

Whales reveal their hand as they accumulate Optimism’s OP token in millions

Dogecoin Price Prediction: DOGE edges closer to a 20% breakout

XRP price prints this exact bullish pattern again, 25% rally in store for Ripple bulls

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.