Dogecoin Price Prediction: DOGE edges closer to 20% breakout

- Dogecoin price has been stuck under a declining trend line, failing to move higher.

- The recent development on the twelve-hour chart promises a 20% move should a breakout occur.

- A daily candlestick close below $0.0631 that flips it into a resistance level will invalidate the bullish thesis for DOGE.

Dogecoin price has shown clear signs of struggle over the past few weeks. Every attempt to breach higher was met with stiff resistance that resulted in a prolonged downtrend. But as DOGE tightens into a range, investors are waiting for a bullish breakout.

Also read: Dogecoin Price Prediction: History suggests a potential 30% rally in DOGE

Dogecoin price sets the stage for volatile move

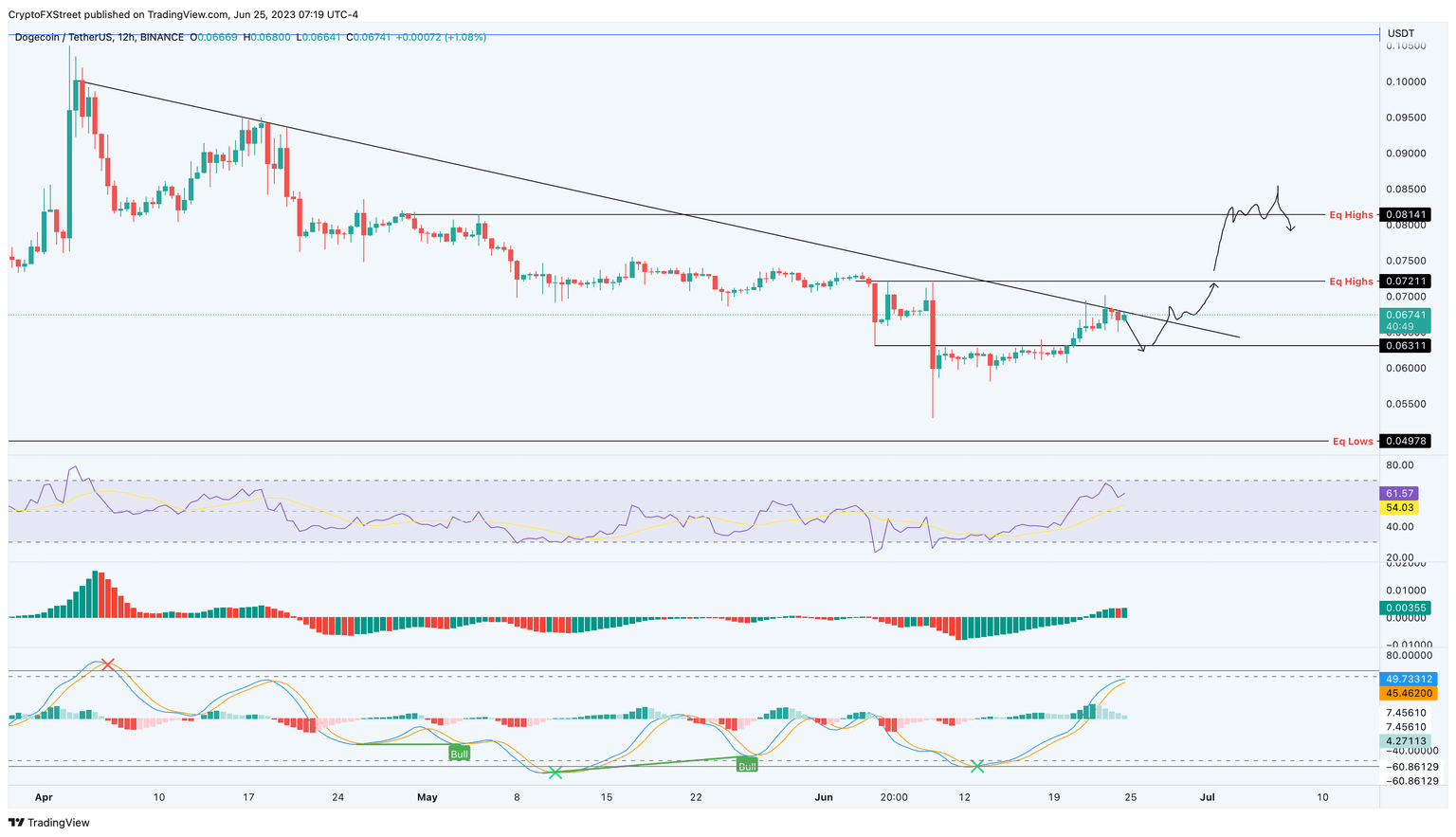

Dogecoin price has been producing lower highs and lower lows since April 3. Connecting these swing highs reveals a declining trend line. Between April 3 and June 9, DOGE lost 50% of its market value and produced a local bottom at $0.0530. Since then, the dog-themed crypto has kick-started a recovery move and rallied 28% and has come face-to-face with the aforementioned declining trend line.

A successful breakout above this resistance level will confirm Dogecoin price has kick-started a volatile move. In such a case, DOGE could eye the liquidity resting above the equal highs at $0.0721.

If the bullish momentum continues to pour in Dogecoin price could eye the next hurdle at $0.0814. In total, this move would constitute a 20% gain from the current position at $0.0673.

Interested investors should also pay close attention to the $0.0631 support level, which is a good buying opportunity should DOGE retrace before attempting a breakout.

DOGE/USDT 12-hour chart

While the bullish outlook is a mid-to-long term thesis, A daily candlestick close below $0.0631 that flips it into a resistance level will invalidate the bullish thesis for Dogecoin price. In this case, DOGE could crash 21% and sweep the liquidity resting below the equal lows at $0.0497.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.