VET price readies for 20% gains as VeChain doubles down on global expansion and sustainability initiatives

- VeChain price has found a new bullish momentum amid a new network partnership with billion-dollar company BCWGlobal.

- VET could rally 20% to $0.025 as investors buy into the bullish catalyst.

- A daily candlestick close under the $0.020 support level would invalidate the bullish thesis.

VeChain (VET) price is finally flashing green after two weeks of a sustained downtrend. The V-shaped recovery currently under construction comes amid a recent development on the network that will potentially deliver on its global expansion and sustainability initiatives. Also, VET has coupled with the Bitcoin (BTC) dominance effect as the king crypto continues to rise, 2% on the day thus far.

VeChain price could rally amid new partnership

VeChain price is up 3.32% in the last 24 hours to auction at $0.021 at the time of writing. This bullish turnaround comes after a fortnight-long downtrend, suggesting that the latest network partnership takes credit for the current bullishness.

Based on recent reports, the VeChain network has signed a collaboration with billion-dollar supply chain management company BCWGlobal.

We’ve entered a new chapter as we leverage #blockchain and #Web3 for #sustainability.

— vechain (@vechainofficial) May 3, 2023

To launch #vechain internationally, we’ve teamed up with leading global communications agency, @BCWGlobal, with integrated PR, a full rebranding, creative and comms support. $VET pic.twitter.com/nvNZRK7dTt

Based on the announcement, the partnership will help VeChain expand its supply chain innovations, while BCWGlobal will leverage the association to maintain sustainability in the multi-billion industry. Notably, the association's hallmark is to use blockchain technology to promote transparency, traceability, and environmental responsibility in supply chains.

Making a case for a 20% rally for VET

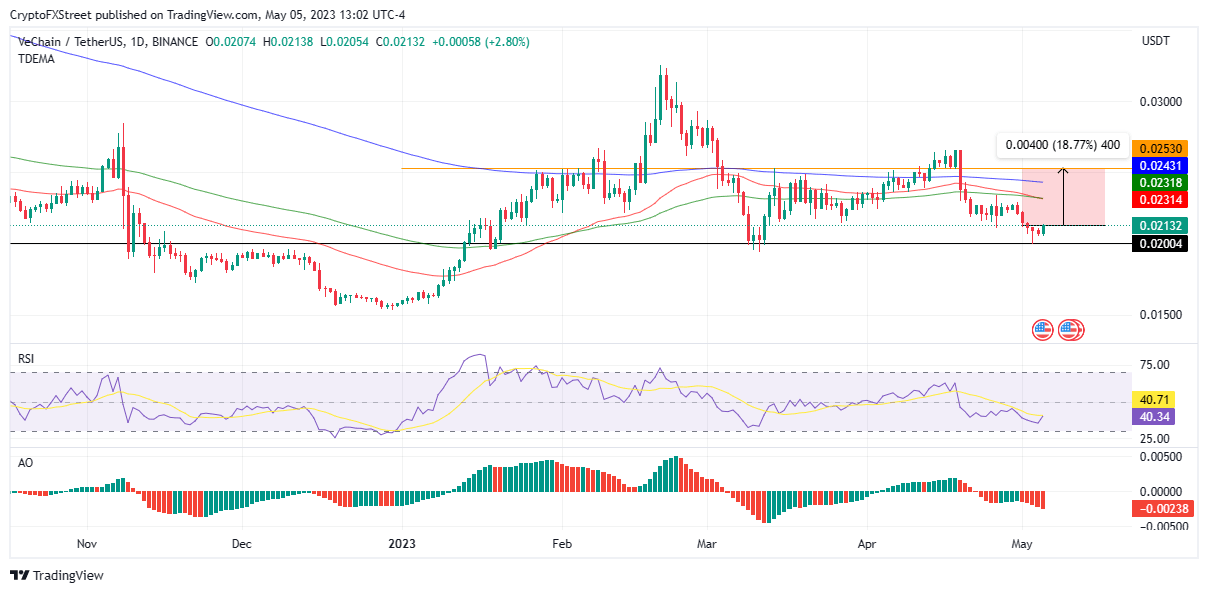

Positive sentiment around the recent network development could fuel the current uptrend. An increase in buying pressure from the current level could see the VeChain price rise to confront the resistance level represented by the confluence between the 100- and 50-day Exponential Moving Averages (EMA) around the $0.023 level.

Further north, and with an influx of sidelined investors, VeChain price could extend a neck up to tag the 200-day EMA at $0.024 or, in a highly bullish case, tag the $0.025 resistance level. Such a move would constitute an 18.77% climb from the current level.

The Relative Strength Index (RSI) also looks more bullish. The northbound move of the RSI could soon signal a call to buy VET once it crossed above the signal line (yellow band). Traders heeding this call could enhance the uptrend for VeChain price.

VET/USDT 1-Day Chart

On the downside, if retail traders take profit after today's bullish transition, the VeChain price could resume its downtrend. Such a move could see the altcoin drop below the $0.020 support level.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.