Is the new partnering-up strategy the right way for Vechain price to avoid a 30% correction?

- Vechain price undergoes firm rejection on the topside this week.

- VET set to tank as bears took over from bulls last week.

- With several new partner announcements and team-ups, VET tries to change and find synergies.

Vechain (VET) price had a busy week as several new partnerships were announced. Next to integrating with Dappradar to promote cross-chain visibility, the partnership with Boston Consulting Group might be the one that draws the most attention. Vechain price though is not taking this news in a good way and rather is at risk of tanking further.

Vechain price at risk of breaking important support below

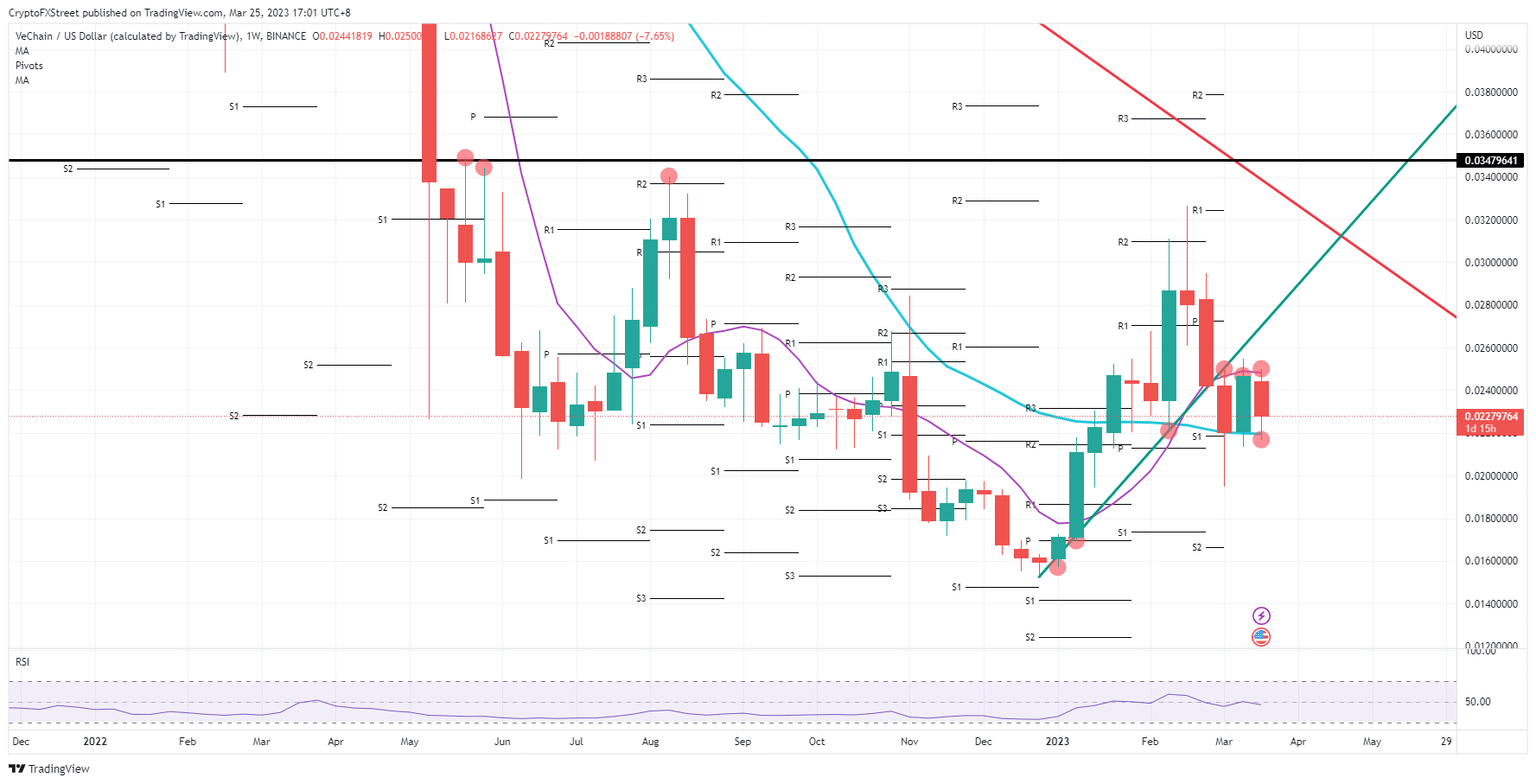

Vechain price has had a rough ride this week as initially it was on the verge of breaking above the 55-day Simple Moving Average (SMA) earlier this week. Instead, both Bitcoin and altcoins have taken a step back and tanked across the board toward Friday. The financial crisis is spilling over into altcoins as the SVB collapse sets an example of whether the US deposit guarantee scheme backs crypto-deposits.

VET, though, has tried to stem investors positivity by announcing a string of new partnerships. Investors pushed price action lower and were flirting with a break below the 200-day SMA. Should the 200-day SMA be broken and new lows are underway next week, expect a long-term selloff that could bring Vechain price towards $0.016.

VET/USD weekly chart

Trust could start to restore as no real issues were being mentioned this week, and that would put the spotlight back on the broad partnerships Vechain has signed up for. Vechain price could be seen flirting with breaking the 55-day SMA to the upside. Although it is quite far away, VET may get revalued at $0.035 once the partnerships start to pay up.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.