VeChain Price Forecast: VET climbs 180% to a new two-year high at $0.032

- Vechain price has seen a massive pump in the past two weeks rising by more than 180%.

- The digital asset can continue climbing higher according to various metrics.

Vechain was trading inside a downtrend since August 2020 and remained flat during the Bitcoin rally in December before finally seeing a massive price explosion by the end of 2020. Several metrics and indicators show that VET can still rise higher in the short-term.

Vechain price can continue rising towards $0.04

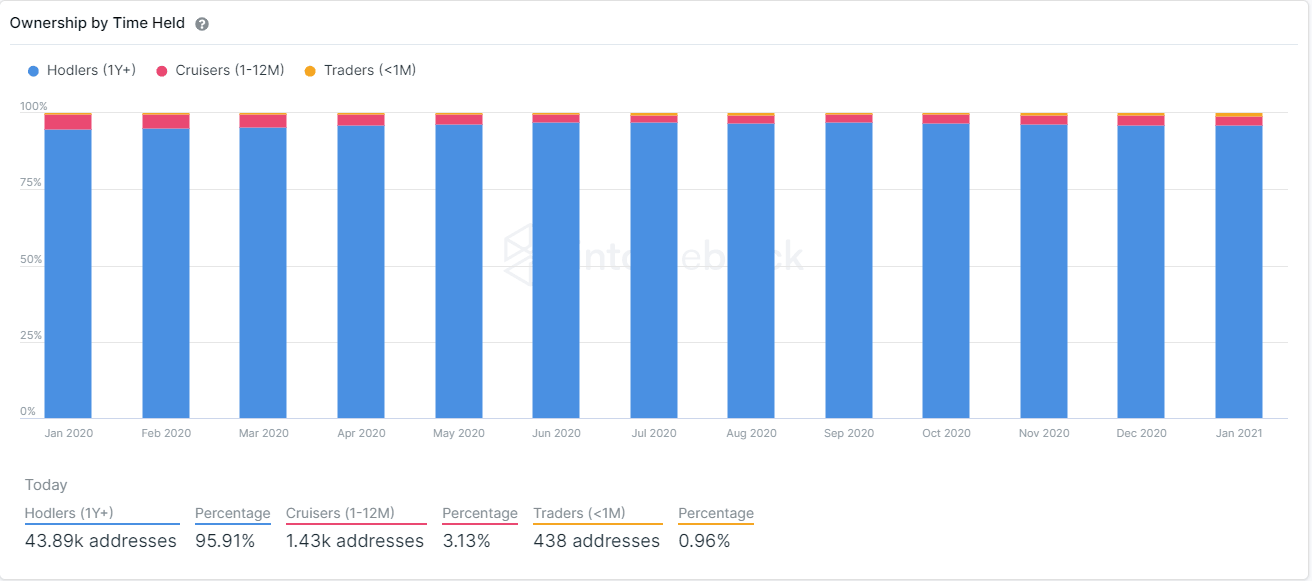

Despite the massive rally towards $0.0322 several indicators continue to show that VET can go higher. The ownership of VET coins by time held hasn’t changed much in the past few months and around 95.91% of addresses have been holders for at least one year, which indicates they arae expecting the price of Vechain to rise even higher.

VET Ownership by Time Held chart

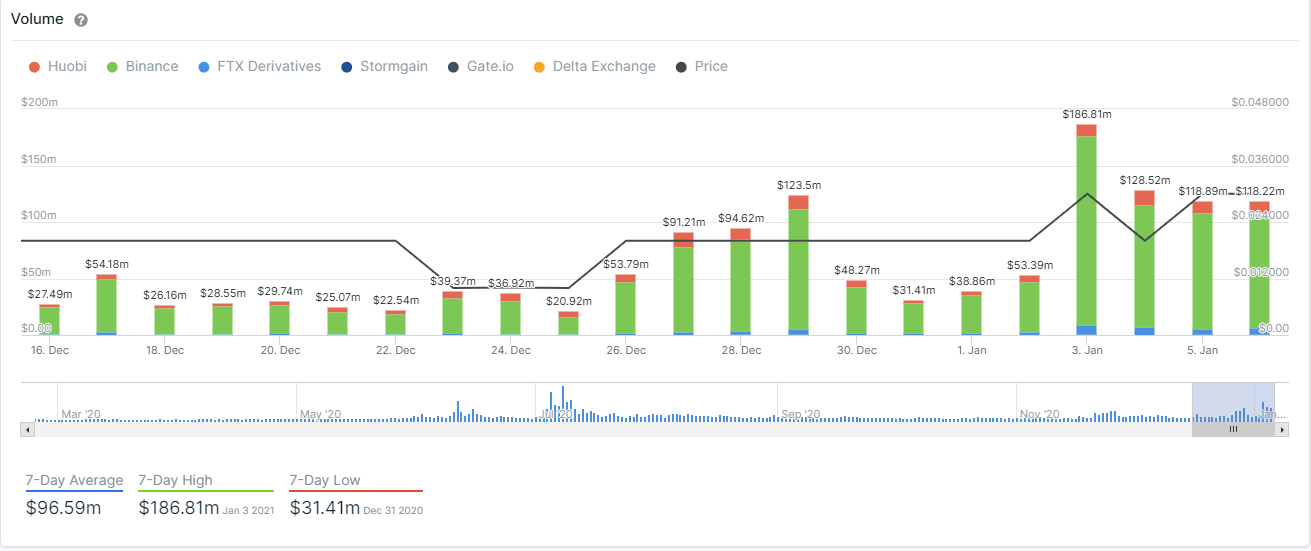

The interest in VET coins seems to have increased significantly over the past few days as the derivatives trading volume hit $186 million on January 3, a number not seen since July 2020.

VET Derivatives Volume chart

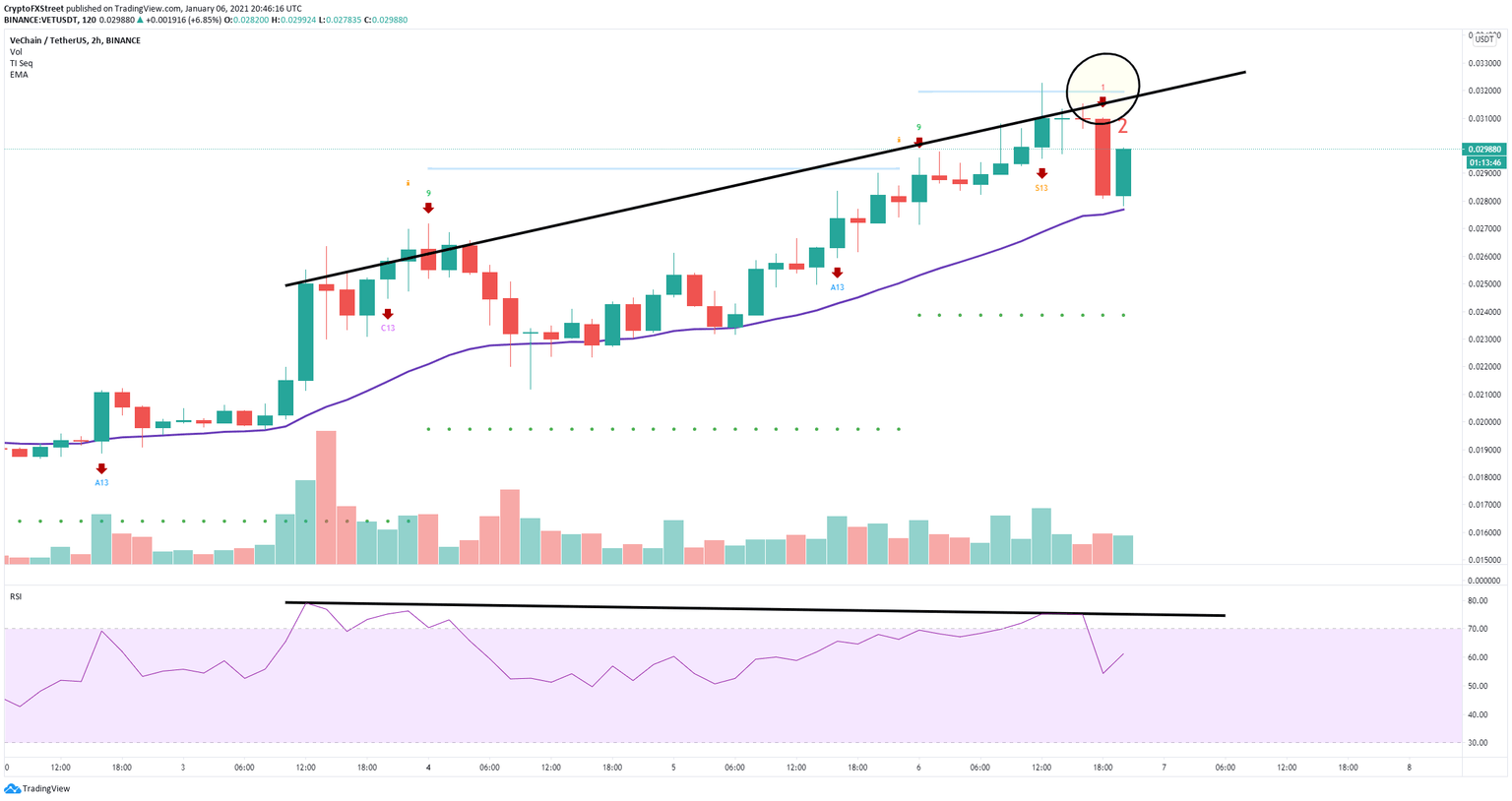

However, on the 2-hour chart, the TD Sequential indicator did present a sell signal which has seen a lot of continuation to the downside. So far, the 26-EMA has served as a support level at $0.027. If bears can push Vechain price below this point, it can quickly drop towards $0.023.

VET 2-hour chart

Additionally, it seems that the RSI and the price have established a bearish divergence on the 2-hour chart. Vechain price hit several higher highs while the RSI established lower highs, creating the divergence and adding credence to the bearish outlook.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.