Vechain price targets $0.012 as bears take control but might see a rebound first

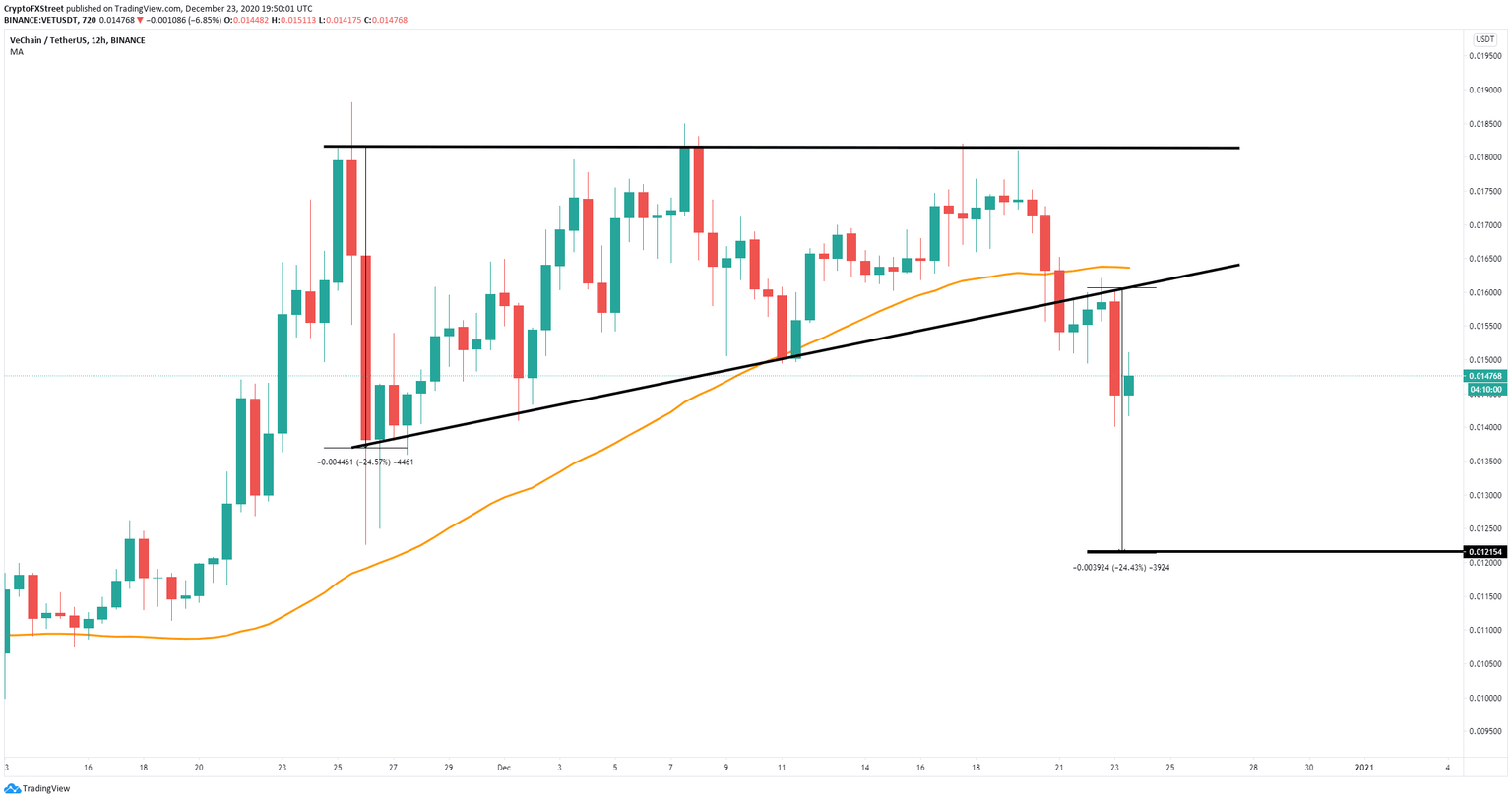

- Vechain price slipped below an ascending triangle pattern on the 12-hour chart.

- Bears target $0.012 but the digital asset could first see a rebound.

Vechain was trading inside an ascending triangle pattern on the 12-hour chart and broke down on December 21. The digital asset revisited the support trendline two days later and failed to climb above it. Bears target $0.012 in the long-term.

Vechain price sees bullish signs in the short-term

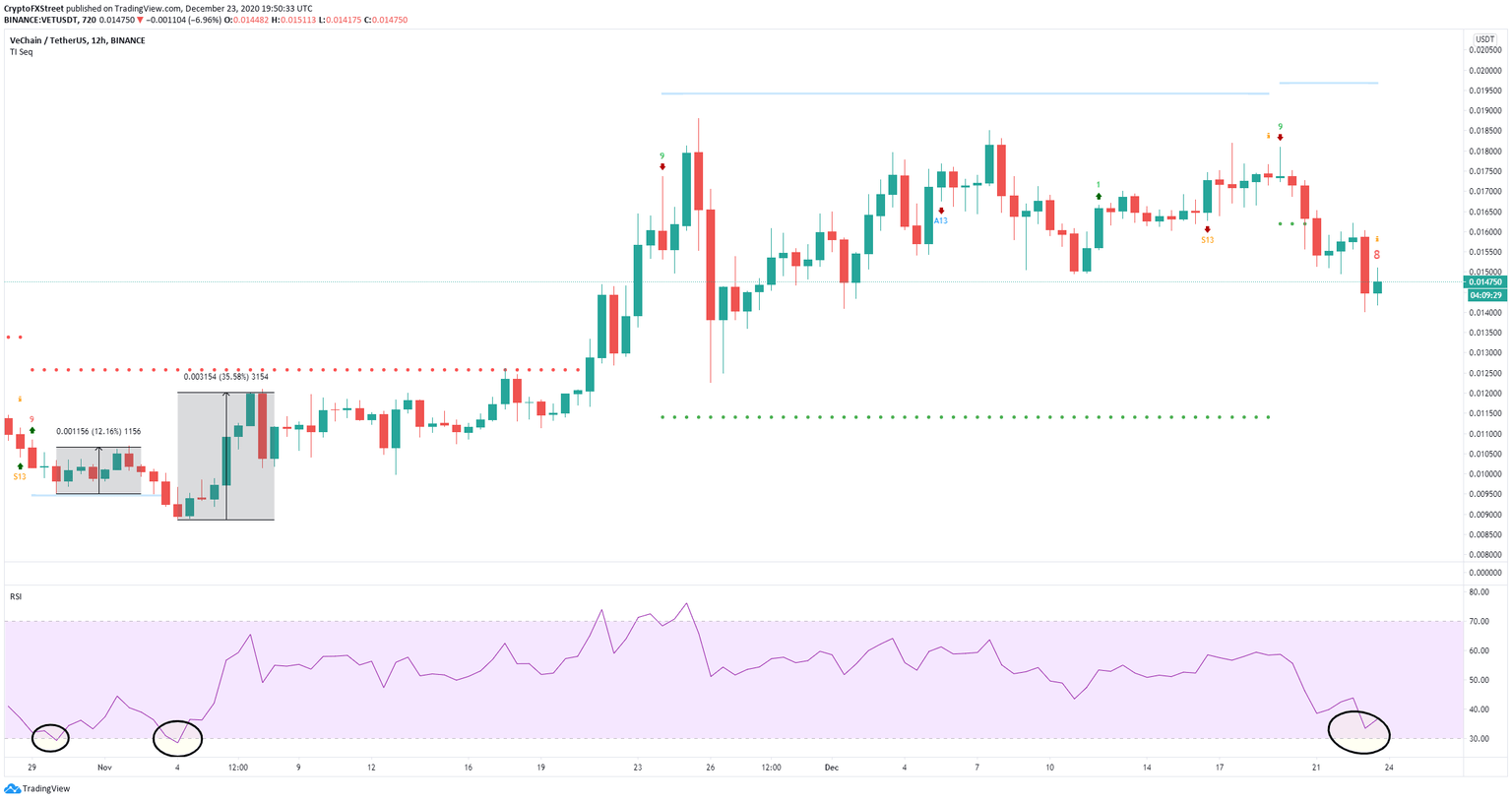

On the 12-hour chart, the TD Sequential indicator has just presented a red ‘8’ candle which is followed by a strong buy signal. The current price of VET is $0.0147 and validation of the call can quickly push it towards the upper trendline at $0.016.

VET/USD 12-hour chart

Additionally, the RSI seems to be on the verge of crossing towards the overextended zone. In the past, every time the RSI touched 30 or less, Vechain price had significant rebounds. The RSI is currently at 37, which adds credence to the potential bullish rebound.

VET/USD 12-hour chart

However, bears remain in control of the trend and the price target of $0.012 is still valid even if Vechain rebounds. The upcoming buy signal can easily be invalidated if the bears push VET below $0.014.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.