VeChain Price Forecast: VET bulls charge ahead for 25% gain

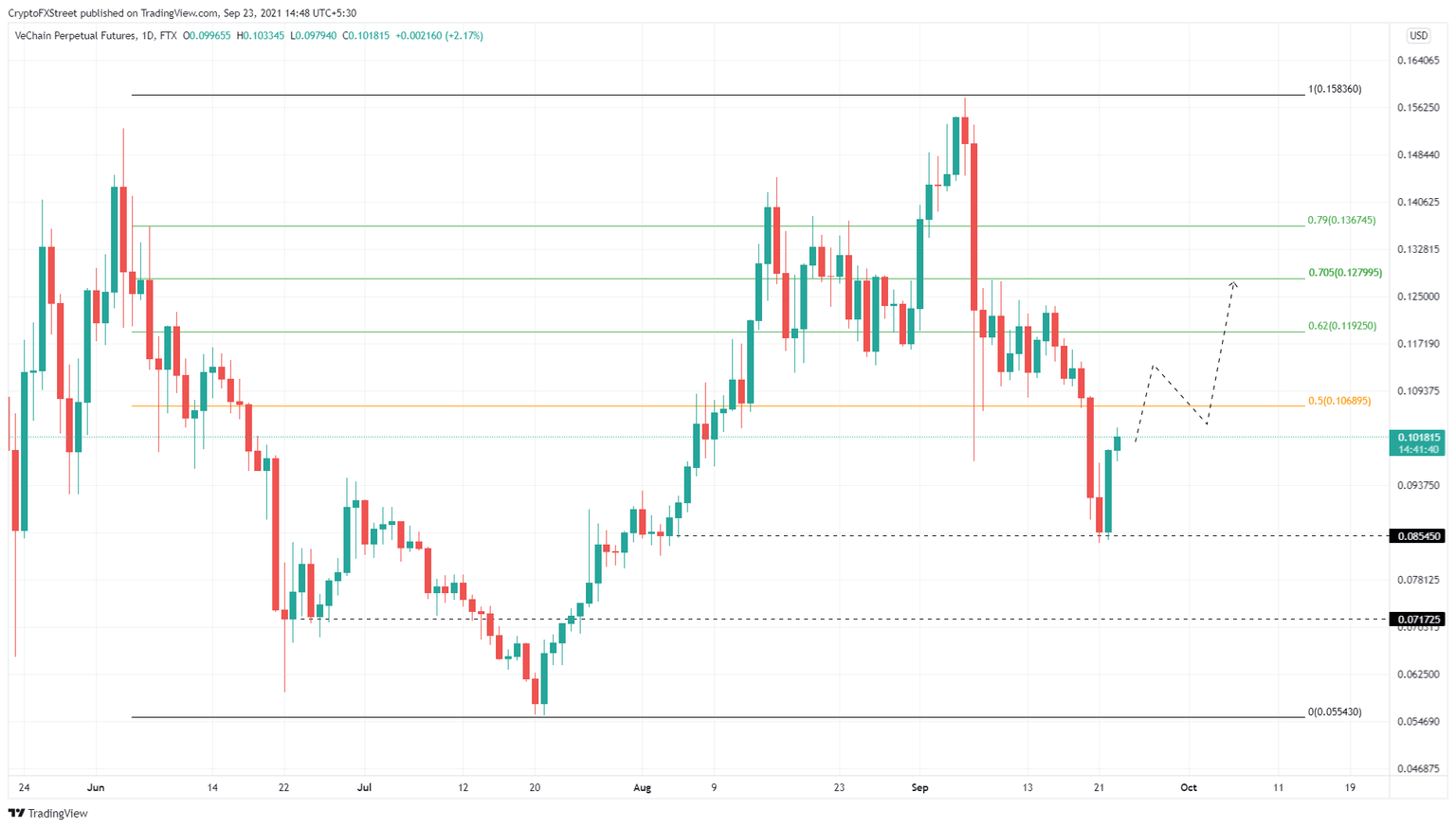

- VeChain price looks to continue its ascent as it retests the 50% Fibonacci retracement level at $0.107.

- Even if buyers push VET through $0.107, the upswing will face other hurdles.

- A failure to climb past the immediate ceiling could trigger a pullback to $0.0854.

VeChain price (VET) witnessed a flash crash for the second time in September as Bitcoin and the cryptocurrency market at large tumbled on September 19 and September 20. However, things seem to have turned around temporarily as BTC has sprung back. Despite the quick run-up, the bullish outlook does not appear to be a definitive one.

VeChain price embarks on an uphill battle

VeChain price rose 21% after forming a swing low at $0.085 on September 23. Although the run-up was impressive, VET needs to overcome the 50% Fibonacci retracement level at $0.107. Clearing this key barrier will open the path to a high probability reversal zone ranging from $0.119 to $0.137.

While there is a chance for VeChain price to pierce this area, it is unlikely that the buyers have the momentum to hold above it. Therefore, the upside potential for VET is capped at $0.128. This climb from the current position to $0.128 constitutes a 26% gain.

In a highly bullish case, the buyers might retest $0.137, but a close above it is highly unlikely.

VET/USD 1-day chart

A potential spike in buying pressure might push VeChain price to slice through the 50% Fibonacci retracement level at $0.107, but if the bulls fail to hold VET above this barrier it might indicate a weakness among the buyers.

Such a development could lead to a retracement to the $0.085 support floor. A breakdown of this foothold will set up a lower low and trigger VeChain price to crash to $0.072.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.