VeChain bulls nervous about a 13% drop ahead of VET price

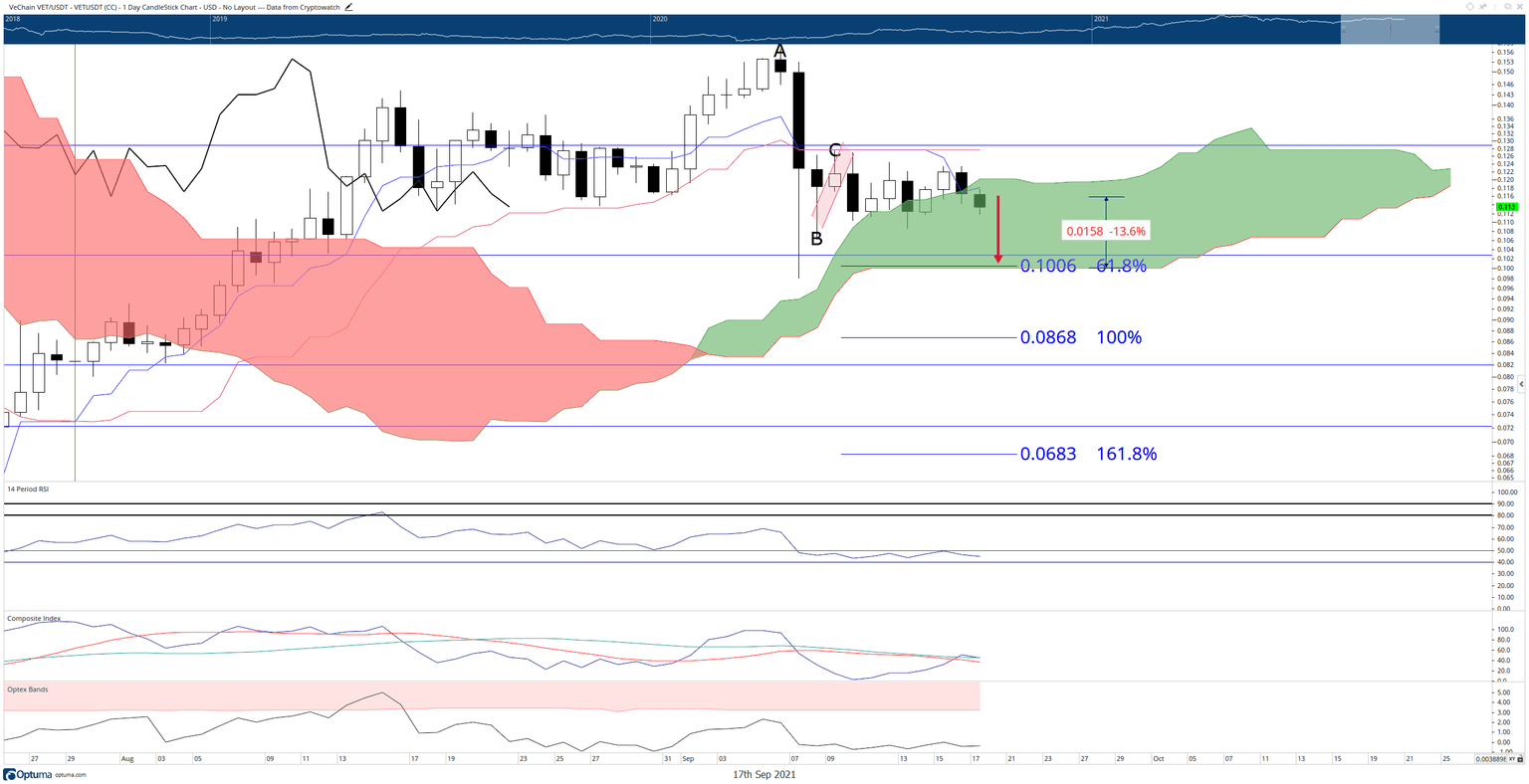

- VeChain price remains inside the volatile Cloud in the Ichimoku Kinko Hyo system.

- Bulls are attempting to hold $0.11 as support.

- Next support at $0.10.

VeChain price continues to trade in a tight consolidation range between $0.10 and $0.125. VeChain bulls and bears continue to battle against the final support zone at $0.11 before the bottom falls out and price tests $0.10.

VeChain price prepares for another leg south; strong support exists below

VeChain price continues to trade in a constricted manner, with today’s session being the tenth day in that range. VeChain looked like it might have an opportunity to breakout higher on Wednesday, but it was promptly and handily sold against the $0.125 resistance area. Given the broader weakness in the aggregate crypto market, $0.11 will likely fail as support.

VeChain price has strong support against the $0.10 value area. The $0.10 level contains the 50% Fibonacci retracement, the 61.8% Fibonacci expansion and Senkou Span B. However, there is a risk that $0.10 may not hold as support. The Relative Strength Index has spent the past eleven days trading between the two bull market oversold conditions of 40 and 50. If 40 fails to hold as support in the Relative Strength Index, a push towards $0.08 is likely.

VeChain/USDT Daily Ichimoku Chart

The bearish scenario will be invalidated if Vechain bulls can push a close above $0.131. A close above $0.131 would put the close above the top of the Cloud (Senkou Span A), Tenkan-Sen, Kijunn-Sen and 38.2%. This would also put the Chikou Span above the candlesticks. If all those conditions are met, then VeChain will re-enter an undeniable bullish phase and set up for an explosive move higher to test prior all-time highs.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.