Uniswap Price Recovery: Beaten-up bulls still tend to rally

- Uniswap price tanked near 10% intraday on Thursday.

- UNI Bulls got beaten up but appeared to be back in the game.

- Expect price action to restore itself further with a test at $5.60.

Uniswap (UNI) price is a perfect example of the walk of life. It is never a straight line, and sometimes some quirky bends and hiccups along the way make us deviate from our path. It is a similar life lesson for Uniswap price as bulls deviated from their rally and are now trying to get back on the right trajectory after a misstep.

Uniswap price features existential sidestep

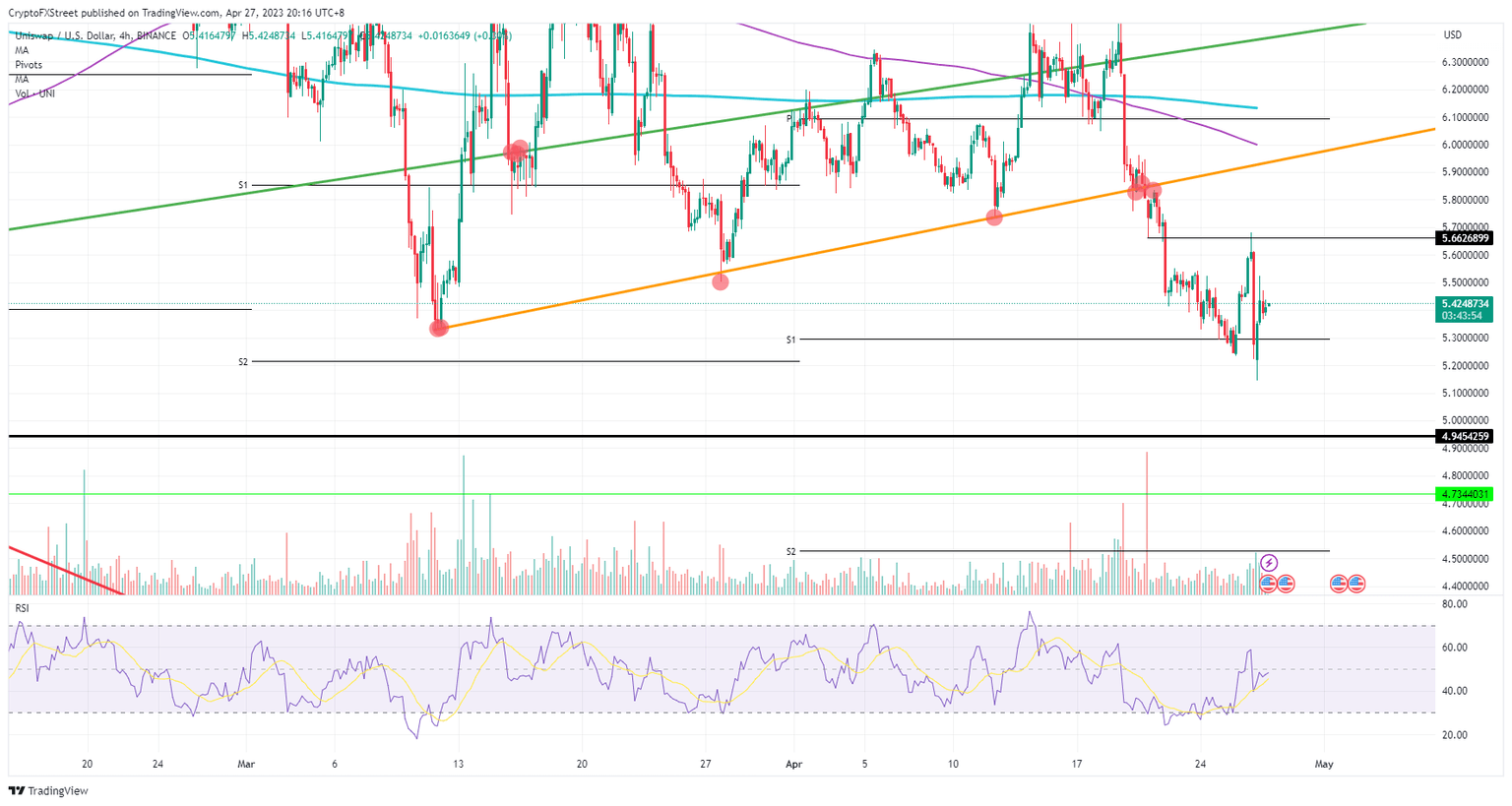

Uniswap price has since March been on a firm trajectory higher with the orange ascending trendline as a clear guide for the road. Unfortunately, bulls were not able to hold that straight line and had to let loose of the price action that started to deviate. With a 15% drop since mid-April, the biggest volatility unfolded on Thursday with a 10% intraday change that eventually resulted in an unchanged close.

UNI currently resides right in the middle of the price range from Thursday and is undergoing some buying after the bulls got a bit beaten up and shaken by Thursday’s volatile session. Expect to see more buying as long as price action remains steady with first a break at $5.66 and next a rally toward $6.

UNI/USD 4H-chart

Uniswap could still continue its decline, seeing how price action on Thursday dipped all the way toward $5.15 before rebounding. At that same level, there is not really anything of a psychological handle, a pivot level or anything else technical. The buy action could have been too thin to fuel a big rally back all the way up to $5.66. If the downtrend does return, expect UNI to fumble and break like a house of cards with its value continuing its search for ample support rather than be found near $4.95.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.