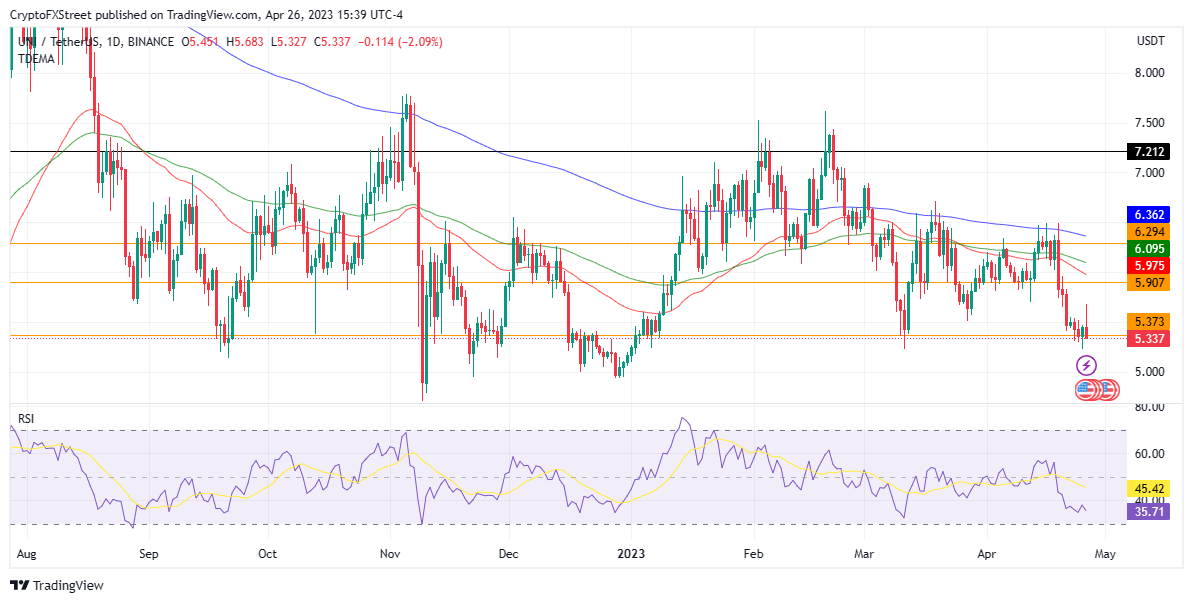

Cryptocurrencies Price Prediction: Uniswap, Bitcoin & Floki Inu — Asian Wrap 27 April

Uniswap rise in trading volume indicates strong growth in trader appetite for top DeFi products

Uniswap (UNI) decentralized exchange (DEX) breached the $1.5 trillion mark in trading volume metrics on April 24, signaling a new wave of bullishness on Web3 liquidity solutions among players in the digital asset sector. With the positive sentiment among cryptocurrency traders for Uniswap, the change is expected to affect rival crypto-native products.

Examining Bitcoin price volatility in relation to US Government's Bitcoin holdings

Bitcoin price drives the crypto market, and at the moment, the cryptocurrency is observing the most volatility. The fragility of the crypto market has grown to the extent of being triggered by a simple alert tweet, resulting in a rally and a crash on the very same day.

Floki Inu price rallying by 50% triggers investors’ interests, lives up to the “meme coin standard”

Floki Inu price, unlike the rest of the altcoins, had a rather stellar reaction to the news of a crucial development of the cryptocurrency. In response, FLOKI holders pulled a move that has now become a meme coin standard where investors only appear when it is beneficial for them, essentially leaving the token to fend for itself.

Author

FXStreet Team

FXStreet