Uniswap Price Prediction: UNI could drop 15% to 30% if crucial support barrier caves in

- Uniswap price crash could extend by 10% if a crucial support barrier at $23.45 is breached.

- Transactional data shows a concentration of buyers around the $21.21 price level.

- A bullish scenario might come into play if the 78.6% Fibonacci retracement level at $26.31 holds.

Uniswap price gains of 580% could come undone if the market-wide sell-off continues. At the time of writing, UNI is trading just above a critical support level at $23.45, waiting to establish a clear trend.

Uniswap price walks on eggshells

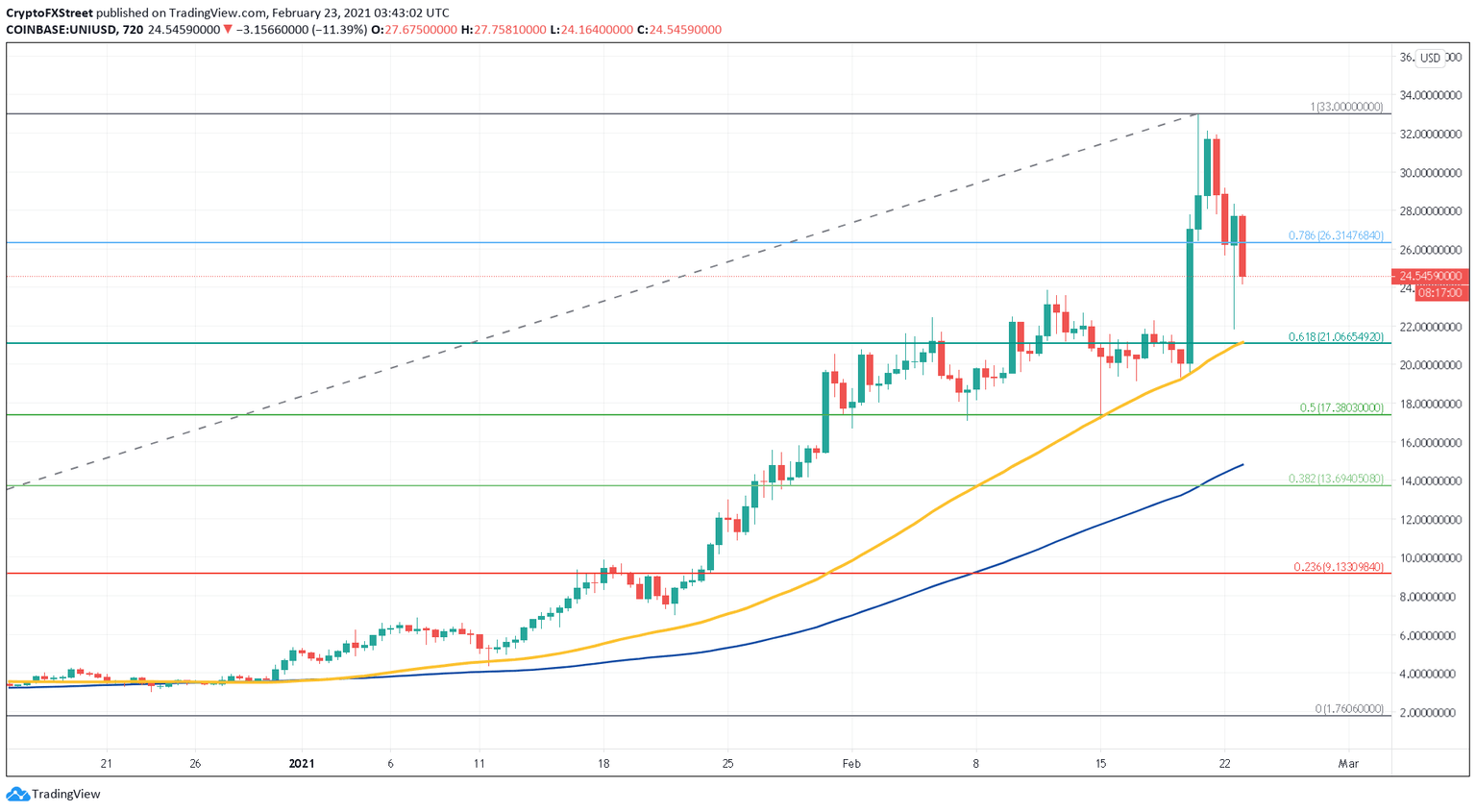

Uniswap price recently crashed by a whopping 33% from an all-time high due to a Bitcoin-led crash. Since then, UNI has recovered 10%, but the bearish momentum keeps chipping away at its market value.

While the initial panic among retail traders has simmered down, the constant selling pressure has pushed the DeFi token under the 78.6% Fibonacci retracement level at $26.31.

UNI/USDT 12-hour chart

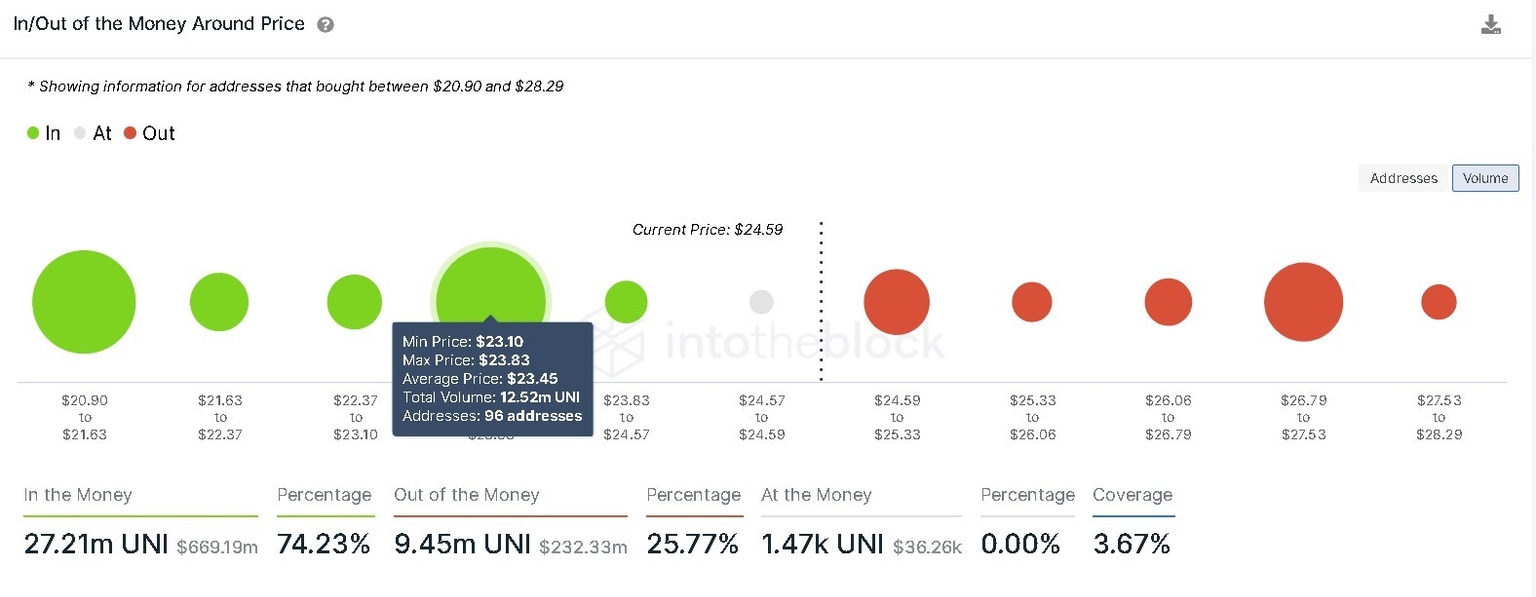

According to IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model, $23.45 will be critical in determining UNI’s fate. Here, roughly 96 addresses purchased 12.5 million UNI. A 12-hour candlestick close below this barrier will put these investors “Out of the Money,” forcing them to sell their holdings to prevent further losses.

Such development will add to the already bearish momentum pushing Uniswap prices down by 10% to $21.21. This level coincides with the 50 twelve-hour moving average (MA) and the 61.8% Fibonacci retracement level.

Based on IOMAP’s transactional data, 11,700 addresses hold 10.6 million UNI here. Hence, these investors will act as a cushion to the incoming selling pressure. However, an unforeseen spike in selling pressure leading to a breakdown of this support could be disastrous and push UNI down to another 15% to $17.38 or the 50% Fibonacci retracement level.

Uniswap IOMAP

Regardless of the bearish outlook, investors should note that a bounce from the $23.45 level is plausible. A build-up of buying pressure here could prevent the reversal altogether and push Uniswap to retest its all-time high at $33.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.