Tug of war intensifies as Ethereum Classic price grinds closer to a 15% breakout

- Ethereum Classic price presents key buy signals ahead of a bullish move to $27.30.

- ETC must break above a falling wedge pattern’s upper trend line to confirm a 15% upswing.

- Ethereum Classic price will keep struggling to sustain an uptrend as long as its on-chain volume continues to drop.

Ethereum Classic price continues to sink deeper into the abyss, with declines from its most recent high at $45.66 seemingly unstoppable. The PoW (proof-of-work) token may have lost its charm, with investors pulling the rug immediately after the Ethereum Merge in September.

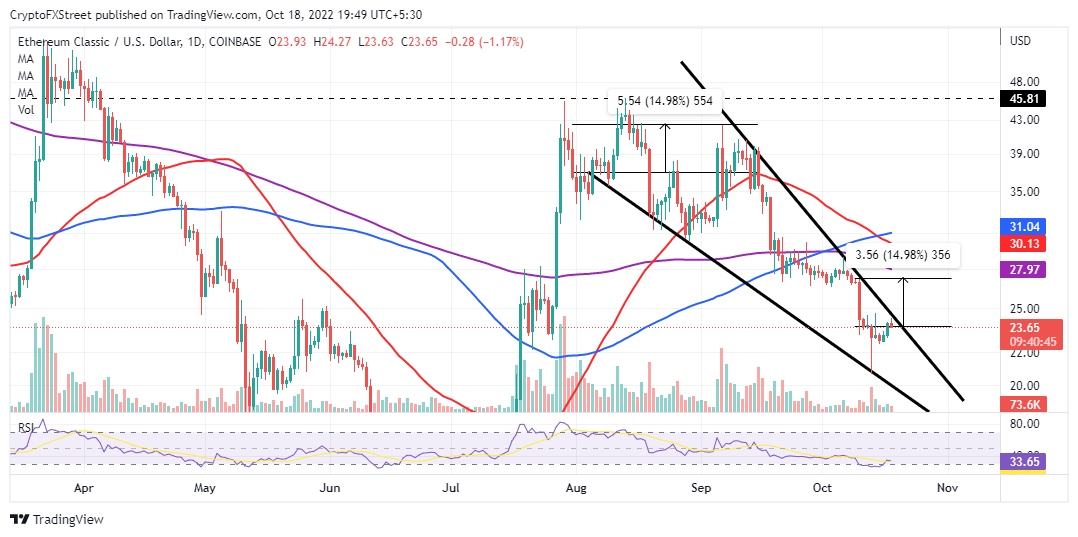

ETC has annihilated various key support areas at $35.00, $30.00 and $25.00 in its futile hunt for solid support. Ethereum Classic price now depends on near-term buyer congestion at $22.00 to validate a falling wedge pattern ahead of a foreshadowed move to $27.30.

Is Ethereum Classic price ready for a trend reversal?

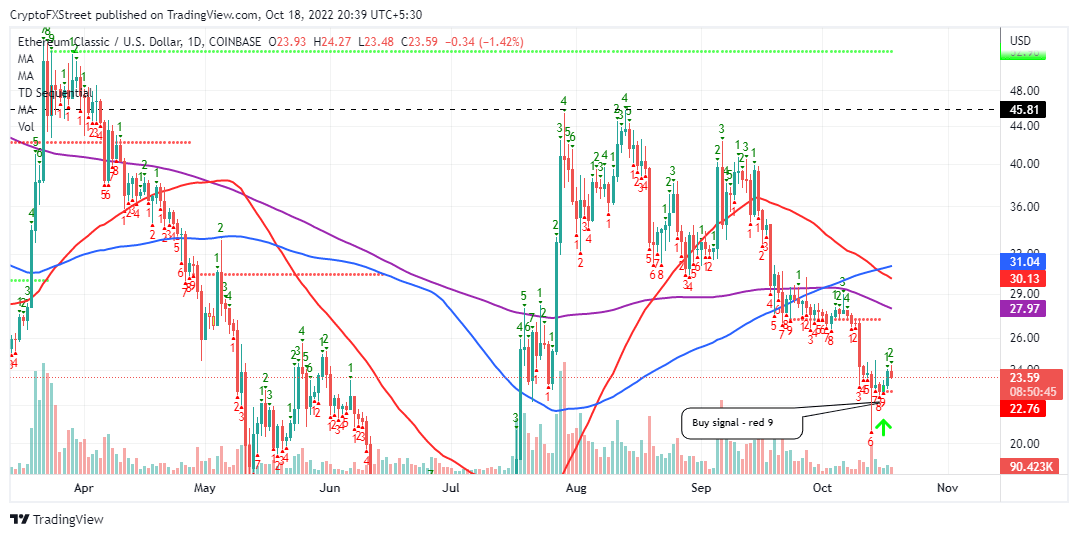

The Stochastic RSI on the daily chart reveals that Ethereum Classic bulls are in the process of reclaiming control. First, they defended support at $22.00 and later pushed above $23.00 amidst highly oversold conditions.

A falling wedge is a bullish reversal pattern drawn by connecting an asset’s lower highs and lower lows using trend lines. As selling pressure gradually decreases into the pattern’s apex, the price tends to break above the upper level of resistance. A strong trend to the upside starts building as the price breaks above the wedge.

ETC/USD daily chart

Ethereum Classic price will be poised for a 15% bullish recovery if it leaps above the upper trend line resistance. Traders hoping for long positions in ETC will find this a strong buy signal.

The TD Sequential indicator has recently flashed a buy signal on the same daily chart. A red nine candlestick represents the call to buy into ETC while it gears up for a trend reversal. Bear in mind that buy orders are recommended if the low of the sixth and seventh candles is exceeded by that of the eighth and ninth bars in the count; see the chart below.

ETC/USD daily chart

Ethereum Classic seems fundamentally weak for a rally

Ethereum Classic price recovery might be a pipe dream on the other side of the fence, considering the drop in on-chain volume. Apart from minor sporadic spikes, the volume of transactions (335 million) on the Ethereum Classic blockchain is a meager reflection of the 5.47 billion in July 2022.

Ethereum Classic on-chain volume

A careful observation of this metric’s impact on ETC’s performance shows that such an extended drop inhibits price growth. Therefore, Ethereum Classic price may struggle with the expected uptrend. Investors hoping for another run to $45.66 may have to exercise patience as ETC navigates the stubborn bear market forces.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20%5B17.19.10%2C%2018%20Oct%2C%202022%5D-638017047061289963.png&w=1536&q=95)