Ethereum Classic price could nosedive to $14 if this support gives in

- Ethereum Classic price has shown a non-stop downtrend since August 14.

- This sell-off could accelerate until ETC reaches $14 on the breakdown of the $22.92 support level.

- A daily candlestick close above $29.58 will invalidate the bearish outlook.

Ethereum Classic price has been in a massive sell-off that has slashed its value by half in just two months. ETC could trigger another nosedive if this development continues and breaks an immediate support level.

Ethereum Classic price at wits’ end

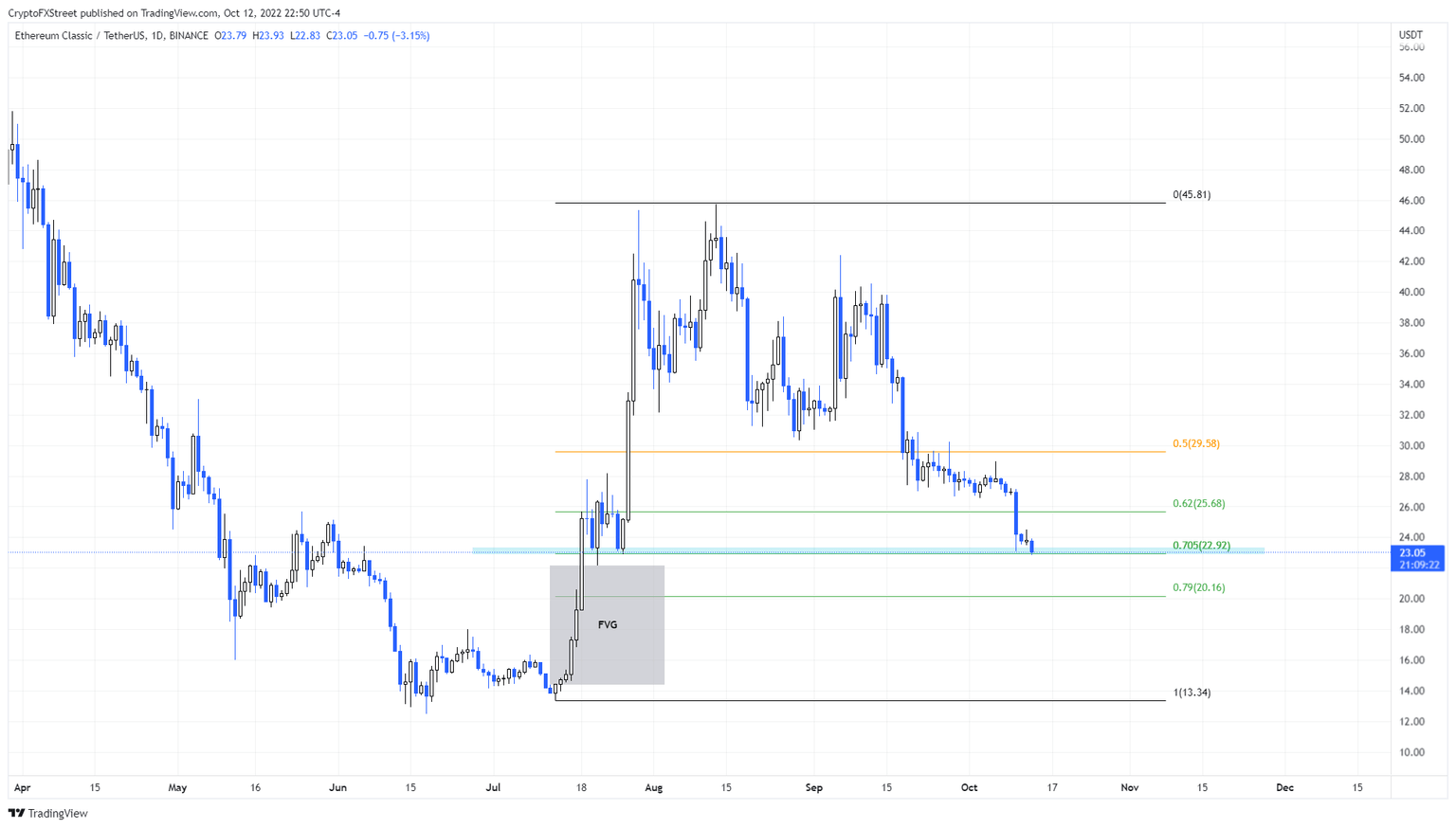

Ethereum Classic price began its 242% rally on July 13 and created a local top at $45.81 a month later. This parabolic run-up was an amazing feat, but the holders began to book profits, kick-starting a downtrend.

So far, Ethereum Classic price has shed roughly 50% and is currently hovering around the 70.5% Fibonacci retracement level at $22.92. Here, a support area extends from $23.35 to $22.92 and is the only thing preventing ETC from sliding lower.

A breakdown of this level could trigger another 37% sell-off that will be helpful in rebalancing the Fair Value Gap (FVG), extending from $22.15 to $14.37. However, market participants should note that this bearish scenario is contingent on Ethereum Classic price breaking below the aforementioned support area.

ETC/USDT 1-day chart

If Ethereum Classic price fails to break below the $23.35 to $22.92 support area, it would indicate that sidelined buyers are purchasing ETC at a discounted price and contesting the incoming selling pressure.

In this case, market participants can expect Ethereum Classic price to stop falling and potentially reverse if the buying pressure is higher than the selling pressure. If ETC flips the $29.58 hurdle into a support floor, it will invalidate the bearish thesis and potentially catalyze a run-up to $30.87.

Note:

The video attached below talks about Bitcoin price and its potential outlook, however, this is still relevant as it is likely to influence Ethereum Classic price.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.