- Bitnovo also supports cryptocurrency purchases using the Bitnovo card and bank transfers systems.

- Customers get the coins in their wallets less than half an hour after purchase.

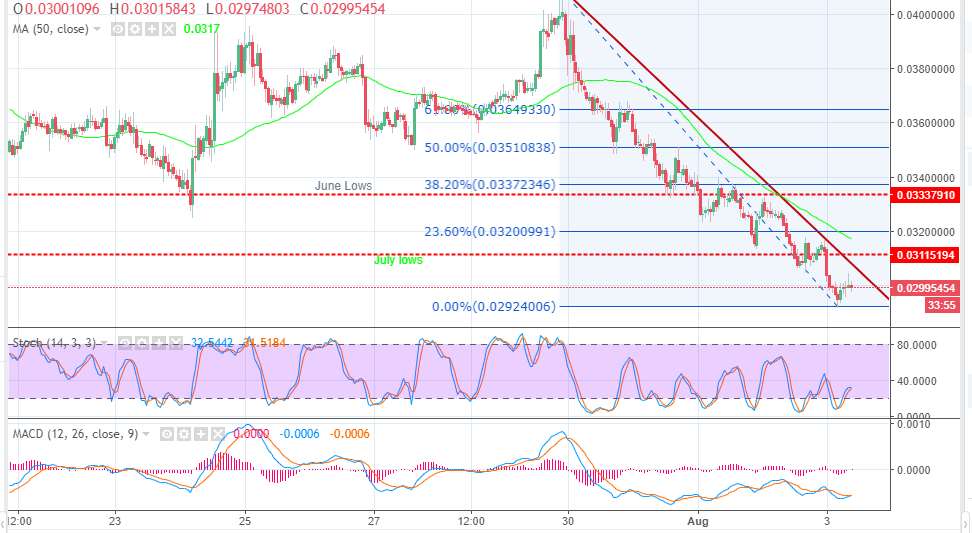

- Tron price has recovered from the lows at $0.029, but the upside is capped by the $0.030 stubborn resistance.

Tron founder, Justin Sun has expressed his gratitude to Bitnovo, a cryptocurrency platform that gives users the ability to purchase Bitcoin, Ethereum, Litecoin and other cryptocurrencies. Tron users will now be able to buy TRX in more than 20,000 stores spread across Spain and Italy.

Users buy vouchers in stores which can then be redeemed for cryptocurrencies. Some of the stores include Carrefour, Game, and FNAC among others. Bitnovo assures its customers of top security when buying cryptos. In addition to that, customers get the coins in their wallets less than half an hour. Significantly, the purchase can be made from anywhere using Bitnovo’s card or through bank transfer system.

Tron price analysis

Tron is trading below both June and July lows explored during the analysis I covered yesterday. The price is facing stiff resistance at $0.030 after recovering from trading lows at $0.029 on the day. The bearish trendline is the critical resistance at the moment. Besides, TRX/USD has been tumbling down every time it touches the trendline.

Therefore, at the moment, the buyers must fight for a break above the trendline resistance for them to realize a sustained uptrend towards $0.031 and the critical 23.6% Fib retracement level resistance taken between the lows of 0.029 and the highs of $0.0409. But before that, the 50 simple moving average resistance at $0.0317 must be dealt with. The MACD has been on the negative side for three days day and the sellers are surely getting tired. The buyers are likely to find an entry and this time it is important that they put their best forward and retrace above the trendline resistance.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: Fed-led rally could have legs towards $65,000

Bitcoin has risen 7% so far this week, supported by the US Fed interest-rate cut and more than $300 million in ETFs inflows. The recent surge led BTC price to shatter several key technical resistance levels, a sign that the current two-week rally has likely some more way to go towards $65,000.

Ethereum, BNB and POL holders on the watch as BingX faces loss of $26 million in hack

Crypto exchange BingX said on Friday that it suffered a hack, an attack that led to “minimal” losses that researchers at PeckShield estimate at $26.68 million. The attacker swapped the stolen altcoins for Ethereum, Binance Coin and Polygon tokens, according to on-chain data.

Pepe price forecast: Eyes for 30% rally

Pepe extends the upward movement on Friday after breaking above the descending trendline and resistance barrier on Thursday. PEPE’s dormant wallets are in motion, and the long-to-short ratio is above one, further supporting this bullish move and hinting at a rally on the horizon.

Shiba Inu is poised for a rally as price action and on-chain metrics signal bullish momentum

Shiba Inu remains strong on Friday after breaking above a symmetrical triangle pattern on Thursday. This breakout signals bullish momentum, further bolstered by a rise in daily new transactions that suggests a potential rally in the coming days.

Bitcoin: On the road to $60,000

Bitcoin price retested and bounced off from the daily support level of $56,000 this week. US spot Bitcoin ETFs posted $140.7 million in inflows until Thursday and on-chain data supports a bullish outlook.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.