TRON price boldly overcomes trend line resistance

- TRON price only 5% away from the 2018 all-time high at $0.100.

- Volume running more than double the daily average.

- Delicate decision facing traders today.

TRON price putting pressure on the bulls to decide between capturing a 50% gain today or waiting to see if it has the momentum to test the all-time high. Simply, risk a reversal for an extra 5%?

TRON price in the blow-off phase

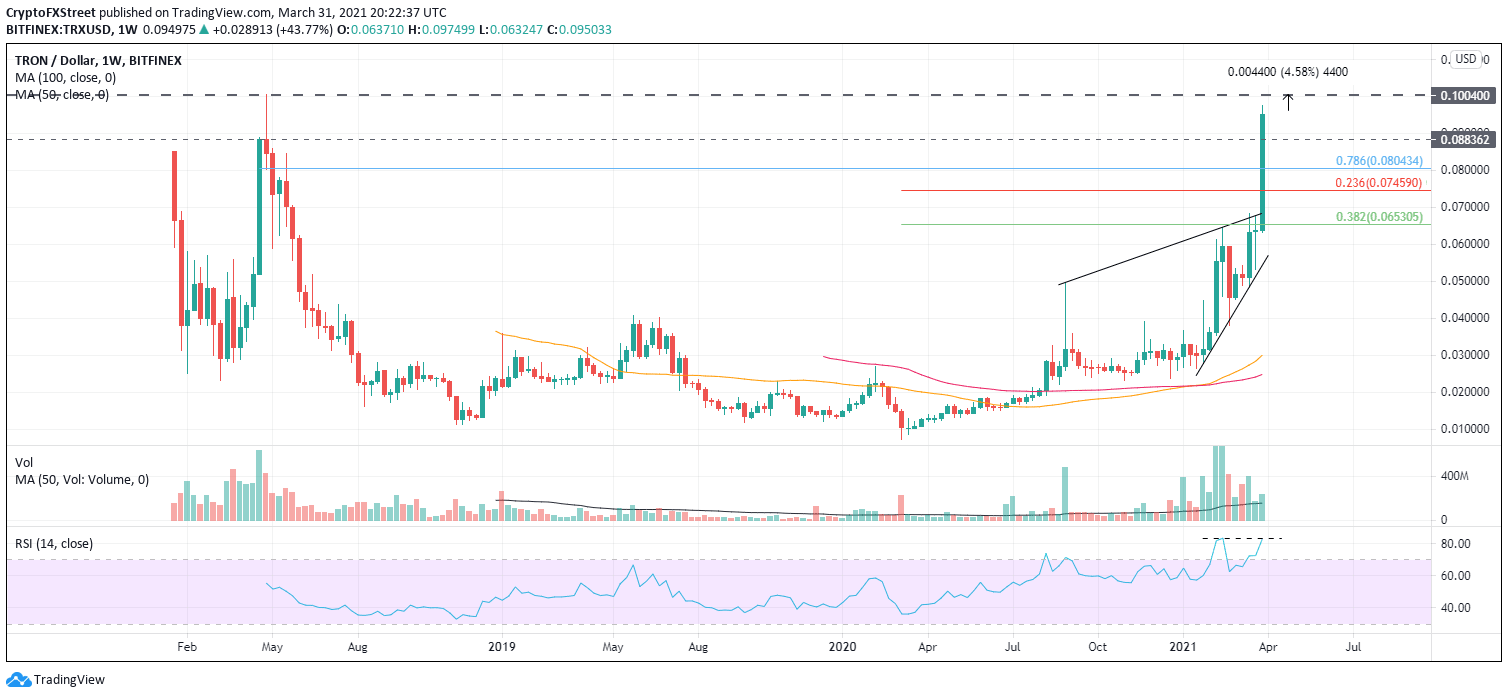

For consecutive weeks this month, TRX failed to overcome the topside trend line’s resistance from August 2020 through the February high at $0.067. This week is a different story as the digital token has quickly cleared the displayed trend line and rallied through the 0.786 Fibonacci retracement of the 2018-2020 bear market at $0.080 and the highest weekly close in 2018 at $0.088.

At the time of writing, TRX is not showing signs of exhaustion, and it MAY hit the all-time high today or this week. However, it is essential to underscore that this is the blow-off move for the 2021 rally, and traders should be preparing to lock in gains.

The only clear upside target is the all-time high at $0.100.

TRX/USD weekly chart

As with all trading opportunities, downside protection is critical, and traders should plot the highest weekly close of 2018 at $0.088 to start. If that fails to hold, TRX will crumble to the 0.236 Fibonacci retracement of the 2021 rally at $0.074. The topside trendline is the next support level, currently at $0.068, followed by the 0.382 retracement level at $0.065.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.