Tron founder Justin Sun open to purchasing FTX assets despite substantial amount being allegedly missing

- FTX’s assets are being evaluated by Justin Sun’s company Tron.

- A partner at the firm representing debtors of FTX's collapse stated that many of the exchange's assets have been stolen or are missing.

- Tron price is still struggling to recover its November 6 crash losses trading at $0.05.

FTX's day in the sun came to an end earlier this month, following its bankruptcy filing. Tron's founder Justin Sun who has been rather vocal about its support for FTX and its former CEO Sam Bankman-Fried (SBF), is now attempting to provide further help.

FTX assets find buyers

FTX recently announced that it was looking to sell some of its businesses and reorganize them in order to recoup money to pay its clients back. Sun’s company Tron might be up for taking FTX's assets off of their hands, according to a Wall Street Journal report.

In a statement to reporters, Sun said,

"We are open to any kind of deal. I think all the options [are] on the table. Right now we are evaluating assets one by one, but as far as I understand the process is going to be long since they are already in this kind of bankruptcy procedure."

He further added that representatives of the Tron team are present in the Bahamas along with officials from Huobi, a Seychelles-based crypto exchange. Huobi's involvement in this process comes from the fact that Justin Sun acts as an advisory board member of the company. At the moment, both Tron and Huobi are in talks with FTX, creating positive expectations for the bankrupt exchange's clients.

However, the very assets that Justin Sun is eyeing to grab are in question at the time. During FTX's bankruptcy proceedings on November 22, James Bromley, a partner at law firm Sullivan & Cromwell, said that a substantial amount of assets had either been stolen or remained missing at the moment.

Bromley said that despite the attempts to protect the assets against hacks, attacks continue:

"We're not just talking about crypto assets, or cash assets, or physical assets — we're also talking about information, and information here is an asset."

To avoid attacks, FTX has mustered the help of many cybersecurity firms, including Chainalysis.

Tron price exhibits no reaction

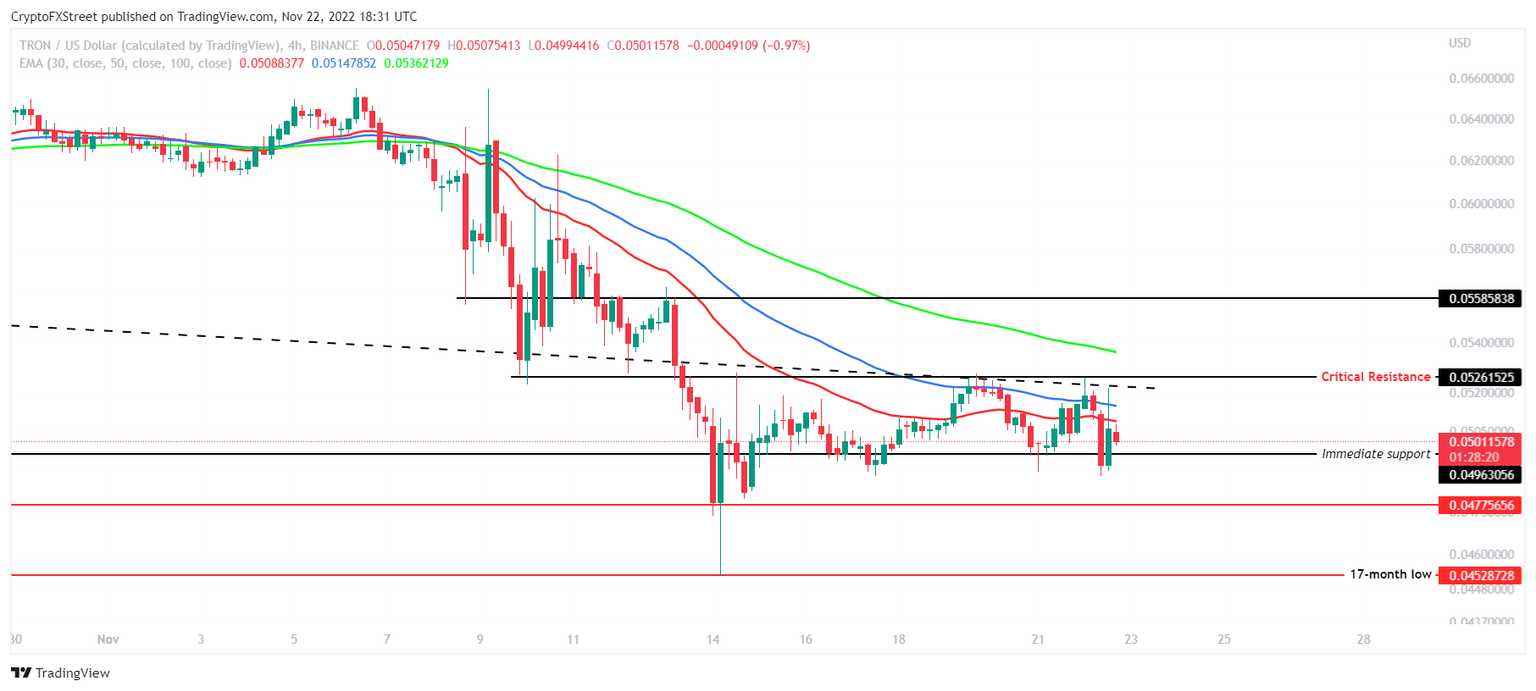

Tron price did not see a spike in value despite its founders' abovementioned statements. Following the broader market bearish cues, TRX continued to trade within the resistance and support range of $0.0526 and $0.0496. Currently, at $0.0502, the altcoin is still giving mixed signals.

If the cryptocurrency was to find some bullish pressure over the next trading sessions, Tron price could climb toward its critical resistance at $0.0526. If that is the case, TRX price will also flip the 30 and 50-day Exponential Moving Averages (EMAs) into support. This would set the altcoin up for further recovery toward $0.0558.

TRX/USD 4-hour chart

However, if the bearish cues persist, Tron price could note a decline below its immediate support at $0.0496. Bouncing off of the $0.0477 level would enable TRX to recover over the next few days. On the other hand, a daily candlestick close below $0.0477 would invalidate the bullish thesis, pushing the coin toward the 17-month low of $0.0452.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.