Genesis could potentially file for bankruptcy following the liquidity crunch caused by FTX’s collapse

- Genesis is looking to raise about $1 billion before bankruptcy filing becomes its last resort.

- U.S. prosecutors have been reported to be investigating FTX months before the exchange filed for bankruptcy.

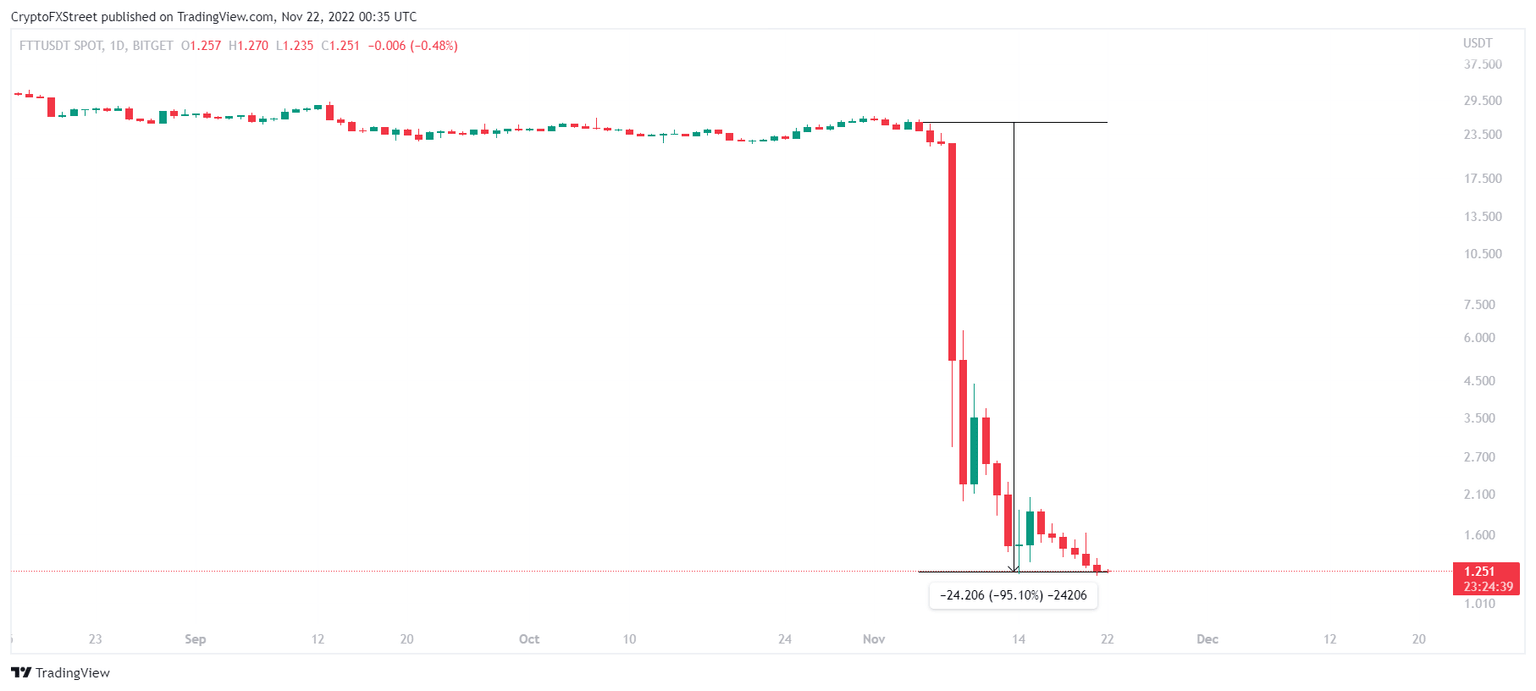

- FTX token (FTT) continues to establish new lows with every passing day, trading at $1.251.

FTX exchange triggered one of the biggest crashes this year, and the crypto market continues to bear its aftershocks weeks later. The impact, which slightly affected Genesis Global Capital, is now facing a much bigger threat unless resolved soon. On the other hand, suspicions about FTX’s wrongdoings have emerged to have been far older than expected.

FTX causes more troubles

FTX exchange filing for bankruptcy was expected to end the crypto market crisis, but the liquidity crunch that emerged from it is hurting Genesis. As per a report from Bloomberg, the lending company is currently attempting to raise about $1 billion from investors.

Following the liquidity crisis, Genesis temporarily suspended redemptions and new loans on its platform. The collapse of Three Arrows Capital was also reported to have a hand in Genesis’ current conditions. The company also had over $175 million locked up in derivatives on the FTX exchange and was provided with an equity infusion worth about $140 million from its parent company Digital Currency Group.

Although the company is not looking to file for bankruptcy immediately and is only treating it as a last resort. Genesis was reported saying,

“Our goal is to resolve the current situation consensually without the need for any bankruptcy filing. Genesis continues to have constructive conversations with creditors.”

In addition to this, FTX’s collapse has led to the American professional basketball team Golden State Warriors facing trouble. According to Forbes, the NBA team was alleged in a lawsuit for fraudulently promoting FTX and its platform.

Furthermore, more details about FTX’s criminal conduct have also come forward. Reportedly, the exchange was involved in an investigation by the U.S. Attorney’s Office for the Southern District of New York for months. The prosecutors were investigating Bank Secrecy Act compliance focusing on FTX’s U.S. and other arms.

The impact of these developments has led to the exchange’s native token repeatedly painting red on the charts.

FTX Token keeps the crypto market below $800 billion

FTX’s native token, FTT, has been registering red candles consistently for about a week now. The cryptocurrency has lost over 95% of its value since the crash of November 6 and is currently trading at $1.251.

FTT/USD 1-day chart

The broader impact on the crypto space has not been kind either, as the total market capitalization fell below the $800 billion mark once again. Bitcoin price fell to its two-year lows in the last 24 hours before slightly recovering to trade at $15,845.

The retesting of the $15,800 level might make it seem like the market has hit bottom. However, the king coin, along with other altcoins, still faces a possible sell-off due to increasing bearish momentum, which could trigger a further decline in prices.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.