Top 3 Price Prediction Bitcoin, Ethereum, XRP: Crypto uptrend threatened ahead of the weekend

- Bitcoin price made a new higher high this week but faces near term selling pressure.

- Ethereum price is in danger of facing reversal due to a powerful Gann cycle.

- XRP price inside a bear flag and at risk of moving below that bearish pattern.

Bitcoin price action continues to digest the drop found on Wednesday as prices continue their slow slide south. Ethereum price completes a seven-week uptrend, creating a likely turning point and a corrective move extremely likely. XRP is at risk of a 48% drop if it fails to hold its Ichimoku support levels.

Bitcoin price nears its final support before a push down to $54,000 could occur

Bitcoin price is currently testing its final Ichimoku support level, the Kijun-Sen ($63,250), before deciding whether to bounce or collapse. If Bitcoin fails to hold the Kijun-Sen as support, then the next support level within the Ichimoku Kinko Hyo system is the top of the Cloud at $54,250. That would represent a 15% drop from Friday’s open. On the other hand, if Bitcoin does fall to that level, then $54,250 should hold because $54,250 is the 61.8% Fibonacci extension and the weekly Tenkan-Sen.

BTC/USD Daily Ichimoku Chart

If support does hold at the Kijun-Sen, then sideways price action over the weekend would be the most likely scenario traders would observe. In that scenario, Bitcoin would likely pause and wait for the weekly Tenkan-Sen to move higher to return to equilibrium with Bitcoin price.

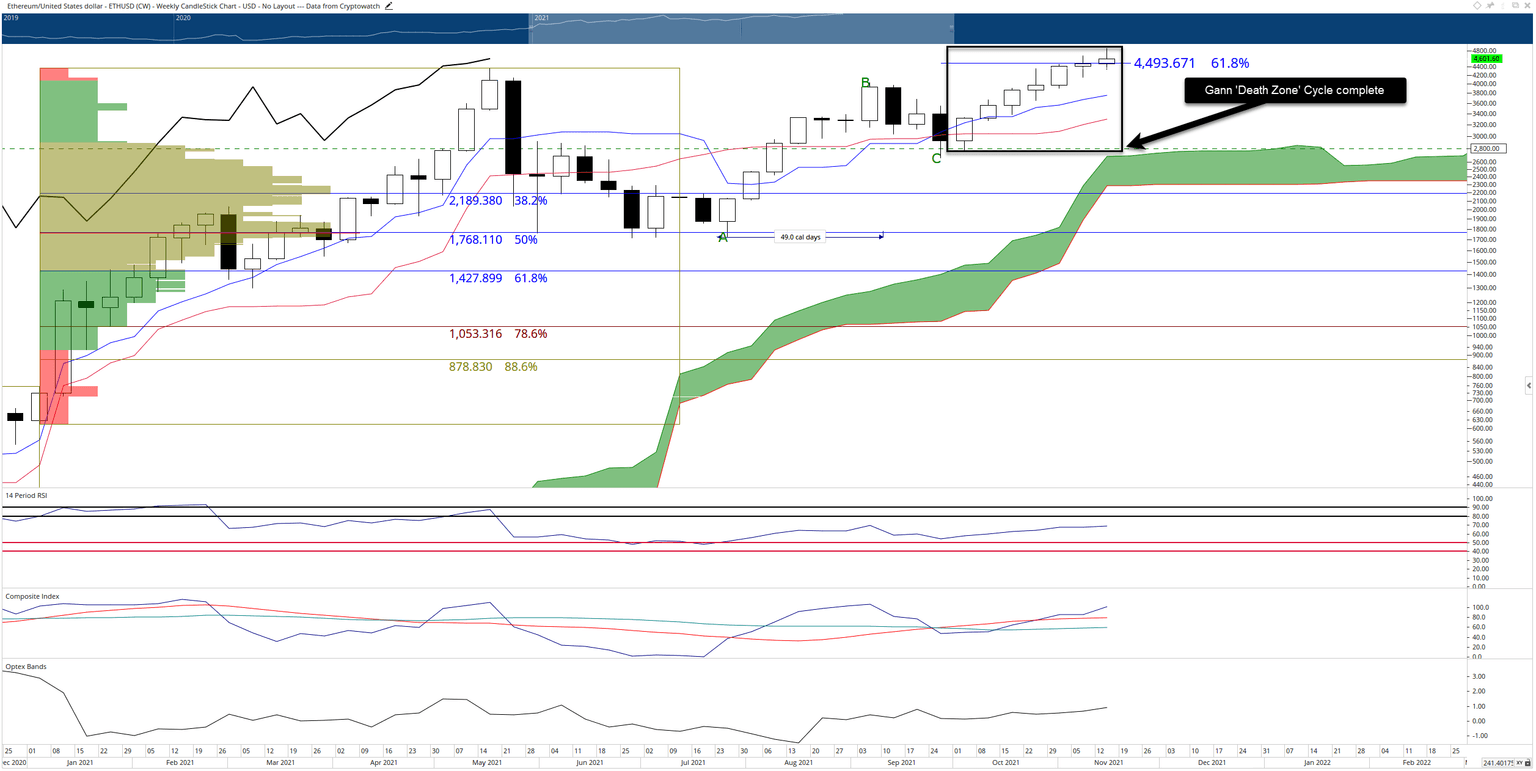

Ethereum price completes Gann ‘Death Zone’ time cycle, bearish price action likely

Ethereum price, despite making new all-time highs, is under threat of making a deep corrective move due to a powerful Gann time cycle that Gann referred to as his ‘Death Zone’ cycle. This cycle is a forty-nine to fifty-two-day cycle (seven weeks). Gann wrote that a violent corrective move is likely if an instrument is trending at a steep slope over seven weeks. Ethereum is a textbook example of this cycle. Given the significant gaps on the weekly chart between the candlestick bodies and the Tenkan-Sen, a corrective move is increasingly likely.

ETH/USD Weekly Ichimoku Chart

The projected retracements for Ethereum are the Tenkan-Sen at $3,750 and the Kijun-Sen at $3,300. A move down to either of those levels would fulfill a return to equilibrium in the Ichimoku system, creating sufficient conditions for a resumption of a strong bullish expansion phase. Of course, any near-term bearish projections will be eliminated if Ethereum goes parabolic and makes new all-time highs.

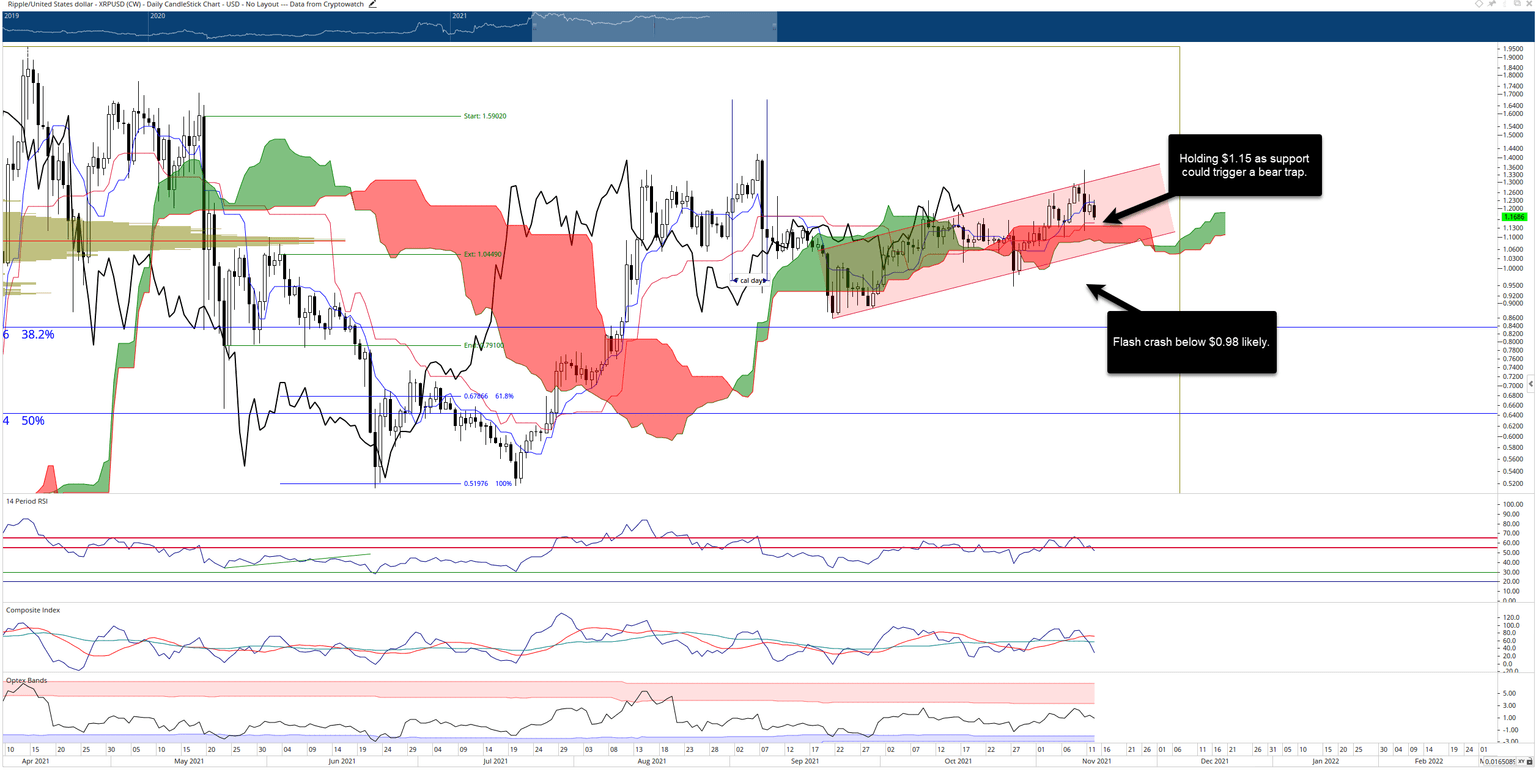

XRP price action could generate a nasty bull trap if it moves below $1.00

XRP price is in a longer-term bearish continuation pattern known as a bear flag (red channel). The primary support level that XRP must hold is the bottom of the Cloud (Senkou Span A) and the 2021 Volume Point Of Control, both at $1.09. Below that, only the Chikou Span can support XRP. As a result, bears will likely target a strong short setup on any close at or below $0.98 to target the $0.65 to $0.70 value areas.

XRP/USDT Daily Ichimoku Chart

To invalidate the current bearish setup, buyers need to support XRP price above the bear flag and above the November 8th close at $1.29. Bulls could also surprise any short-sellers by holding the Kijun-Sen and Senkou Span B at $1.15 as support.

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.