Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Is 2023's first rally in works?

- Bitcoin price bounces off the $16,624 support level, signaling a resurgence of buyers.

- Ethereum price skyrockets after BTC’s small spurt in buying pressure, but bears are persistent.

- Ripple price continues to make strides in its attempt to revisit the hurdle above.

Bitcoin price shows a clear trend shift on a lower timeframe after its recent spike. Although this move does not confirm the start of an uptrend, Ethereum, Ripple and some altcoins are already flying high.

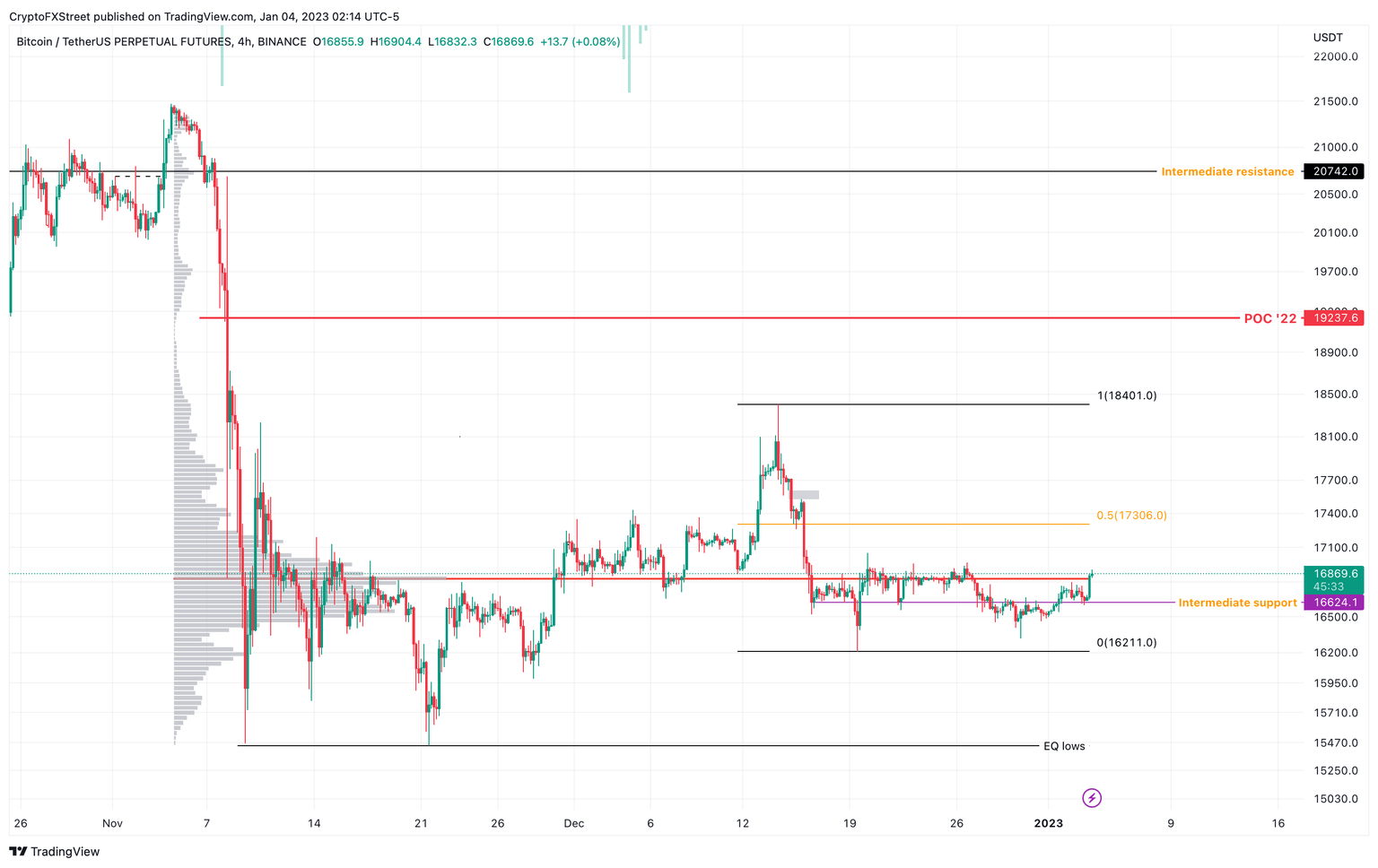

Bitcoin price ready to make its move

Bitcoin price triggered an uptrend after bouncing off the $16,624 support level. This move has produced a market structure shift when considering the recent higher high. While the bullish outlook is alive, confirmation of the uptrend will arrive if BTC manages to flip $16,822, which is the highest volume traded level since November 5.

If successful, Bitcoin price could attempt a move to $17,306 followed by the range high at $18,401 and the highest volume traded level for 2022 at $19,237.

BTC/USD 4-hour chart

While the outlook remains bullish, a failure to breach the $16,822 could be a sign of weakness. If Bitcoin price produces a four-hour candlestick close below $16,221, it will invalidate the bullish thesis. In such a case, BTC could revisit the equal lows at $15,443.

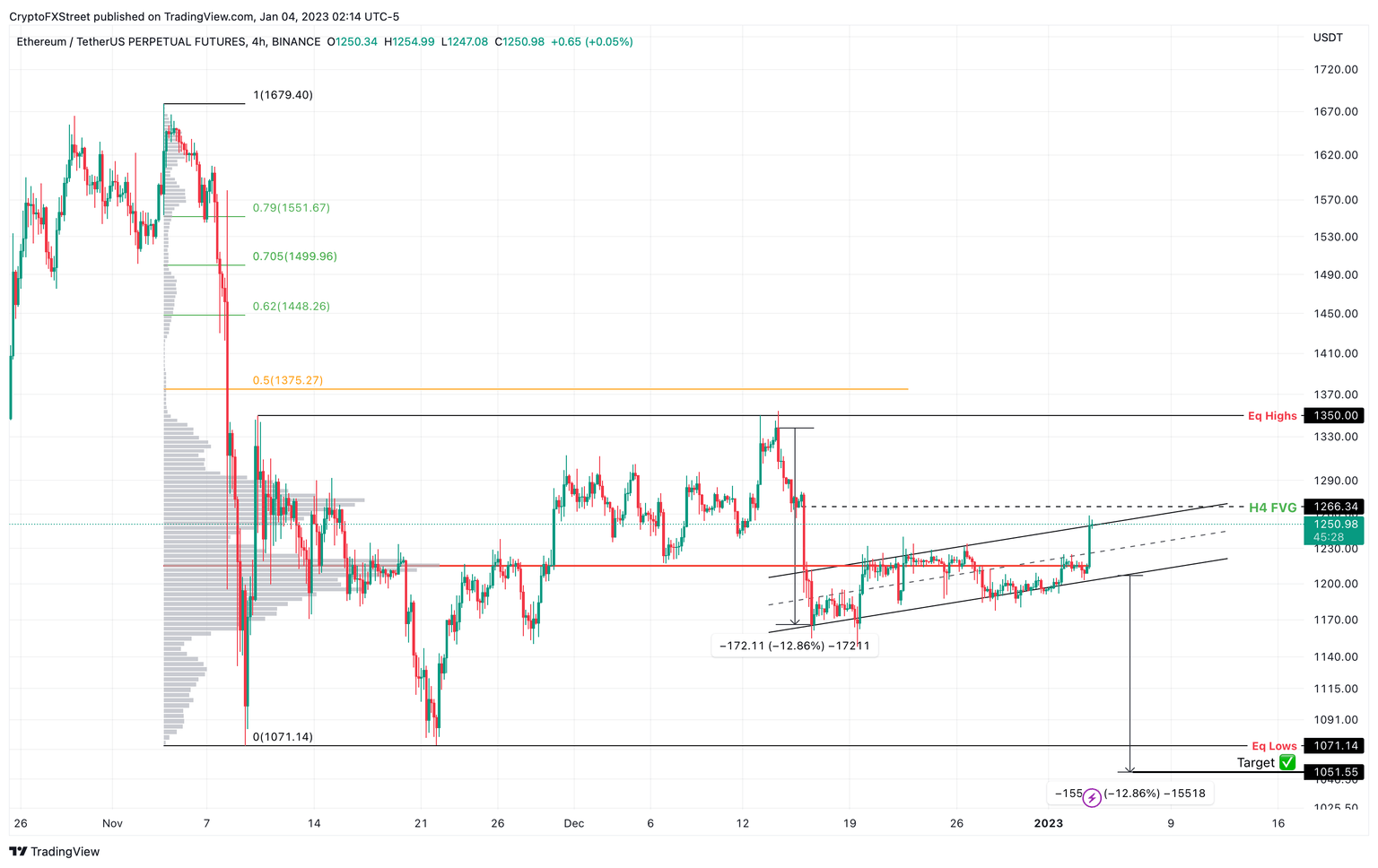

Ethereum price reaches its upper limit, what’s next?

Ethereum price is traversing a bear flag pattern as described in a previous article. Based on the technical formation a 12% downswing is forecast upon the breakdown of the flag at $1,206.

For the bearish outlook to play out, BTC needs to remain in a lull or flip bearish and Ethereum price needs to get rejected at the upper limit of the flag, resulting in a steep correction to $1,071 and $1,051 support levels.

ETH/USD 4-hour chart

While things are looking bearish for Ethereum price, invalidation of this thesis will occur if ETH flips the $1,266 hurdle into a support level. In such a case, Ethereum price could revisit the $1,350 resistance level.

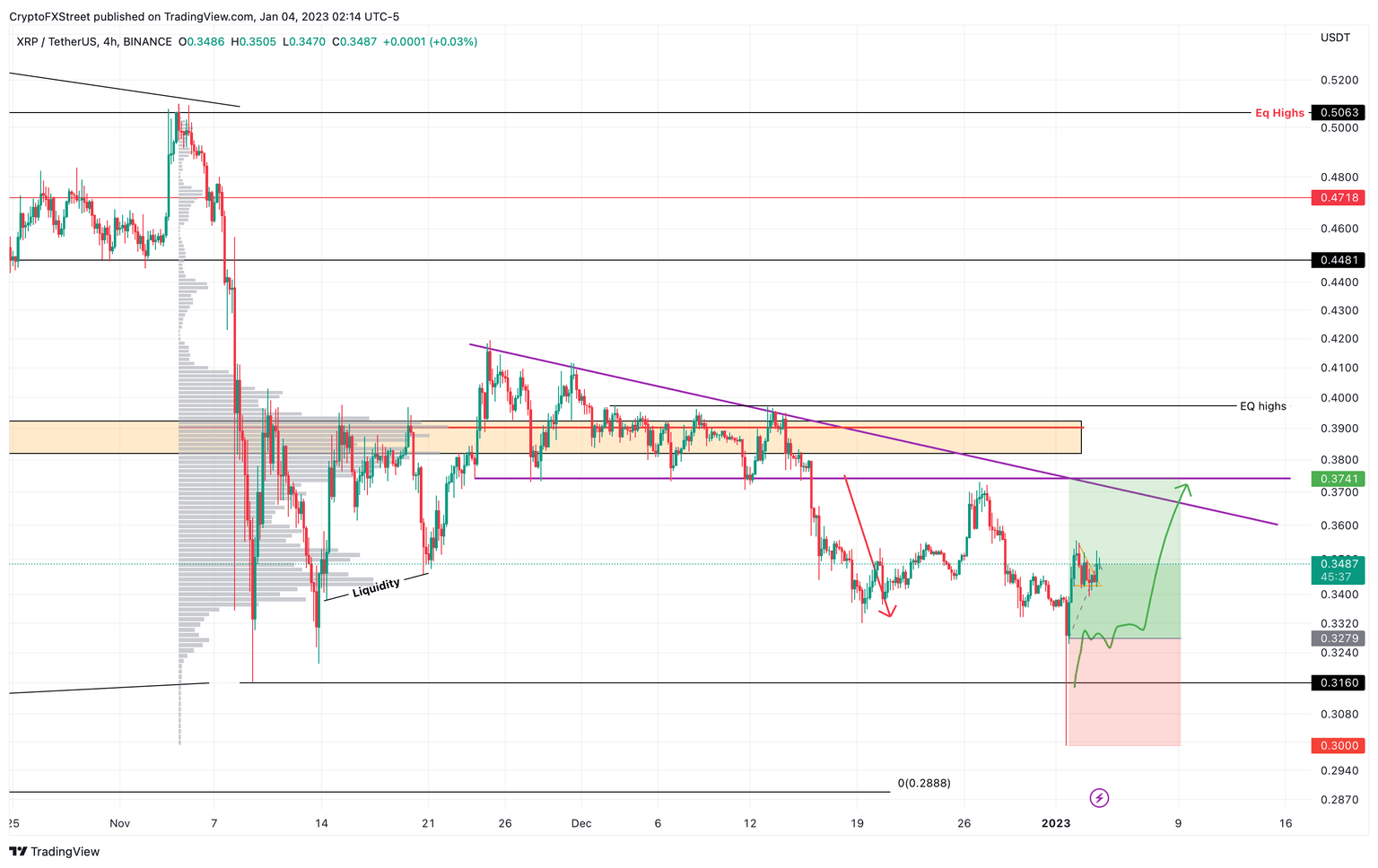

Ripple price picks up slack

Ripple price dug a lot lower than other altcoins on January 1 but its recovery since then has come along well. As XRP price trades around $0.348, investors can expect this trend to continue until it tags the $0.374 hurdle.

Beyond this level, if the buying pressure continues to hold, the remittance token could retest the the equal highs at $0.397.

XRP/USD 4-hour chart

Regardless of the bullish outlook seen in Ripple price, a breakdown in the optimistic structure in Bitcoin price could cause altcoins to tumble. If XRP price produces a four-hour candlestick close below $0.316, it will create a lower low and invalidate the bullish thesis.

In such a case, Ripple bulls could try to make a comeback at the $0.288 support floor.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.