Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto’s Summertime Sadness Pt.2

- Bitcoin rejected from $20,000 to end the month of June.

- Ethereum price tests a critical support level.

- Ripple price loses the battle as bears aim for $0.29.

The cryptocurrency market continues to fester with pessimism. If market conditions persist, the summer of 2022 will yield a fruitless crop.

Bitcoin price signals scary times

Bitcoin price trades at $19,350 at the time of writing. The bears showed up towards the final days of June with enough strength to produce a monthly close below the psychological $20,000 level at $19,942. The monthly close is now the second-largest bearish candlestick since May 2021. This unfortunate piece of evidence bears the necessity to consider lower targets for the Bitcoin price in the coming months. $18,750 and $17,300 will be key levels to keep an eye on.

Invalidation of the bearish downtrend relies upon a breach above $23,500. If the bulls can hurdle the mid $23,000 barrier, they may be able to reconquer the trend and rally toward $31,000, resulting in a 60% increase from the current Bitcoin price.

BTC/USDT 1-Month Chart

Ethereum price tests final support

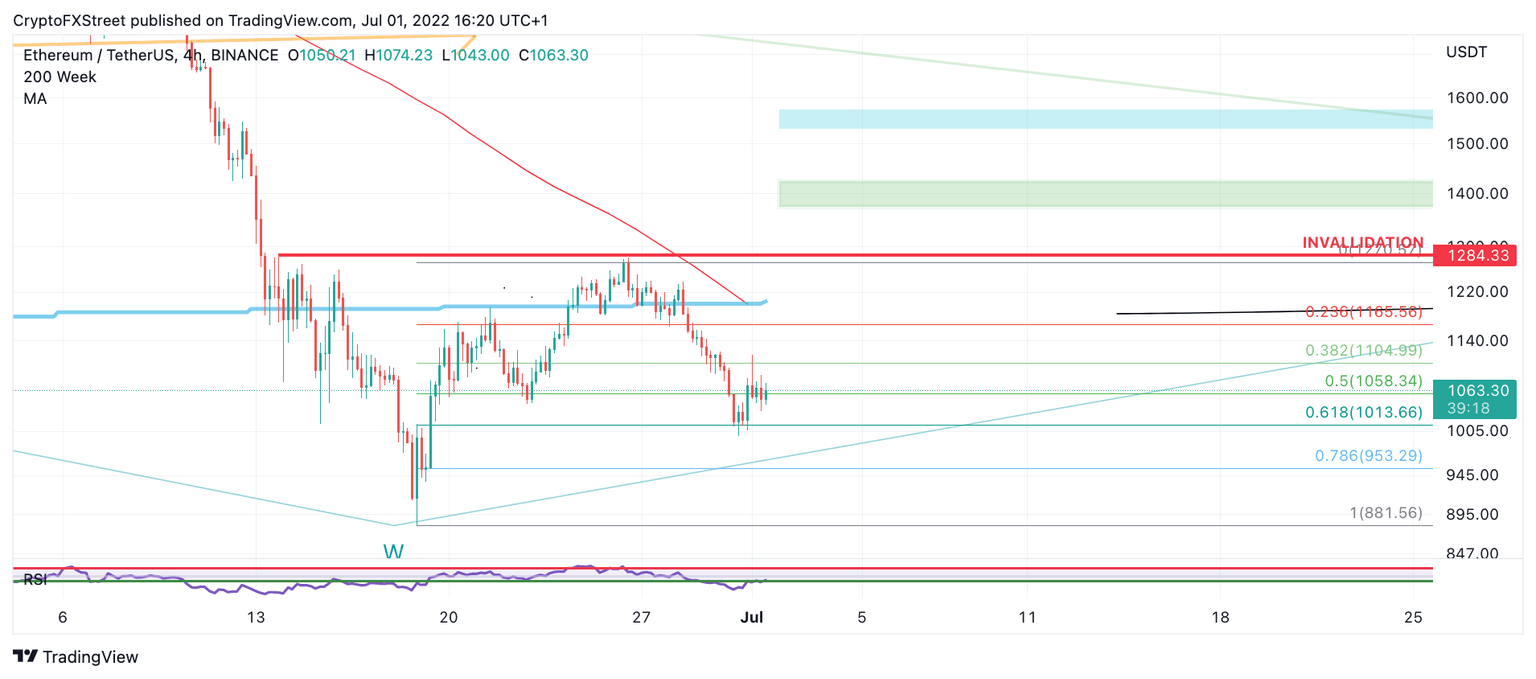

Ethereum price trades at $1,047 at the time of writing. A Fibonacci retracement tool surrounding June's low and high ($881 - $1,233) suggests that the ETH price has lost 50% of profits accrued. If the bulls cannot produce a rally from the current price levels, the bears will reconquer the trend aiming for the June 18 swing low at $890 and potentially $700 to shake knife catchers out of the market. It is worth noting that a death cross is underway as the 21-day moving average is plummeting into the notorious 200-week moving average. The collision of these key moving averages confounds the market’s sentiment as a whole as the Crypto Fear and Greed Index revisits historical levels.

Invalidation of the bearish trend remains a breach above $1,284. If the bulls can take out this level, they may be able to rally as high as $2,100, resulting in a 100% increase from the current Ethereum price.

ETH/USDT 4-Hour Chart

Ripple’s XRP price loses bullish grounds

XRP price shows unsustainability as June was a highly volatile news-correlated market. The technicals suggest the hype is over as the bears have confidently breached through the 50% and 61.8% Fibonacci Retracement levels (surrounding June’s monthly low at $0.28 and a monthly high of $0.38).

XRP price looks to aim for the $0.28 swing lows in the shorterm. However, a $0.20 Ripple price has long been forecasted at FXStreet. Investors should consider a liquidation into the $0.20 vicinity as the second probable target.

Invalidation of the bearish downtrend is a breach above $0.39.

The next attempt at this $0.39 barrier could trigger a bull rally towards $0.51, resulting in a 63% increase from the current XRP price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.