XRP Price Prediction: Whales in the market aim for $0.20

- Millions of XRP tokens have been transported to the Bitstamp exchange.

- Ripple’s XRP price has breached below a critical Fibonacci Retracement tool.

- Invalidation of the downtrend is a breach and close above $0.35.

Ripple’s XRP price shows concerning signals to end the month of June. Investors should prepare for a devastating blow.

Ripple’s XRP shows whales in the water

Ripple’s XRP price looks to end the final day of June with a blow as the bears confidently come out to suppress the XRP price. On June 30, 2022, the bears have produced impulsive bearish candlesticks in nearly free-fall fashion. The sell-off comes after the optimistic memorandum issued by Ripple vowing to hire 100 new employees in the near future. Unfortunately, the news created a buyer's frenzy into a high at $0.3871 that was short-lived.

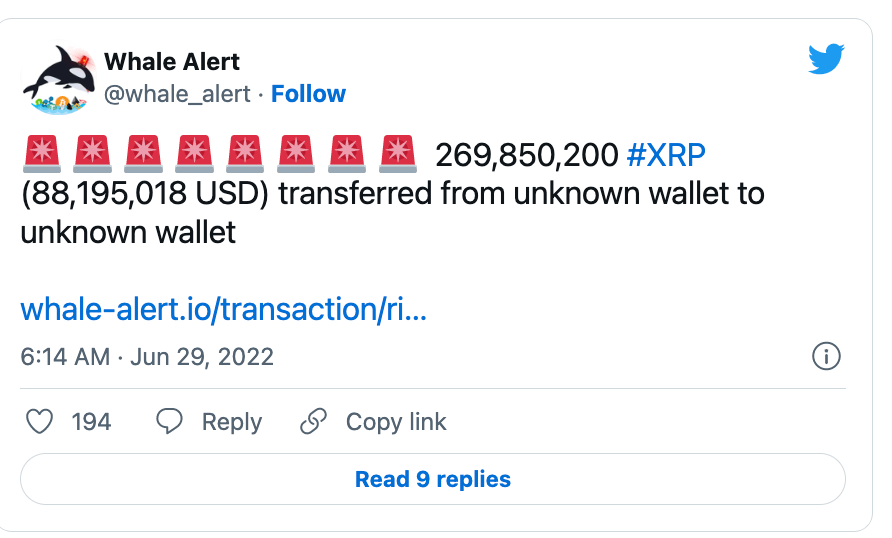

XRP price currently trades at $0.31 as traders are coming out to join the profit-taking downtrend. This week, on-chain metrics show millions of XRP tokens offloading onto the popular Bitstamp exchange in the last few days. According to blockchain auditor @Whale_Alert, nearly 600 million XRP tokens were sent into an anonymous Bitstamp wallet. This anonymous user now has the power to sell millions of tokens with just one click of a button. This mass movement of capital warrants the idea of a hefty sell-off into a $0.20 target as per previous bearish outlooks.

A Fibonacci Retracement tool surrounding the June 18 low at $0.2872, and the newly established high at $0.3871, shows the bears have already breached the 61.8% Fib level at $0.32 with confidence on the 3-hour chart. The bearish engulfing candle piercing through the key Fib level strongly confounds the idea of more sell-offs to come.

XRP/USDT 3-Hour Chart

Invalidation of the bearish downtrend is a breach and close above $0.35. If the bulls can breach this barrier, they may be able to reconquer the trend and rise towards $0.42, resulting in a 30% increase from the current XRP price.

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.