Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Crypto markets go silent, investors wonder if this is the top

- Bitcoin price hovers around $23,000 as bulls hash it out with the bears.

- Ethereum price continues to get rejected at the $1,678 monthly resistance level.

- Ripple price shows no signs of weakness yet, but bulls reveal exhaustion.

Bitcoin price shows no signs of directional bias as it sticks to its tight consolidative regime. Ethereum price and Ripple price are following the big crypto’s lead and continue to remain silent. Low market capitalization altcoins continue to pump, but participants start to wonder if this bull rally has hit a local top.

Bitcoin price in a spot

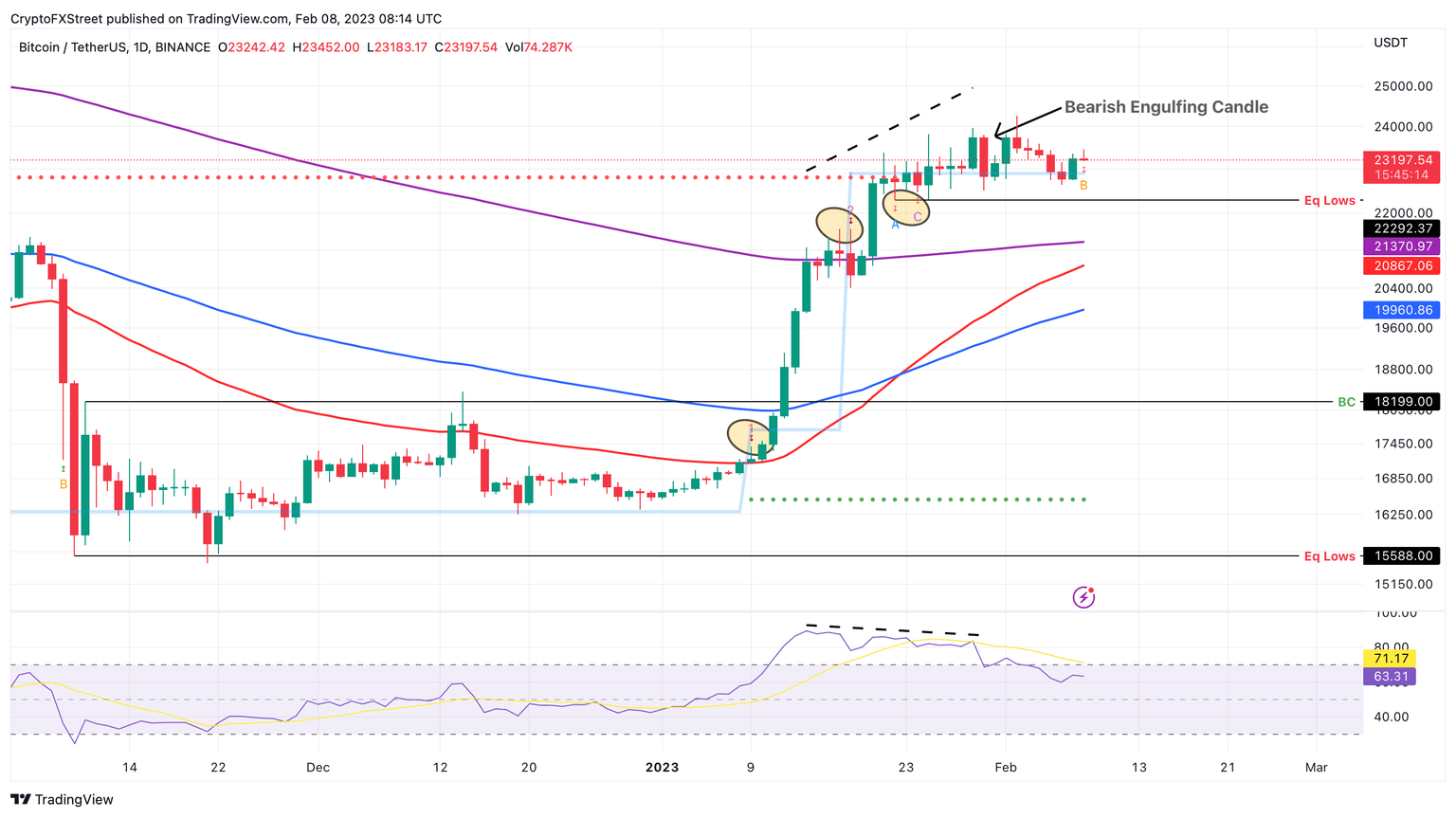

Bitcoin price continues to consolidate above the Momentum Reversal Indicator’s (MRI) state trend resistance level at $22,838. Since this level coincides with the breakout line, it will play a pivotal role in where BTC heads next.

Sustenance above this barrier will open the path for Bitcoin price to retest the $25,000 psychological level. A rejection here is also highly likely considering high timeframe blockades.

BTC/USD 1-day chart

However, a swift breakdown of the $22,838 level that flips it into a resistance level will invalidate the bullish outlook for Bitcoin price. In such a case, BTC could revisit the support zone, extending from $21,370 to $19,660.

Ethereum price struggles with hurdles

Ethereum price has spent more than two weeks trying to overcome the $1,678 resistance level but to no avail. The daily candlestick formed on February 8 is also seeing a quick exhaustion of buying pressure.

Unless Bitcoin price takes a bullish step, Ethereum price is due for a correction to $1,329 support level.

ETH/USD 1-day chart

While the outlook for Ethereum price is slightly pessimistic, an optimistic move for Bitcoin price could propel ETH higher. If this move flips the $1,700 level into a support floor, it will invalidate the bearish thesis and trigger a run-up to $1,820 and $2,000 hurdles.

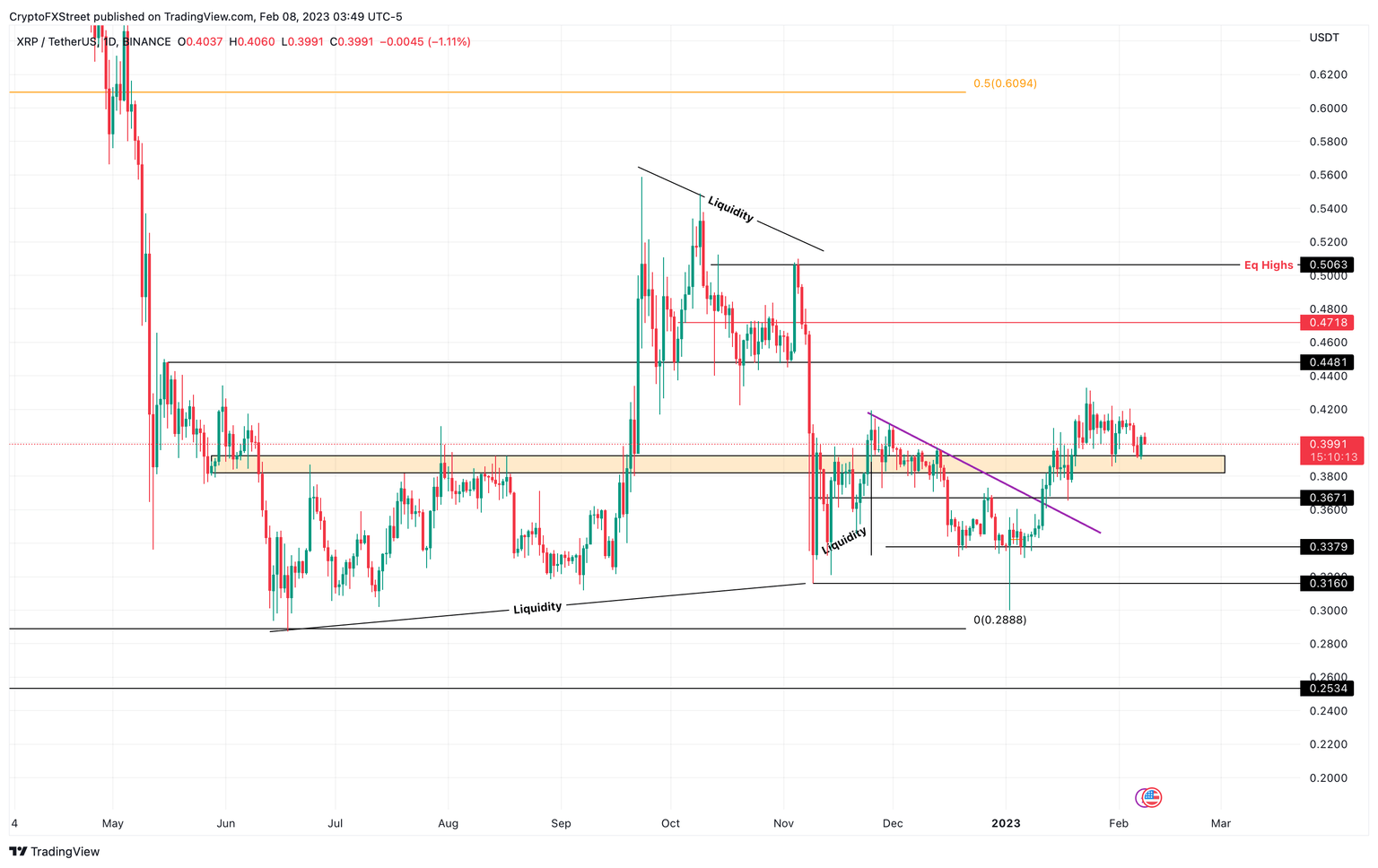

Ripple price and its feeble attempt

Ripple price bounced off the $0.380 to $0.400 support zone in an attempt to revive its bullish outlook. However, things are not working out so well for the top three coins, including XRP, due to the ongoing sideways movement.

Investors should be cautious and expect a breakdown of the said support structure and proceed depending on the signs. A successful invalidation of the $0.380 level would call for an 11% correction to $0.337.

XRP/USD 1-day chart

On the other hand, if Ripple price produces a daily candlestick close above the $0.448 hurdle and flips it into a support floor, it will invalidate the bearish thesis. Such a development would see XRP price attempt a push up to $0.471 and $0.506 hurdles.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.