Ethereum Price Forecast: ETH whales reveal this about the $2,000 psychological level

- Ethereum price hovers below a monthly resistance level of $1,677 after multiple rejections.

- Transaction data and whale movements suggest a local top has already formed and that the trend reversal is underway.

- A daily candlestick close that flips the monthly hurdle at $1,677 into a support floor will invalidate the bearish thesis for ETH.

Ethereum price shows multiple signs that this uptrend has lost its steam. There is clear power struggle between the bulls and bears, which has led to a tight consolidation. But odds seem to be favoring the sellers.

Ethereum price needs to decide its next move

Ethereum price chart looks simple and indicates that a rejection at the monthly hurdle of $1,677 will lead to a correction to the $1,329 support level. But a flip of the said level could trigger a rally for ETH.

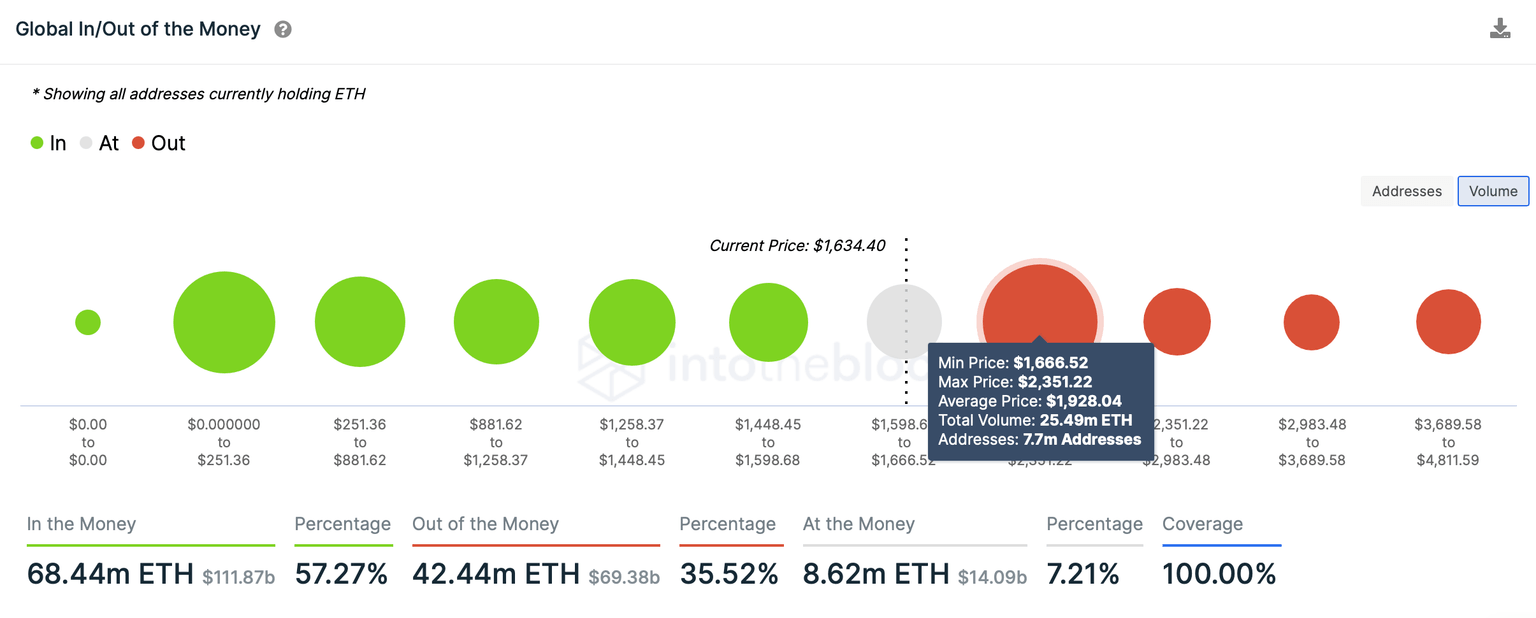

While the price chart remains the same, certain sell signals are developing, as seen in the on-chain metrics. IntoTheBlock’s Global In/Out of the Money (GIOM) reveals a massive cluster of investors at $1,928. Here roughly 7.7 million addresses that purchased 25.5 million ETH are “Out of the Money.”

These investors bought their ETH between $1,666 and $2,351 and are likely to sell their holdings as ETH enters their buy zone. This move would add weight to the selling pressure triggering a liquidation of the longs.

Hence, a move into the $2,000 psychological level seems highly unlikely, at least until Bitcoin price recovers.

ETH GIOM

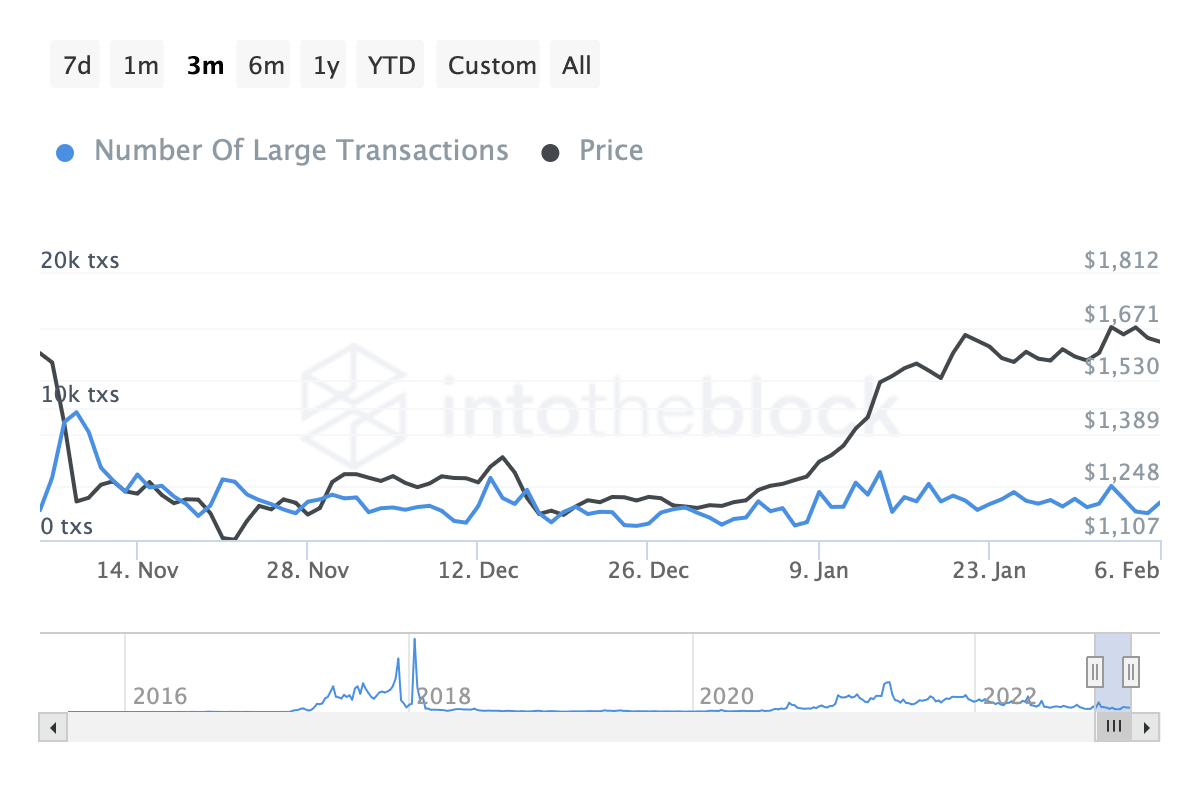

Further adding credence to this outlook is the large transactions worth $100,000 or more on the ETH network. This metric is used as a proxy to the number of whales or institutional investors interacting with the Ethereum network.

Typically, a sharp increase in large transactions after a rally indicates these whales could be moving their holdings to book profits. Hence, upticks in this metric can be used to predict local top formations.

As for Ethereum, the large transactions have spiked from 2,020 to 4,070, denoting a roughly 100% surge in whales’ interaction with the Ethereum network and potential for local top formation.

ETH large transactions

Adding these two outlooks to the fact that Bitcoin price is also forming a potential top will provide a more succinct picture of the market conditions. Therefore, investors need to be cautious.

On the other hand, a flip of the $1,677 monthly hurdle into a support floor will confirm that the bulls are back. In such a case, Ethereum price could attempt to retest the immediate hurdles at $1,779, $1,820 and the $2,000 psychological level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.