Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC to dip, taking altcoins with it

- Bitcoin price faces rejection at $28,485 hurdle and looks ready to slide lower.

- Ethereum price sits above a key support area of $1,551, a breakdown of which could see ETH revisit $1,309.

- Ripple price retests the $0.500 foothold with $0.469 and $0.420 barriers ready to support incoming selling pressure.

Bitcoin (BTC) price shows weakness as it approaches a key hurdle. Rejection for BTC could prompt altcoins like Ethereum (ETH) and Ripple (XRP) to crash lower as well.

Also read: Bitcoin Weekly Forecast: BTC bearish fractal forecasts correction to $25,000

Bitcoin price shows weakness

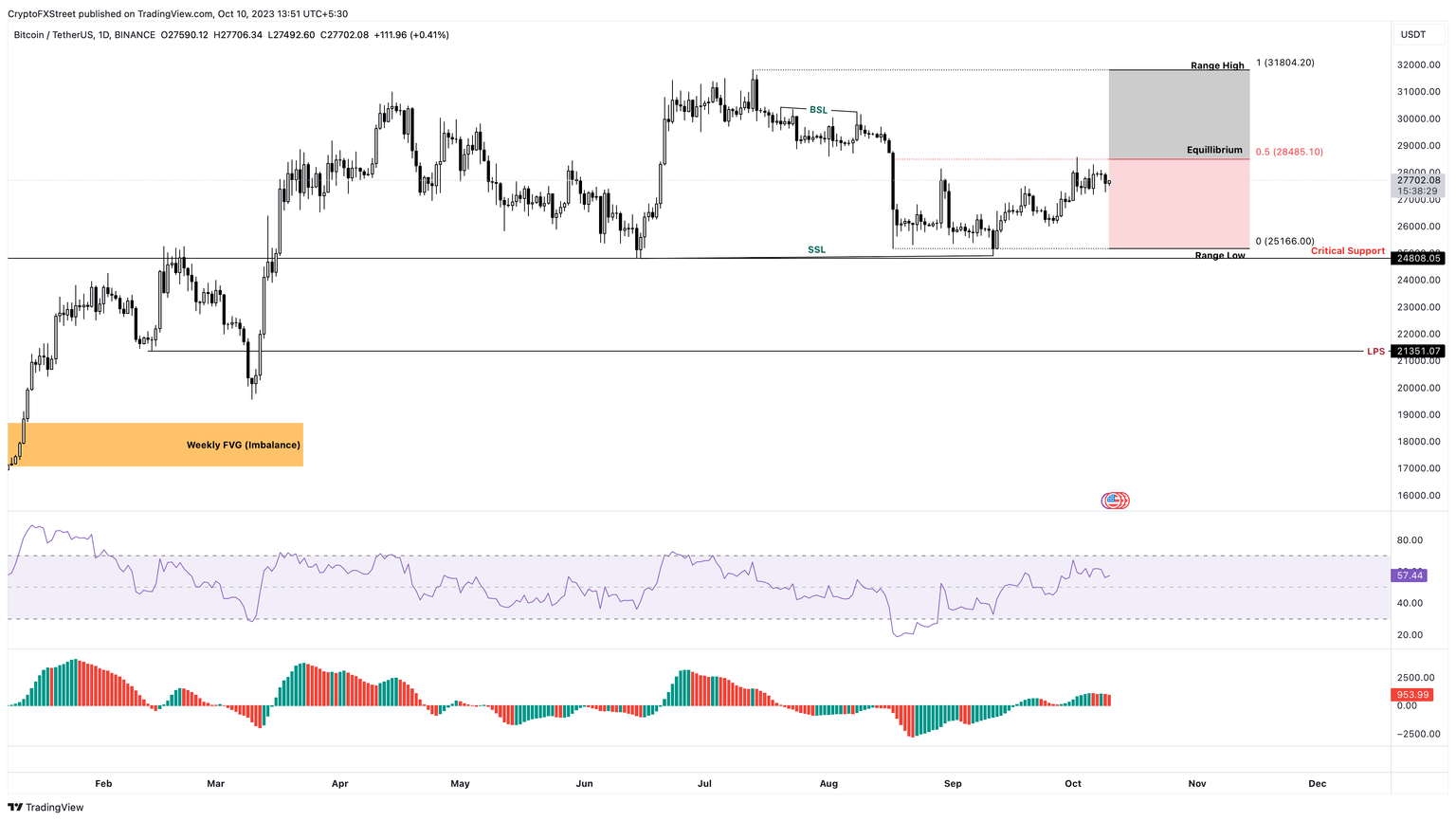

Bitcoin (BTC) price attempted to extend the 2023 rally but failed to overcome the $25,166 to $31,804 range’s midpoint at $28,485. Currently, the Relative Strength Index (RSI) and Awesome Oscillator (AO) indicators show a slowdown in bullish momentum and the potential for a build-up of bearish momentum.

But since the momentum indicators have not flipped bearish yet, investors can expect another dead cat bounce to $30,500 before kick-starting a downtrend. This move would collect the buy-stop liquidity resting above the swing highs formed between August 8 and July 20.

Post liquidity run, BTC could trigger a sell-off that retests the $24,808 support level, a breakdown of which could send it down to the $21,351 foothold.

Read more: Bitcoin holders get clean slate; Will BTC price choose $30,000 or $25,000?

BTC/USDT 1-day chart

On the other hand, if Bitcoin price flips the $30,000 psychological level into a support floor, it will invalidate the bearish thesis and attract sidelined buyers. In such a case, BTC could attempt to sweep the range high at $31,804.

Ethereum price delays the inevitable

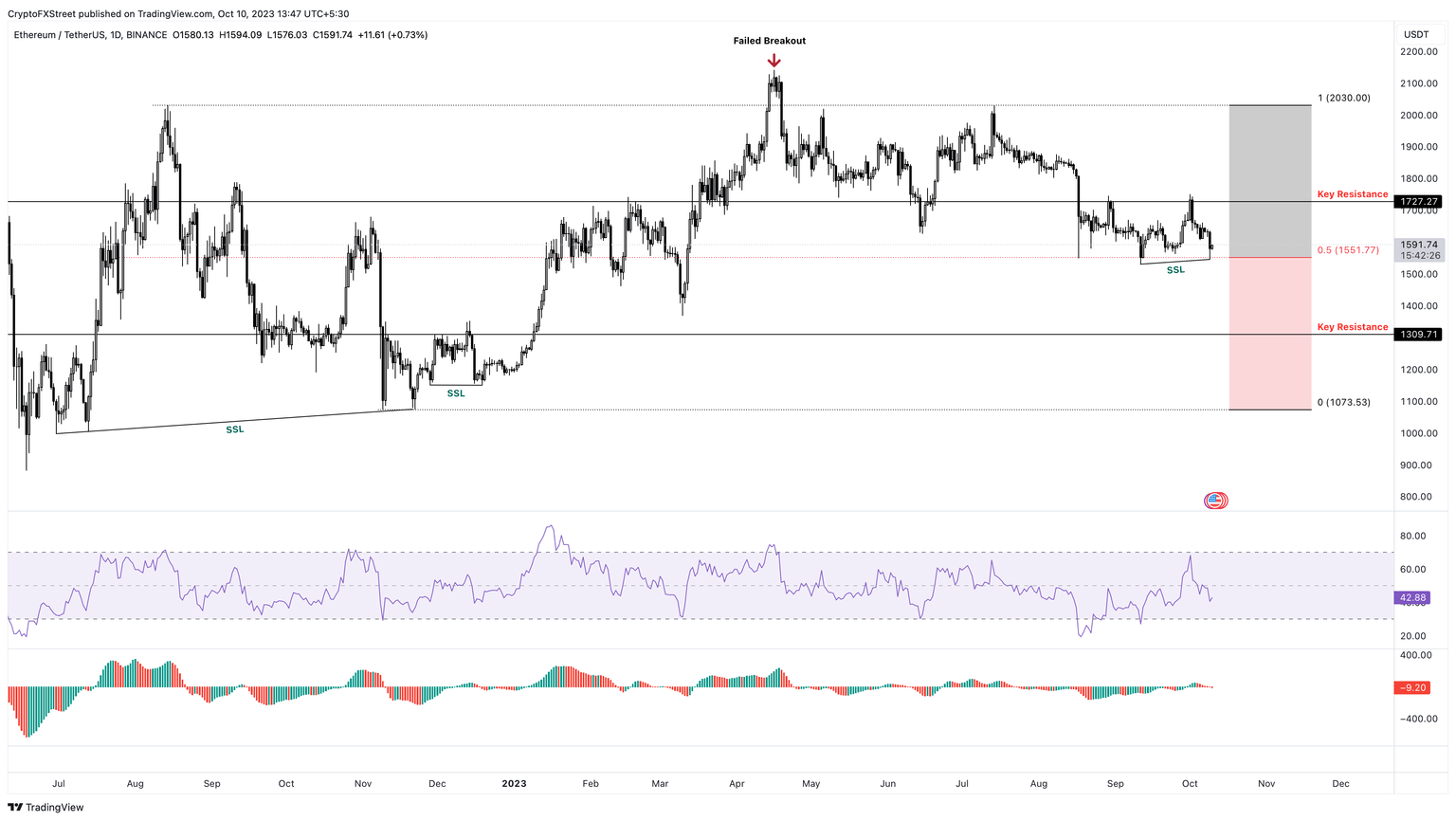

Ethereum (ETH) price sits above the $1,073 to $2,023 range’s midpoint at $1,551. But the RSI and AO indicators have already breached their respective mean levels of 50 and 0, suggesting a surge in bearish momentum.

Going forward, investors can expect Ethereum price to revisit the next support level of $1,309.

Read More: Ethereum price tests crucial support at $1,570 as ETH becomes a polarizing topic

ETH/USDT 1-day chart

Regardless of the bearish signs, if external factors like news or macro events produce a strong bullish spike, it could shift the winds quickly. In such a case, if Ethereum price flips the $1,727 hurdle into a support floor, it will invalidate the bearish outlook. This move could further propel ETH to retest the $2,030 hurdle.

Ripple price needs a push to crash

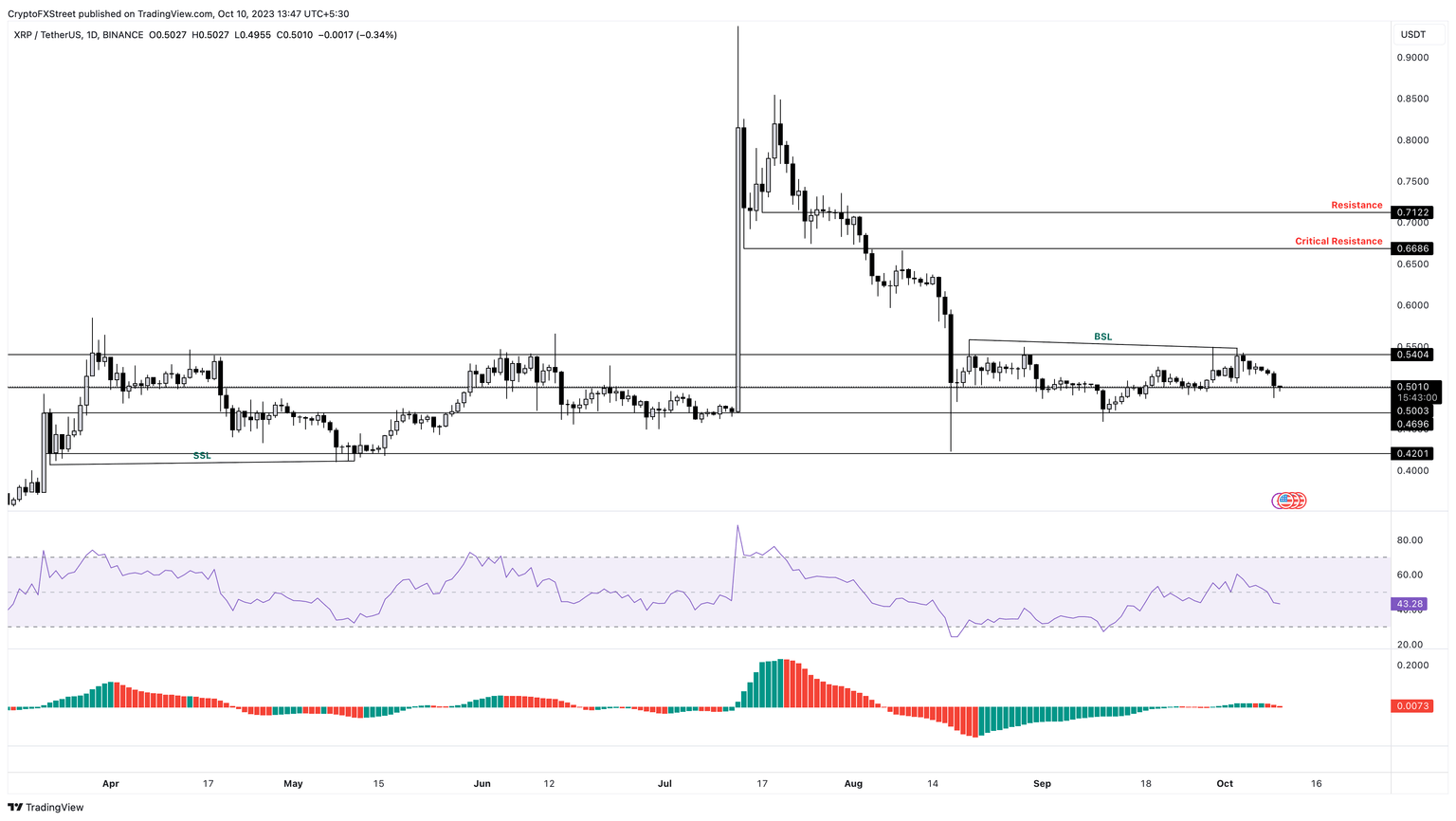

Ripple (XRP) price trades above the $0.500 support level and could slip below it soon, considering Bitcoin’s position. In such a case, XRP could fall back on the $0.469 and $0.420 support levels.

With no drivers like the Ripple lawsuit to push Ripple price higher, XRP is likely to keep sliding lower. In some situations, the altcoin could eye a sweep of the sell-side liquidity resting below swing lows formed between March 22 and May 11 at $0.411 and $0.406, respectively.

The RSI has breached below the mean level of 50, and AO is close to breaching the zero level, further adding proof to Ripple’s bearish outlook.

Read More: Ripple developers announce completion of AMM testing, hint at automated trading coming soon to XRPL

XRP/USDT 1-day chart

On the other hand, if Ripple price flips the $0.540 hurdle into a support level, it will create a higher high and invalidate the bearish thesis. In such a case, XRP price could be suspended for the foreseeable future between the $0.540 and $0.668 levels.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.