Top 10 AI tokens rally, defying broader crypto market lull

- Artificial Intelligence tokens have extended their gains between 4% and 13% in the past 24 hours.

- The largest AI token, NEAR, has recorded 7 million daily transactions, second only to Solana, per report by OurNetwork.

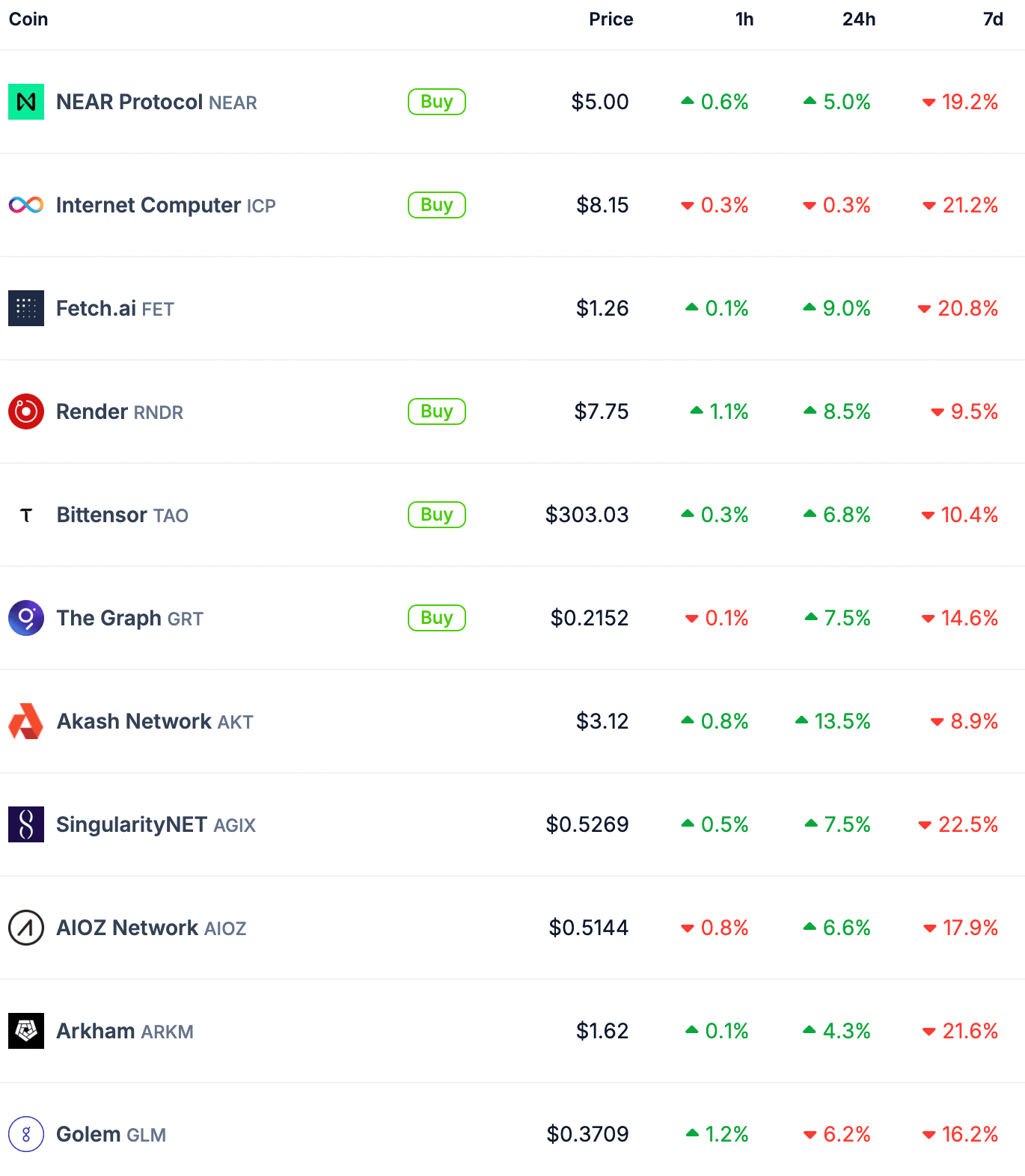

- NEAR, FET, RNDR, TAO, GRT, AKT, AGIX, AIOZ, ARKM and OCEAN posted gains in the past 24 hours, per CoinGecko data.

The Artificial Intelligence (AI) category of tokens is an emerging narrative in crypto in the ongoing cycle. The top ten tokens in the AI category have observed recoveries after recent corrections in their prices.

NEAR Protocol (NEAR), Fetch.ai (FET), Render (RNDR), Bittensor (TAO), The Graph (GRT), Akash Network (AKT), SingularityNET (AGIX), AIOZ Network (AIOZ), Arkham (ARKM), and Ocean Protocol (OCEAN) have extended their gains in the past 24 hours.

AI tokens extend gains in the past 24 hours

AI tokens have extended their rallies in the past 24 hours, with assets in the top 10 posting gains, per Coingecko data. The category’s market capitalization was above $27.32 billion on Wednesday, with FET, AKT and RNDR trending among traders, per CoinGecko.

The AI tokens in the top 10 have erased their losses from the past seven days. Amidst the market-wide correction, tokens erased between 8% and 21% of their value in the past seven days.

AI tokens on CoinGecko

In AI-related news, the price of chip stocks surged, with giant NVIDIA replacing Microsoft as the world’s most-valued public company. The catalyst drove prices of AI-related tokens higher in the past 24 hours.

AI industry updates from last week, Apple’s announcement of Siri 2.0 at the WWDC, Luma Labs’ new AI model launch for video generation and NVIDIA’s open source model Nemotron’s release are likely the other catalysts driving AI prices higher.

Significant progress in AI and Robotics this week.

— Brett Adcock (@adcock_brett) June 16, 2024

Big developments from Apple, OpenAI, Luma Labs, NVIDIA, Stanford, Northrop Grumman, Google DeepMind, Stability AI, and Microsoft.

Here's everything that happened and how to make sense out of it:

Recent research from OurNetwork showed that NEAR Protocol, the largest AI project by market capitalization, has hit 7 million daily transactions, second only to Ethereum competitor Solana. The report highlights the growth of users and the rise in activity on NEAR.

NFTs have reemerged on @NEARProtocol…

— OurNetwork (@ournetwork__) June 19, 2024

NEAR has facilitated 1.1M NFT sales, with 148k of those sales completed in May.

Read consumer alpha on $NEAR from @flipsidecrypto: https://t.co/vBLB07sJFn

Chart via: @flipsidecrypto pic.twitter.com/Uovwja7fuS

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.