- Ethereum price continues to make successive moves higher over the weekend, creating a new three-month higher on Saturday.

- Dip buying continues, but bullish conviction is tested against the $3,500 price level.

- A 12% pullback is likely if bulls fail to close above $3,500.

Ethereum price action is at an inflection point. All eyes are on Ethereum to see how it reacts to the $3,500 level this week. Failure to close above could likely result in a swift return to $3,000 or even lower to the $2,500 level. But success would likely mean new all-time highs are just around the corner.

Ethereum price must break and close above $3,500

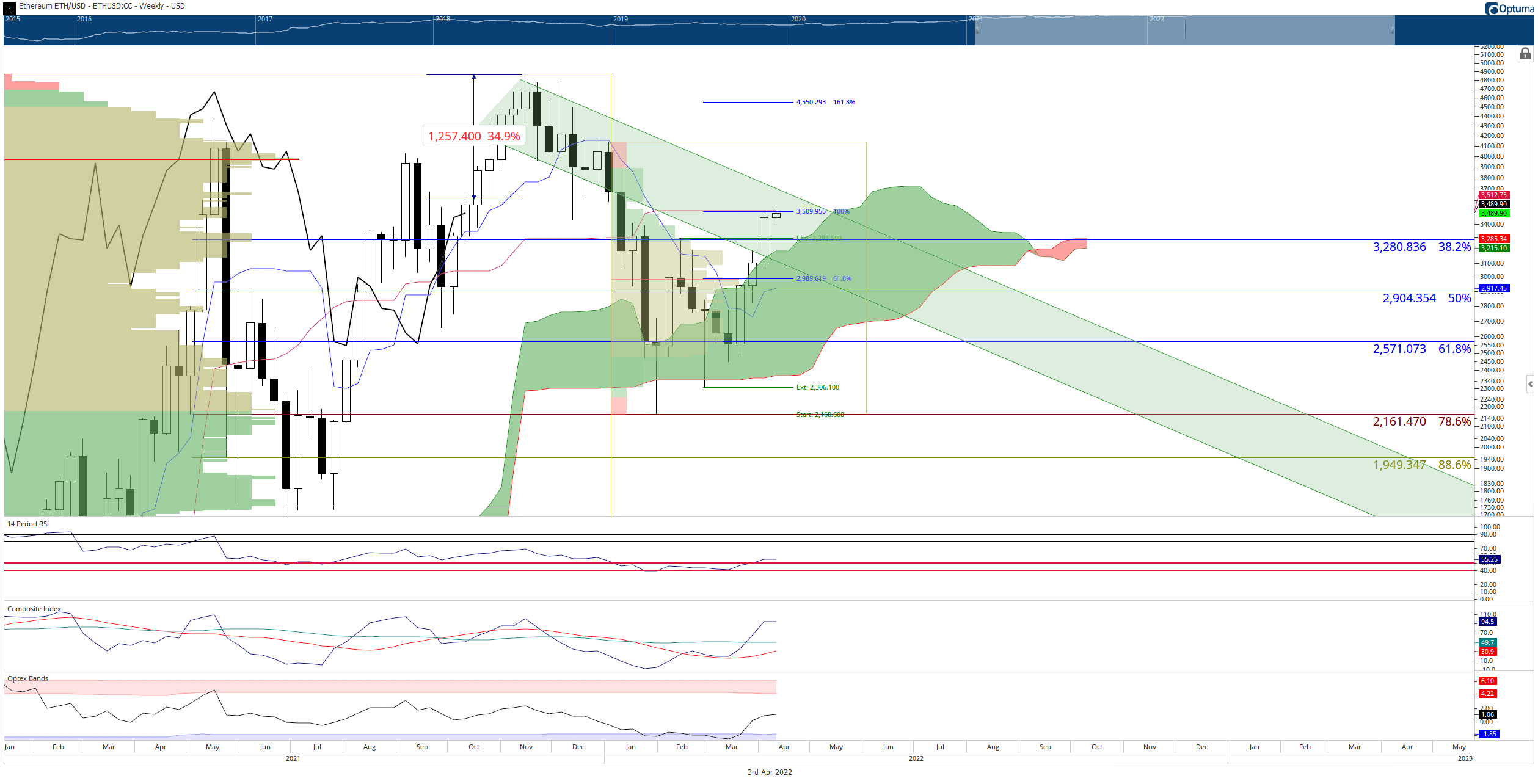

Ethereum price faces a tough resistance zone at $3,500, which is the level preventing ETH from moving higher. $3,500 contains the 100% Fibonacci expansion and the weekly Kijun-Sen, resulting in an exceptionally powerful resistance area. However, above $3,500, wide-open skies and a total lack of any Ichimoku resistance levels are ahead, with only the 161.8% Fibonacci retracement at $4,550 as the final Fibonacci level before new all-time highs are reached.

From an oscillator perspective, a push above $3,500 seems inevitable for Ethereum price. The Relative Strength Index just crossed above the first oversold level in a bull market (50) after trading in between the oversold level of 40 and 50 since the beginning of 2022. The Optex Bands remain in neutral conditions and don’t show any overbought or oversold concerns – but the Optex Bands have only recently turned up from the all-time lows.

Perhaps the most bearish warning signal between the candlestick chart and the Composite Index could be one of the most bullish triggers: the hidden bearish divergence now present. Hidden bearish divergence is a warning that the current upswing is likely to terminate and the prior downtrend will continue. If Ethereum shows a strong close above $3,500, it will likely invalidate the hidden bullish divergence, generating a major bear trap for short-sellers.

ETH/USD Weekly Ichimoku Kinko Hyo Chart

Downside risks, however, are a concern – especially if bulls fail to push Ethereum price above $3,500. There are several support structures below that may halt any major sell-off. The closest cluster of support zones at the $3,000 value area where the 50% Fibonacci retracement, weekly Tenkan-Sen, the 2022 Volume Point Of Control, and prior 61.8% Fibonacci expansion current exist.

However, below $3,000, the next major support level doesn’t appear until the bottom of the Ichimoku Cloud (Senkou Span B) at $2,370.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

CAKE price bottoms out as PancakeSwap announces $25 million burn

PancakeSwap’s price increased nearly 3% on Monday after the decentralized exchange platform on the Binance Smart Chain announced a token burn of more than 8.9 million CAKE tokens, collected from trading fees across Automated Market Makers Version 2 and 3 of the platform.

Ripple lawsuit to see SEC response on Monday, XRP nears 4.5 million mark in liquidity pools

Ripple closed above $0.52 on Sunday and resumed its climb on Monday, May 6. Sentiment among market participants is positive as traders await Securities and Exchange Commission response filing and XRP locked in Automated Market Maker liquidity pools crosses 4.31 million.

Crypto AI tokens post near double-digit gains amidst launches from NVIDIA, OpenAI and Amazon

AI-based cryptocurrencies have experienced nearly double-digit or higher gains on Monday, well above the price increases seen among the main crypto assets, likely fuelled by recent announcements of new developments from AI and tech giants in the US.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin’s consolidation crosses the two-month mark but shows no signs of a breakout or a directional move. Investors waiting with bated breath for a volatile move remain confused about whether to buy the dips or keep some cash reserves for a rainy day.

Bitcoin: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.