The time is right for Cardano price to get back to $1

- Cardano price sees a daily close above $0.789, the low of March.

- ADA Price sees bullish squeeze set to pop towards $0.915 before testing $1.00

- Expect to see a gradual increase with the subdued RSI backing any bullish action.

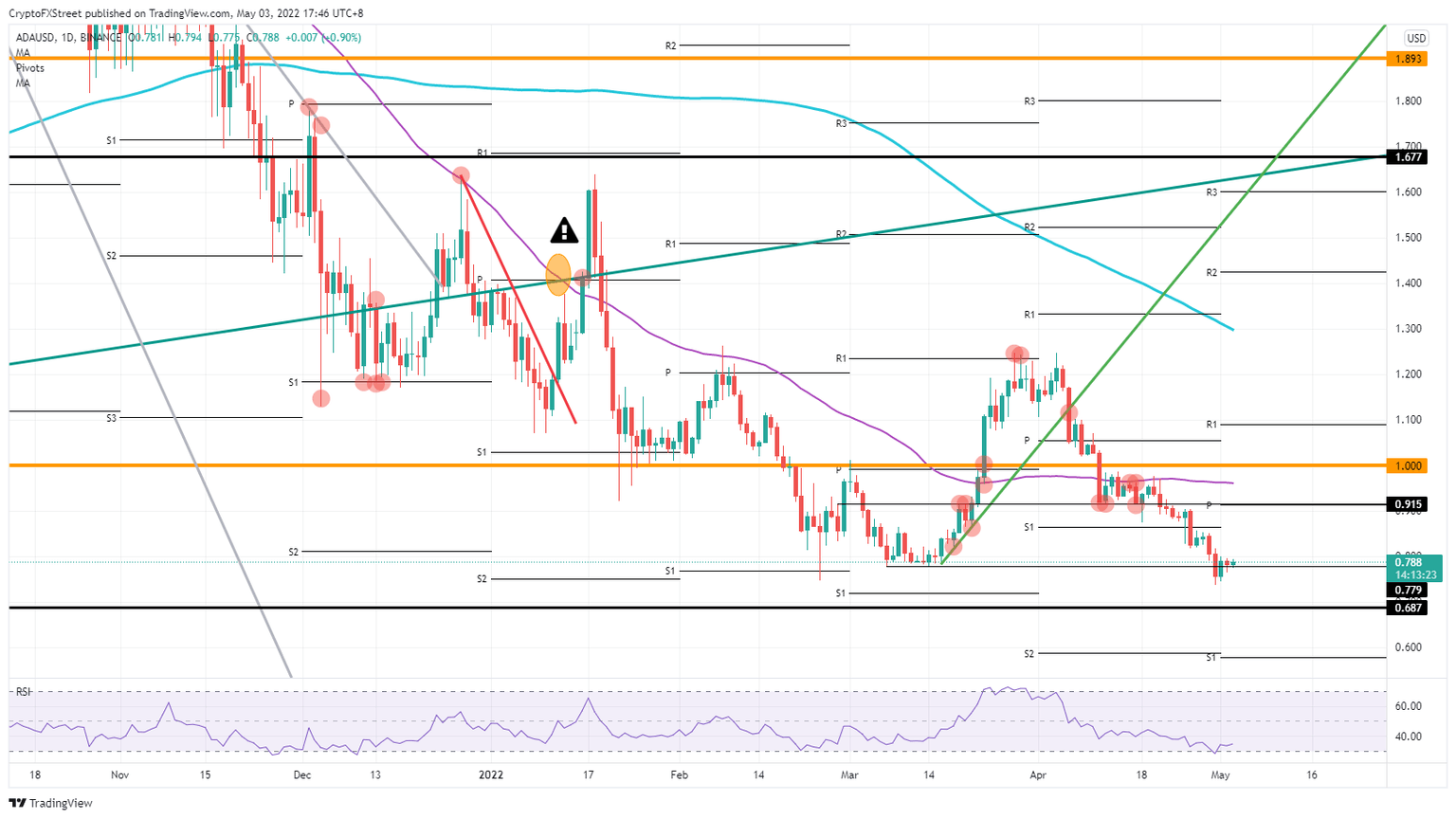

Cardano (ADA) price regained some ground after its rejection against the 55-day Simple Moving Average (SMA) at $0.975 in April. That triggered a 23% downtrend but it looks to be ending as a bullish squeeze with higher lows is set to jump to $1.00, erasing the incurred losses of April. With that move, the 55-day SMA would be breached, signalling a possible end of the downturn since December.

ADA price sees investors coming back, buying the dip

Cardano price did not make it that far low to $0.687, but bulls assessed that ADA price had already devalued enough to start buying into the dip. For the third day in a row, Cardano price is printing higher lows, pushing bears against the low of April 29 at $0.79. With the daily close above $0.789, pressure is mounting and will become intolerable for bears, triggering a sharp move upwards as their stops are run and there is an increased shift to the buy-side.

ADA price will first hit $0.915, a slim historic pivotal level and the monthly pivot level for May. That level will be used as an anchor point going forward before hitting $1.000, and with that, pulling price action up 26% from where ADA price is currently trading. The 55-day SMA will be broken to the upside, which could signal the end of the longer-term downtrend in December of last year.

ADA/USD daily chart

Plenty of tail risks are still overshadowing the cryptocurrency markets, but from a legal corner, dark clouds are forming as well. According to the WallStreet Journal, the SEC announced hiring 20 more investigators and litigators to boost crypto enforcement. If more regulatory crackdowns affect the US market, expect to see interest in cryptocurrencies as an asset class, triggering another drop for Cardano price to $0.687 or even below $0.60 towards the monthly S1 support level.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.