How likely is a $1 recovery for Cardano price

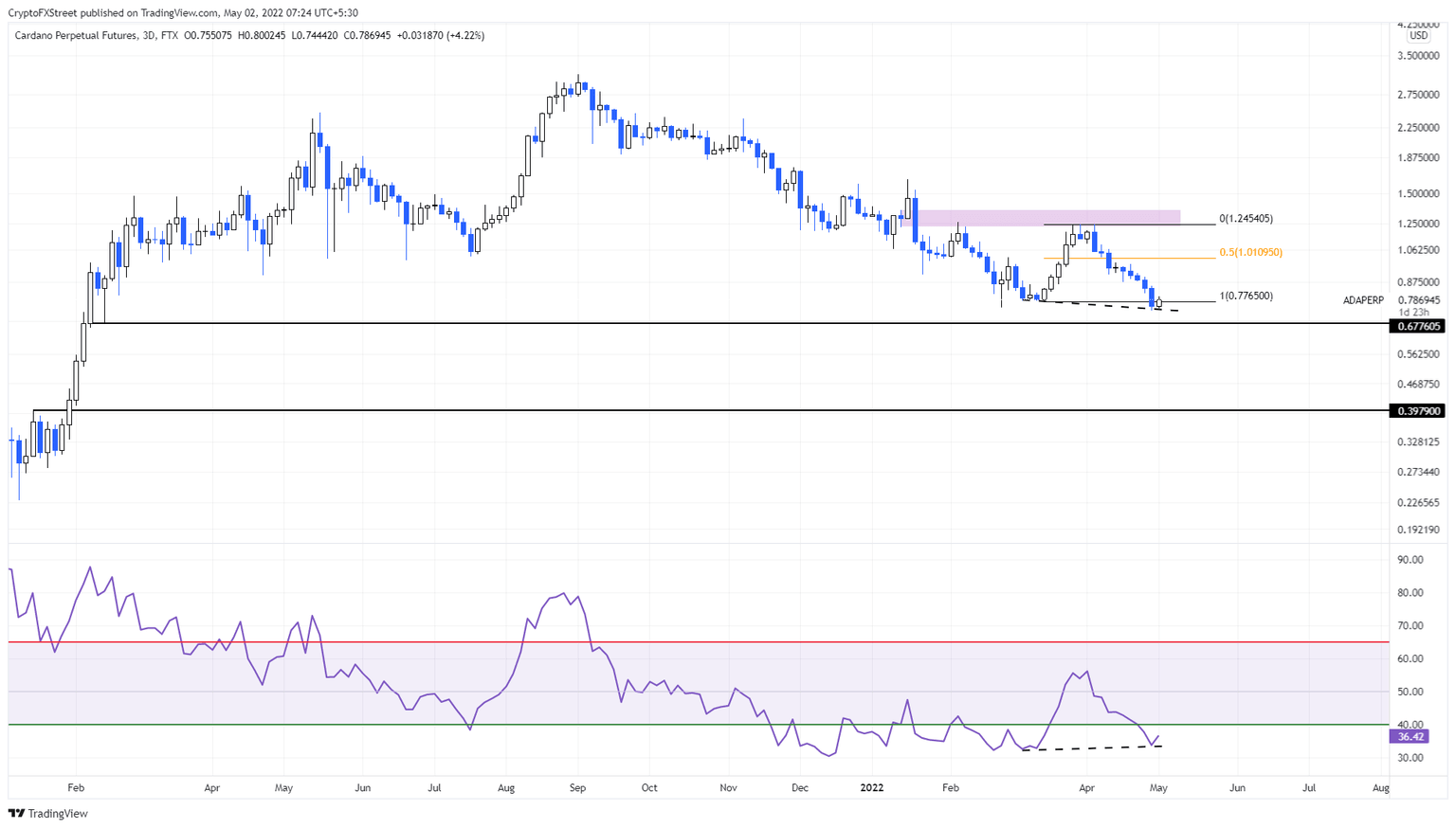

- Cardano price crashed below the long-standing range, extending from $0.776 to $1.245.

- A quick recovery above the $0.776 range low could trigger a move to the range’s midpoint at $1.011.

- A daily candlestick close below $0.677 will invalidate the bullish thesis.

Cardano price continued to crash, pushing it below the lower limit of its consolidation range. As a result, ADA has produced an interesting bullish setup that shows the promise of a reversal to retest a significant hurdle.

Cardano price and the potential recovery

Cardano price set a range between $0.776 to $1.245 after rallying 60% between March 7 and 29. The recent downswing pushed ADA down by 10% to sweep the range low and equal lows at $0.776. This move signals that the market makers are done dragging the so-called “Ethereum-killer” lower and that a reversal could be around the corner.

Moreover, Cardano price has produced a lower low since March 5 while the Relative Strength Index (RSI) has created a higher high during the same period. This technical formation is termed bullish divergence and often forecasts a rally.

Hence, investors can expect ADA to move above the range low at $0.776 and make a run for the 50% retracement level at $1.011 after a quick 28% ascent. This level is likely where the upside is capped for Cardano price, but if the buying pressure continues to build up, there is a good chance the token might trend higher and retest the range high at $1.245.

ADA/USDT 1-day chart

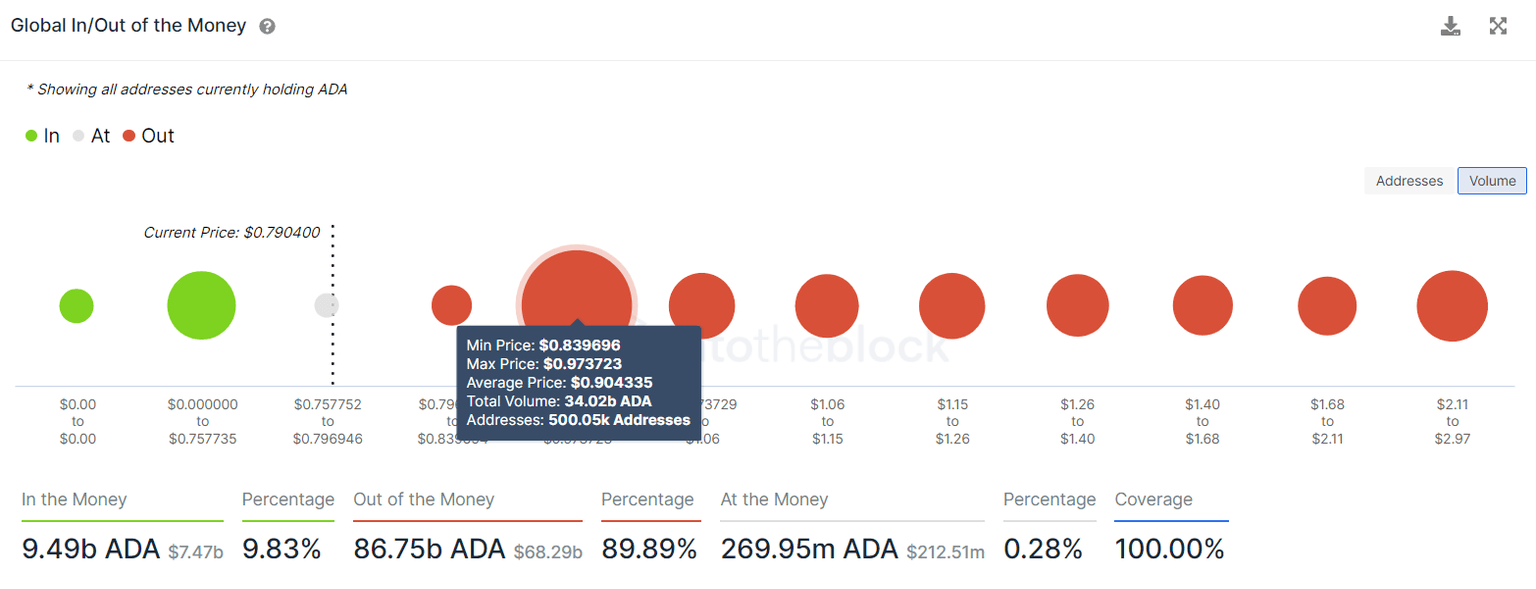

Supporting this move to the range’s midpoint at $1.011 is IntoTheBlock’s Global In/Out of the Money (GIOM) model. This index shows that the significant hurdle for ADA extends from $0.839 to $0.973, where roughly 500,000 addresses that purchased nearly 34 billion ADA tokens are “Out of the Money.”

Therefore, a move into this cluster of underwater investors is likely going to be met with selling pressure from investors trying to break even.

ADA GIOM

While Cardano price has already swept the range low at $0.776 for liquidity, a further descent without recovery is a bad sign. A daily candlestick close below the $0.677 level will create a lower low and invalidate the bullish thesis for ADA.

In such a case, the altcoin is likely to crash 40% and retest the $0.397 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.