Cardano price can revisit $1 after these events

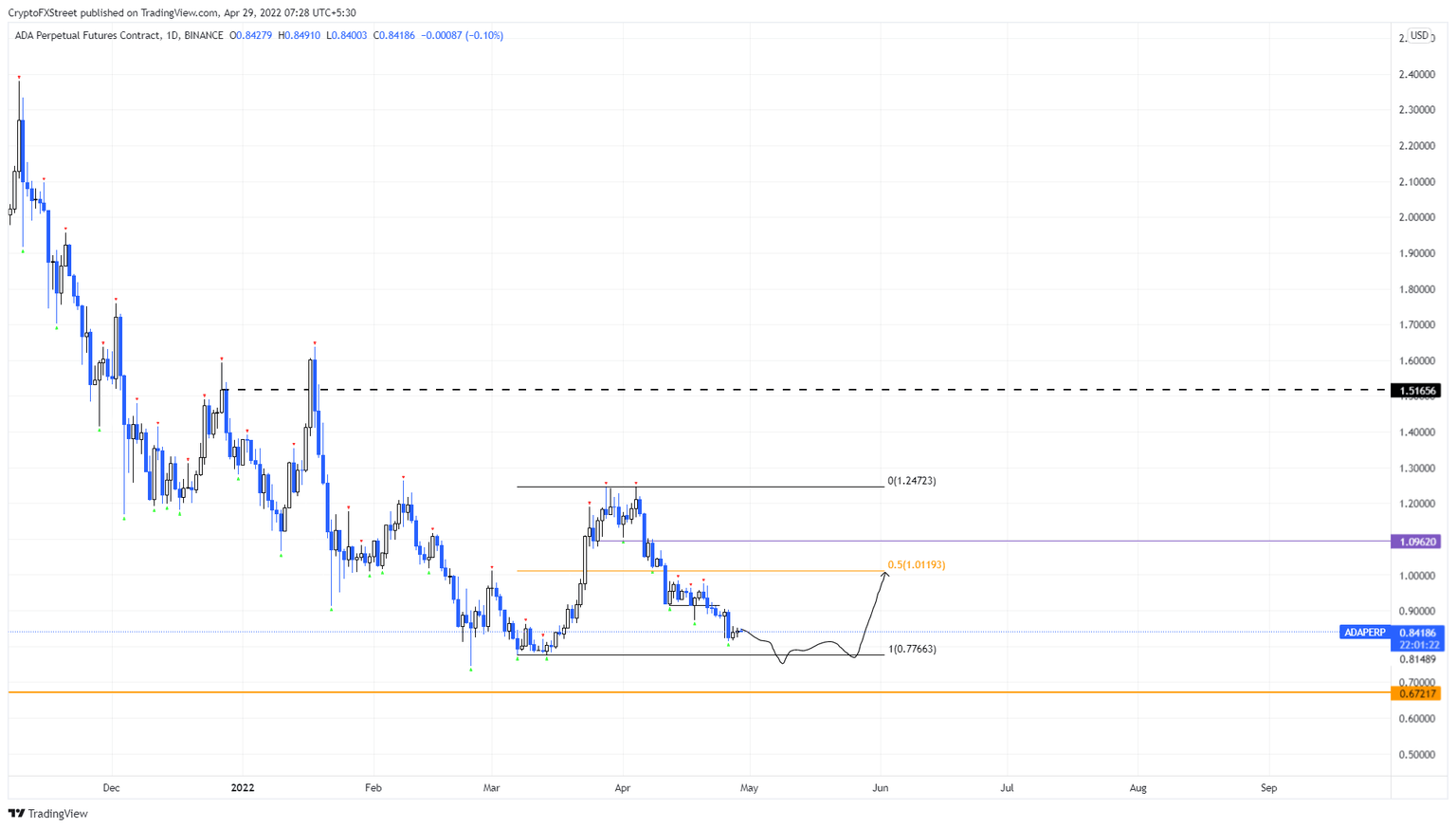

- Cardano price is rangebound between the $0.776 to $1.240 barrier and is currently looking to revisit the upper limits.

- ADA might sweep the range low at $0.776 before making a 30% run-up to $1.01.

- A daily candlestick close below $0.672 will invalidate the bullish thesis.

Cardano price seems to be hemorrhaging nonstop since its all-time high in September 2021. Unlike other altcoins, ADA has not sneaked in any substantial rallies and has been on a steady downtrend. However, a sweep below a stable support level could hold the key to triggering a minor uptrend.

Cardano price continues to bleed

Cardano price rallied 60% between March 7 and 29 to set a range, extending from $0.776 to $1.240. On both sides of the range, ADA has created equal swing points, which reveals the presence of liquidity.

Since setting up the range high, ADA has dropped 32% to where it currently trades - $0.841. A few more periods to the downside will push Cardano price to sweep the range low at $0.776 and collect the sell-stop liquidity.

This development is more than likely to trigger an uptrend to retest the range’s midpoint at $1.01 after a 30% rally. In a highly bullish case, ADA can flip this hurdle into a foothold for further gains. Doing so will allow ADA bulls to propel to the $1.09 hurdle where the buying pressure might decline.

In total, ADA has the potential to rally at least 40%.

ADA/USDT 1-day chart

While sweeping the range low at $0.776 is a good spot to buy ADA at a discount, a failure to recover quickly will indicate that the bulls are weak. In such a case, ADA might slide lower and retest $0.672.

A daily candlestick close below the $0.672 level will invalidate the bullish thesis by producing a lower low.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.