The real reason why Shiba Inu diamond hands refuse to sell despite 40.6% SHIB price rally

- Shiba Inu holders who held SHIB for over 11 months have not sold their holdings since December 2021.

- Bullish catalysts failed to move long-term holder’s resolve, Shytoshi Kusama recently announced the burn of trillions of SHIB.

- Shiba Inu price yielded 40.6% gains since December 28, wiping out the losses from the FTX’s collapse.

Shiba Inu holders who acquired SHIB more than 11 months ago are holding onto their tokens. These holders have refrained from selling their SHIB holdings since December 2021. Shiba Inu’s layer-2 scaling solution Shibarium’s launch is a long-awaited developmental milestone and it could act as a bullish catalyst for the meme coin. It is likely that SHIB holders are awaiting this milestone for shedding their Shiba Inu tokens.

Also read: Court filing reveals Netflix, Apple, Binance, Fortune, Coinbase, among FTX exchange’s creditors

Shiba Inu holders await these two bullish catalysts in SHIB

Shiba Inu’s lead developer Shytoshi Kusama announced the burn of trillion of SHIB tokens at layer-2 scaling solution Shibarium’s launch. The head of the Shiba Inu project recently confirmed that one of the development team’s goals is to burn trillions of SHIB tokens with the layer-2 protocol’s launch.

Kusama was addressing the query of a community member and this disclosure has significantly increased the hype around Shibarium. The Shiba Inu community, known as SHIB Army considers “token burn” as one of the primary concerns.

Kusama’s revelation in the community discord channel was recently brought to public attention by ShibaSpain, an anonymous Spanish-based Shiba Inu community member on Twitter. Shibarium is therefore one of the largest bullish catalysts for the Dogecoin-killer token.

I have always said it, TRILLIONS $SHIB will be burned when #Shibarium is fully active. #SHIBARMYSTRONG pic.twitter.com/M6r0s3J7Pt

— Shib Spain️ (@ShibSpain) January 25, 2023

The Shiba-Inu-themed cryptocurrencies recent partnerships and support for dApps is another bullish catalyst. Atomic wallet, a non-custodial software wallet for storing and managing different types of cryptocurrency, recently confirmed support for Shiba Inu’s layer-2 protocol.

Support for Shibarium from dApps, decentralized exchanges and wallets is likely to drive SHIB adoption and utility, fueling a bullish sentiment in the SHIB Army.

Diamond hands is a term used to describe an asset’s holders who refuse to sell easily and hold on to the cryptocurrency for prolonged periods, unfazed by volatility in prices. That is why the term has been used to describe SHIB’s holders who acquired the meme coin prior to 11 months have refrained for selling in the past year, from December 2021 till date.

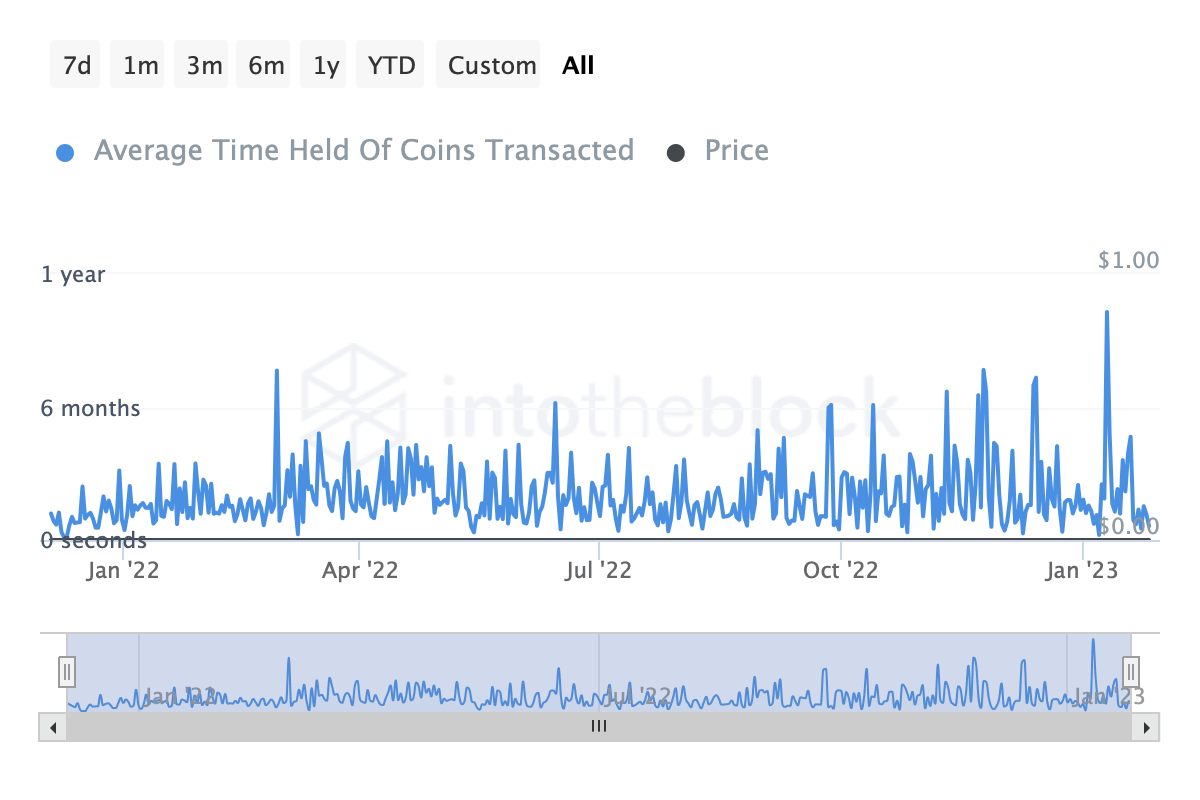

Average time held of coins transacted

The above chart reveals the average time that Shiba Inu tokens were held when transacted between January 2022 and 2023. The average time is nearly 11 months and holders who purchased SHIB prior to the time period have refrained from selling.

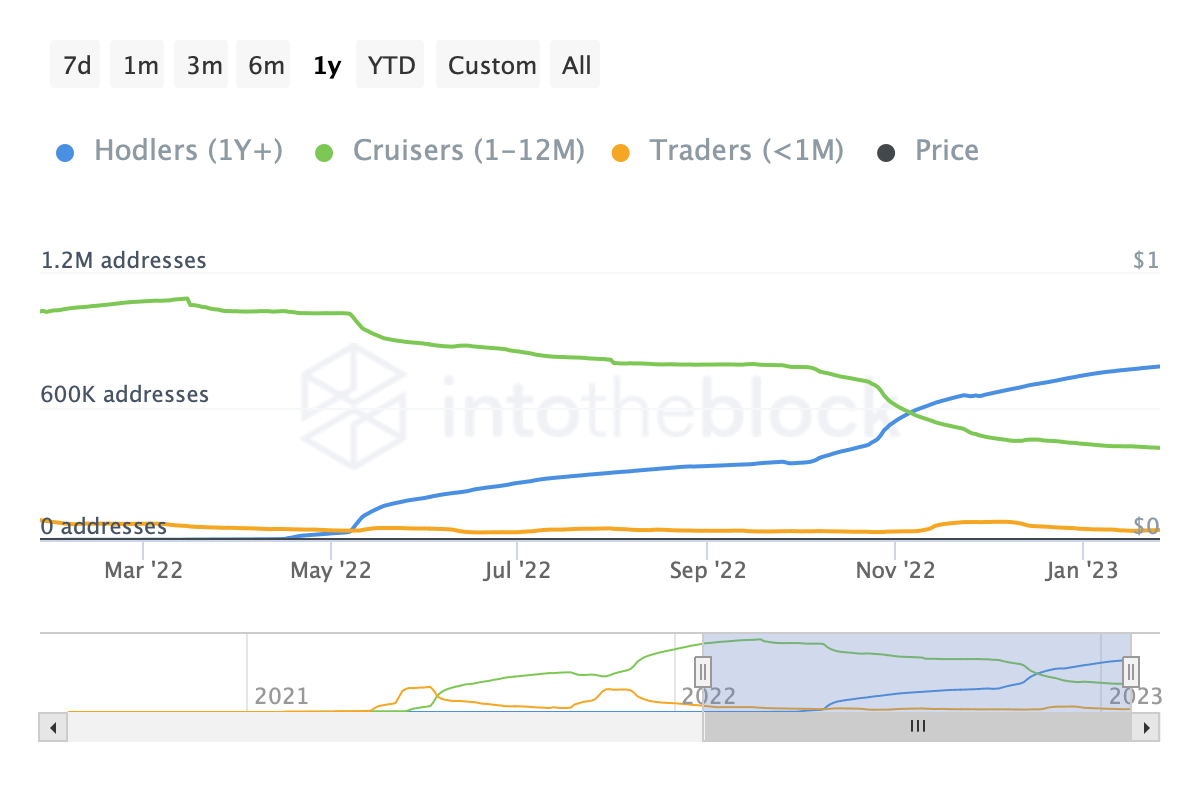

Interestingly, the number of SHIB holders who held the token for over a year has increased significantly between November and January 2023.

Addresses by time SHIB was held

The two charts from crypto intelligence tracker IntoTheBlock reveals market participants’ interest in acquiring and holding SHIB for a long duration; refraining from selling SHIB as a result of market volatility.

Despite a 40.6% rally in SHIB price since December 28, the two metrics point at bullish sentiment among diamond hands holding Shiba Inu tokens.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.