Is the dramatic rise in whale activity in AAVE, MATIC and DYDX a sell signal?

- AAVE, MATIC and DYDX have witnessed a massive spike in the amount of whale transactions on their network over the past month.

- Whale transaction count in MATIC and DYDX has hit the highest level since December, alongside double-digit price rallies in these two tokens.

- Experts believe that the increase in interest in large wallet investors in AAVE, MATIC and DYDX needs to be watched closely.

AAVE, MATIC and DYDX price rallied alongside large market capitalization cryptocurrencies Bitcoin and Ethereum in January. Experts at the crypto intelligence tracker Santiment believe the recent spike in activity by whales on these networks needs to be watched closely. Typically a rise in interest from large wallet investors is a precursor to increasing selling pressure and a decline in the asset’s price.

Also read: Court filing reveals Netflix, Apple, Binance, Fortune, Coinbase, among FTX exchange’s creditors

AAVE, MATIC and DYDX see increase in whale activity alongside price rally

AAVE is the native token of a lending platform built on the Ethereum blockchain. The token is used for paying transaction fees, participating in governance and earning interest on deposited funds. The token witnessed a 56% spike in its price over the past month.

MATIC is the token of a layer-2 Ethereum scaling solution Polygon. The token is used for the platform’s governance and as collateral for borrowing on the platform. It supports the transfer of a wide range of other Ethereum-based assets, including cryptocurrencies and NFTs. MATIC price yielded 35% gains in the last thirty days. DYDX, is the token of a DEX that allows users to trade and lend assets in a trustless environment. The token rallied nearly 95%, witnessing a dramatic rise in its price over a 30-day period.

Interestingly, all three cryptocurrencies have garnered increasing interest from large wallet investors in the network. Large volume transactions (>$100,000) by whales have hit their highest level since December, based on data from crypto intelligence tracker Santiment.

Aave, Polygon and Dydx see high whale activity

Experts at Santiment believe that the spike in activity by whales needs to be watched closely. Typically, whales engage in massive profit-taking and shed their holdings, followed by an increase in selling pressure. This influences the token’s price negatively and results in a correction.

As seen in the chart above, the rise in Bitcoin price has been accompanied by an increase in whale activity. Altcoins have followed Bitcoin in its January rally and whales increased their transaction volume accordingly. Bulls need to be cautiously optimistic when adding AAVE, MATIC and DYDX to their long positions.

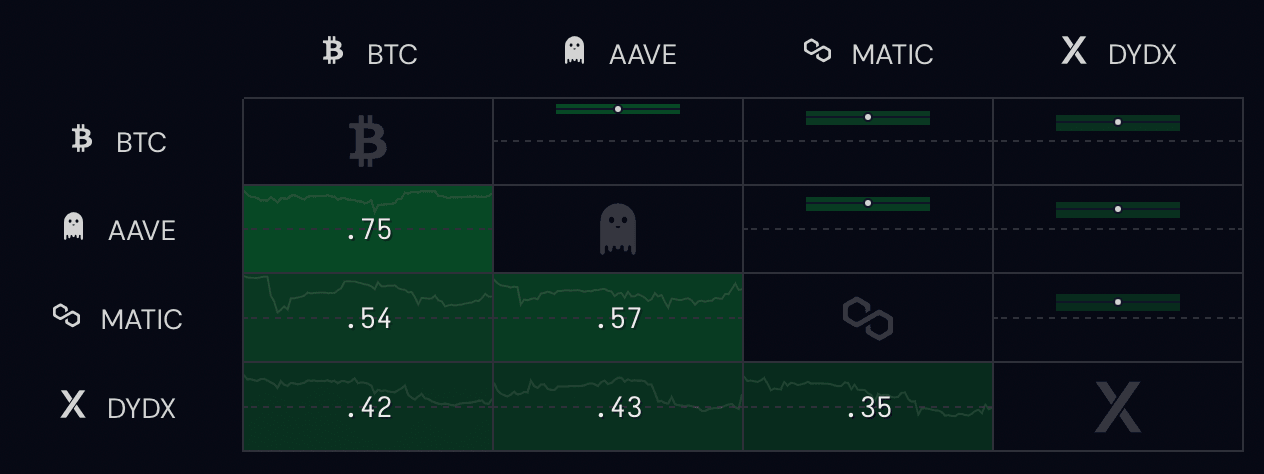

Correlation between BTC and AAVE, MATIC and DYDX

Large transaction count is typically a precursor of a correction in an asset and is considered a sell signal. If Bitcoin sustains above the $23,000 level and flips it into the support floor, it is likely that altcoins will follow, owing to their correlation with the asset.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.