Court filing reveals Netflix, Apple, Binance, Fortune, Coinbase, among FTX exchange’s creditors

- Samuel Bankman-Fried’s FTX exchange’s creditor list is 116 pages long with giants like Netflix, Apple, Coinbase, Binance, Fortune on it.

- Court filing reveals airlines including American, Spirit and Southwest as well as Stanford University rank among FTX’s creditors.

- FTX contagion has spread throughout the crypto ecosystem and the exchange owes nearly $3.1 billion to its top 50 creditors.

A recent court filing revealed that airlines, universities, publishing and production giants and cryptocurrency exchanges rank in the 116-page creditor list of bankrupt crypto exchange FTX. Samuel Bankman-Fried’s defunct exchange owes nearly $3.1 billion to its top 50 creditors.

Also read: Bitcoin options traders bet on massive rally in BTC, battle FTX contagion and Genesis meltdown

Court filing shows FTX exchange owes giants Netflix, Apple, Binance, Coinbase and Stanford

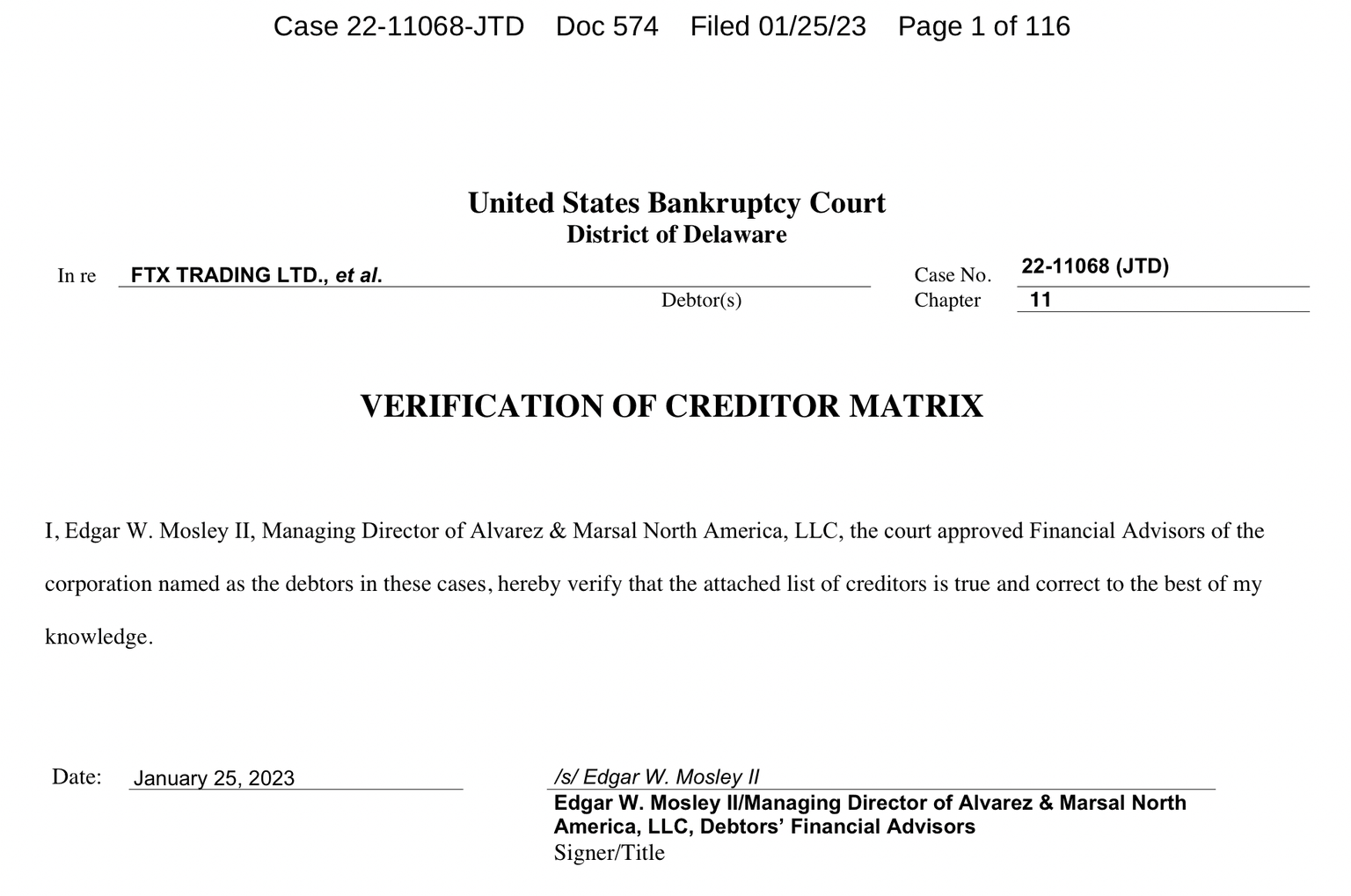

As proceedings in the FTX exchange bankruptcy case continue, Edgar W. Mosley II, Managing Director of Alvarez & Marsal North America, filed a “verification of creditor matrix,” on January 25.

Judge John Dorsey, who is overseeing the bankruptcy proceedings, allowed the names of individual creditors to remain sealed for some three months at a hearing in early January, but requested a list of institutions invested in the company to be filed by FTX’s lawyers.

Verification of FTX exchange’s creditor matrix

Several media companies like the Wall Street Journal, Fortune, Fox Broadcasting and CoinDesk as well as big crypto names like exchanges Coinbase and Binance were listed. American, Spirit and Southwest airlines, as well as Stanford University and its credit union were also listed in the document.

Nearly 9.7 million customer names were redacted and the list paints a grim picture for FTX’s creditors as the firm owes nearly $3.1 billion to the top 50 among them. The collapse of FTX started a fast spreading contagion in the industry and tarnished the reputation of several crypto lenders and trading firms. Firms like DCG’s crypto lending unit Genesis, and BlockFi filed for bankruptcy in the months following FTX’s collapse.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.