Tezos price is set to plunge 8% just today if US markets adopt European concerns

- Tezos price sees bulls being squeezed to the downside in a negative trading session during European hours.

- XTZ price has no answer to global market worries after headlines on Saturday and Sunday triggered a sell-off at the open.

- Expect to see a possible extended drop should the US session take over the European spirit as most US traders are off on a long weekend.

Tezos (XTZ) price action already lost 3% during the European session as European markets were slaughtered after governments issued several measures to avoid a full collapse of the energy market. The issue came about after Russia halted Europe's gas supply. With the geopolitical tail risks flaring up, markets are set to choose safe havens over risk assets, which means bad news for Tezos price action.

XTZ price set to drop to $1.40

Tezos price sees investors fretting and worrying about what to do next after the news flow erupted on Sunday evening just hours before the ASIA PAC trading session was about to begin. The trigger came from a joint statement from Sweden and Finland saying they had to issue an emergency fund to safeguard energy supply as a few market makers were near bankruptcy on the back of elevated margin calls from energy futures. On Monday morning, heavyweight Germany came out with a similar statement, triggering another leg lower in the euro, with dollar strength resulting in a headwind for cryptocurrencies.

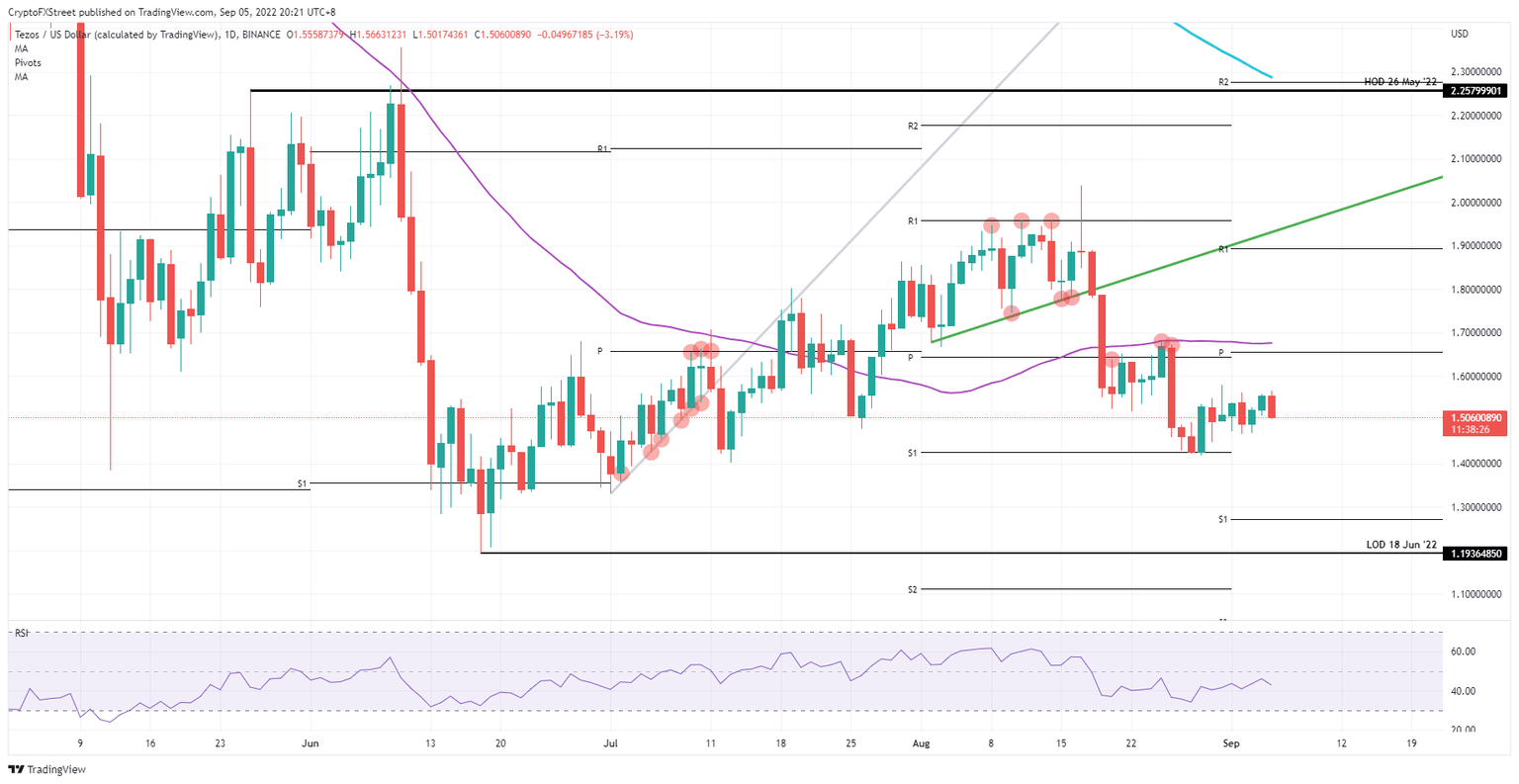

XTZ price will see bears pushing to the downside towards roughly $1.40, which is the low of two weeks ago and is near August’s monthly S1 pivot. If that level does not hold, expect another 9% drop towards $1.30, with the monthly S1 for September situated nearby to catch any dips. Together with that, the Relative Strength Index (RSI) will have hit the oversold marker and should be ready for a pickup by bulls.

XTZ/USD Daily chart

As several floors are being identified, a very big sell-off does not seem to be unfolding just yet. The energy crunch is quite distant from cryptocurrencies as an asset class, so the negative spillover effect is likely to be rather contained and possibly see a turnaround in the price action as early as Tuesday. Expect to see a little pop higher towards $1.60, from which the double cap comes into play. That resistance band contains the 55-day simple Moving Average (SMA) and the monthly pivot just below $1.70.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.