Why the Tezos price could start September off on the wrong foot

- Tezos price has lost 27% of market value this month.

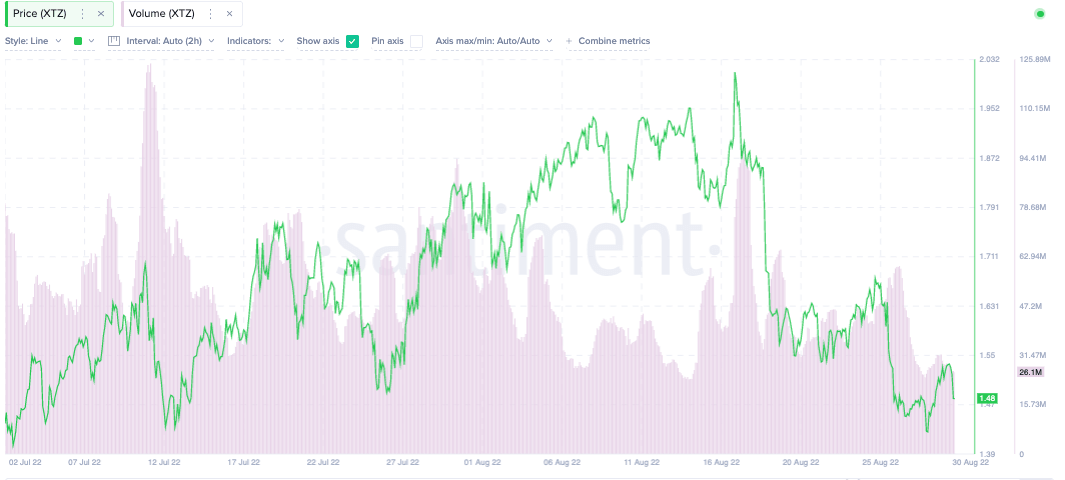

- XTZ price shows bearish dominance on the Volume Profile Indicator.

- Invalidation of the bearish thesis remains a breach above $2.03.

Tezos price hints that more decline is on the way. If market conditions persist, a sweep the lows event is likely to occur.

Tezos price faces resistance

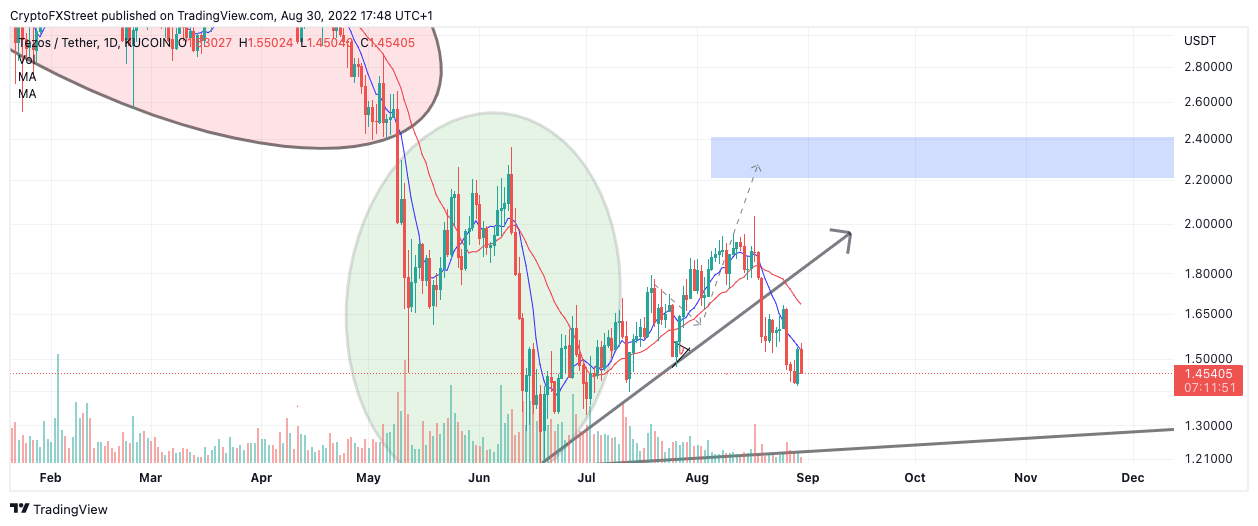

Tezos price shows concerning signals as August comes to an end. Since August 17, the XTZ price witnessed a 30% decline as the bears printed a classical evening star pattern near the $1.90 barrier. The final blow occurred on August 27, when the bears breached through a supportive trend line that played a key role in the uptrend optimism for Tezos price throughout the summer.

Santiment’s Volume Profile indicator shows bears have confidently entered the market and are adding to their positions on each pullback. If market conditions persist, a sweep-the-lows event will likely occur, targeting $1.18.

Santiment's Volume Profile Indicator

Tezos price currently auctions at $1.48 as the bulls have managed to recover 3% of the value from the devastating decline. The bulls are currently experiencing resistance near an 8-day simple moving average, confounding the idea that the sell-off is not over yet.

XTZ/USDT 1-Day Chart.

Invalidation of the bearish thesis remains a breach above $2.03. If bulls can breach this level, they may be able to kick off a crypto bull run targeting $3.00, resulting in a 100% increase from the current XTZ price.

In the following video, our analysts deep-dive into the Tezos price action, analyzing key levels of interest in the market - FXStreet Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.