Cryptocurrencies Price Prediction: Crypto.com, Cardano & Tezos — Asian Wrap 25 August

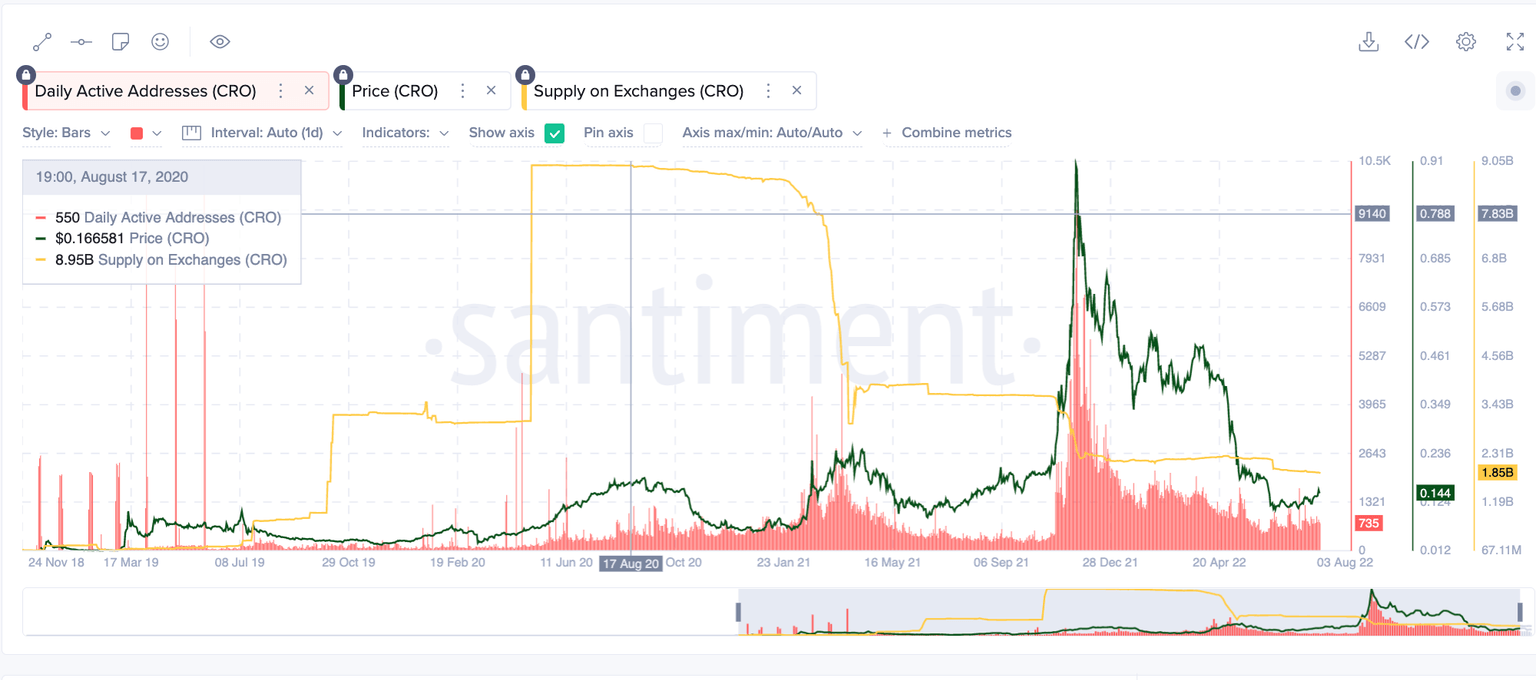

Crypto.com’s CRO edges near calamity, but On-chain metrics suggest whales aren’t selling.

Crypto.com price shows mixed signals going into the end of August. The technicals suggest bears are in control, but On-Chain metrics hint that the final bottom may be near. Crypto.com price may be a token worth adding to your watch list as the digital exchange shows an interesting set of information.

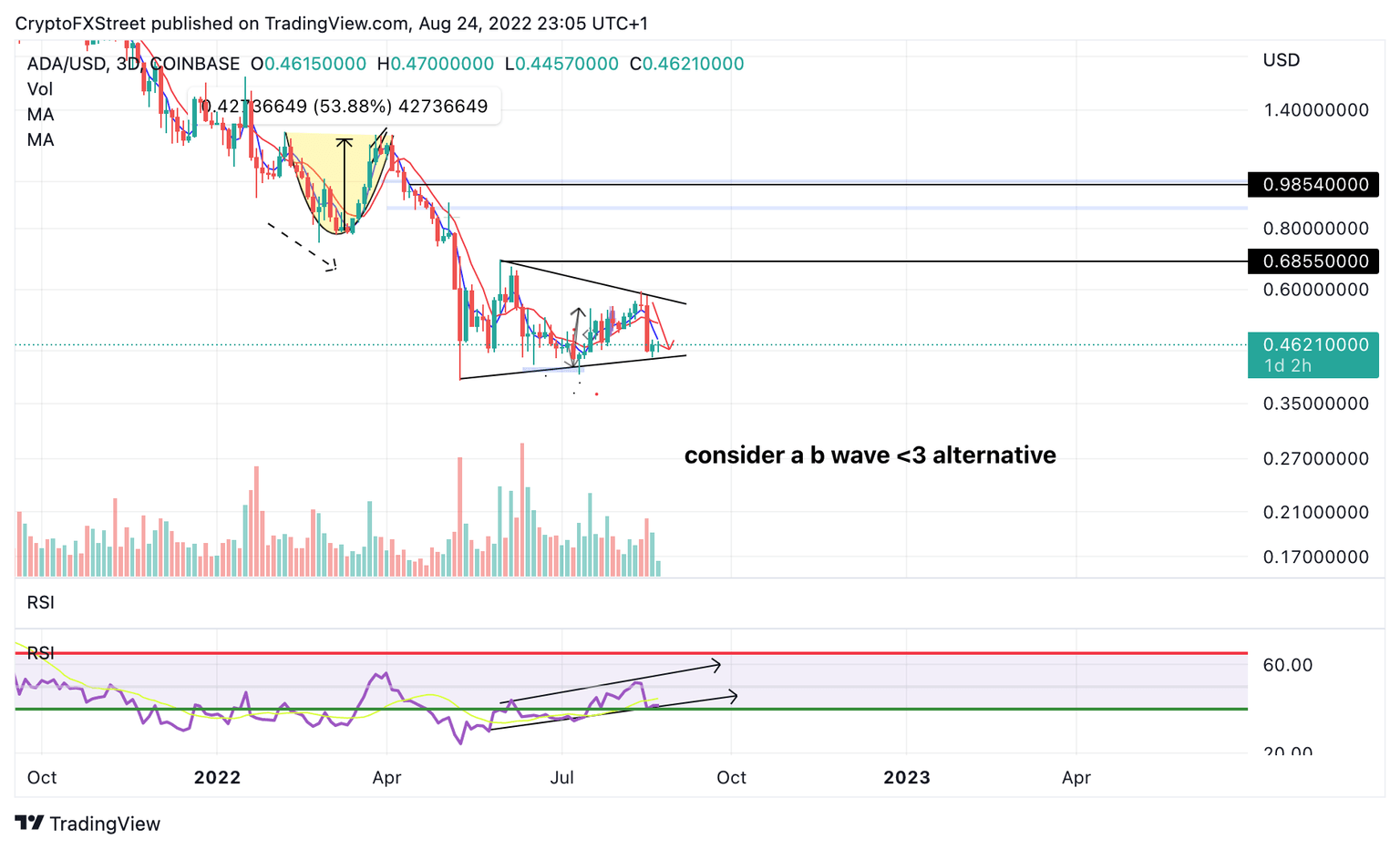

Cardano Price Prediction: 224 million dormant tokens hit circulation signaling a whale dump

Cardano price coils in triangular fashion on the 3-day chart. Santiment’s 3-year Dormant Circulation Indicator shows a massive influx of circulating coins, signaling an upcoming sell-off. Invalidation of the bearish thesis is a closing candle above $0.595.

Tezos Price Prediction: Investors should take this signal serious as bears flex control

Tezos price displays a change-of-hands as the uptrend hike since June 18 has come to a screeching halt. An ascending trend line that has consistently provided support for the XTZ price has officially been conquered by the bulls as a 3-day bearish engulfing candle settled below it at $1.57.

Author

FXStreet Team

FXStreet