Tezos price stills hold some 8% of an uptick before the tank runs drydry

- Tezos price action is on the cusp of printing a new weekly high at $1.60.

- XTZ price could go as far as $1.70 before hitting a brick wall of resistance.

- Expect to see a fade back lower once those bulls have raked in an 8% gain.

Tezos (XTZ) price is ready to close out the week with a bang as markets rally after a weary week where investors are puzzled about what to do next. Time for some TGIF and an uptick in equities and cryptocurrencies, investors must have thought this morning when they got out of bed. Preparing for that last squeeze higher towards $1.70 looks to be the plan for today, followed by a fade from profit taking as a big cap hangs overhead preventing further upside for price action.

XTZ price on its last fuel damps

Tezos price action is set to not only break the high of this week but also enlarge the weekly profit for XTZ as price action looks to jump that last few percentage points. The positive sentiment comes as investors want to push back against the choppy price action from the past week and try to recover some of the lacklustre moves from this week. Expect to see that last jump to bear roughly 8% of gains.

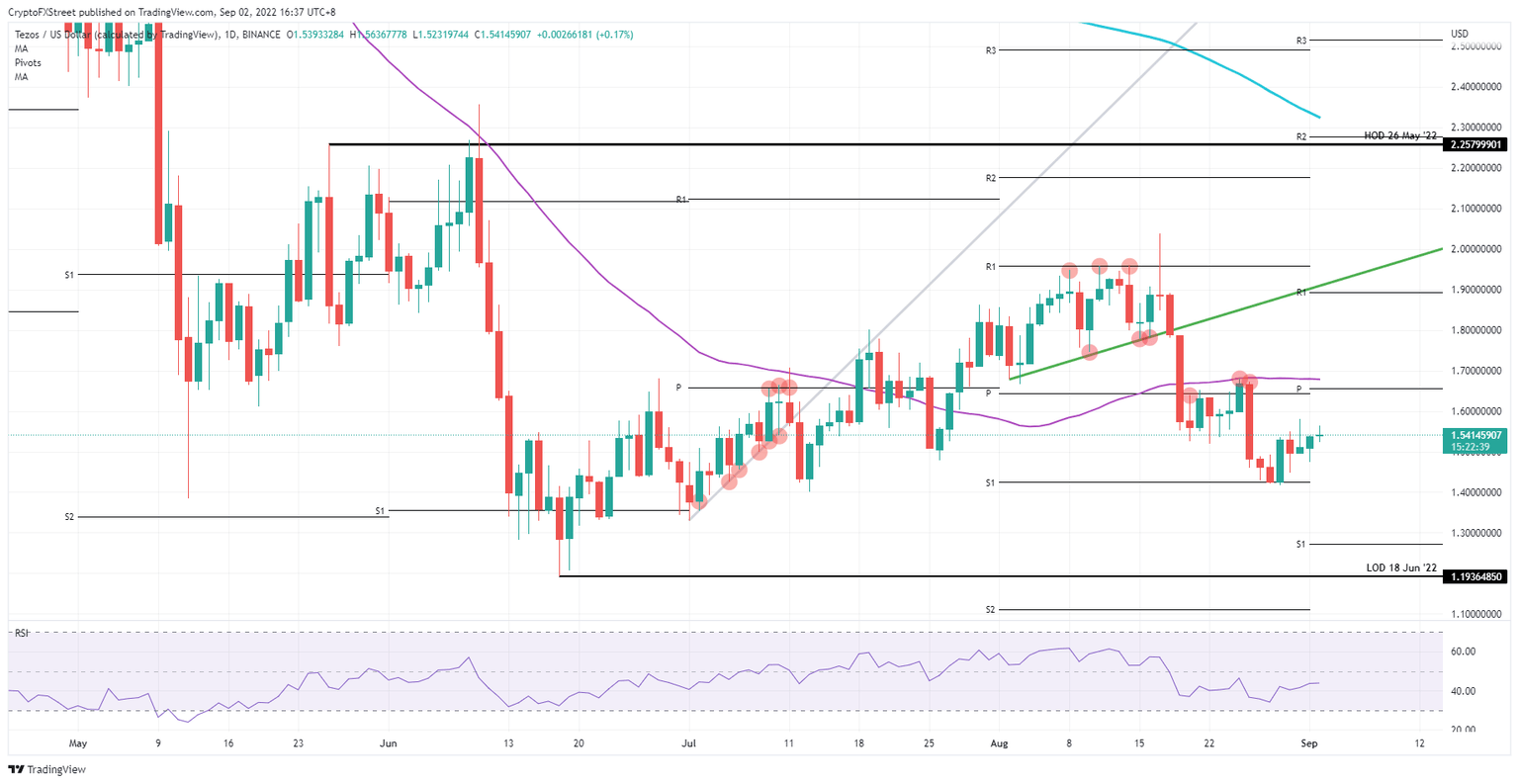

XTZ price has not further to go to reach that $1.70 level as only the high this week at $1.58 could stand in their way. The US job report this afternoon could be enough of a catalyst to lift price action a bit up towards it. Around that level, the 55-day Simple Moving Average (SMA) resides, which already acted as a cap last week on August 25 and 26.

XTZ/USD Daily chart

That is as far as the good news goes because the 55-day SMA which is acting as a cap on price action does not look ready to break. Instead it is quite possible a fade could get underway, with price action falling back towards the monthly S1 near $1.30, which is quite far off. 17% of losses would materialise, while the low of June 18 of this year at $1.19 is present to catch any falling knives in case the downturn accelerates sharply.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.