Terra Luna Classic price is the next altcoin to explode by 50%, but there’s a catch

- Luna Classic price shows a potential reversal outlook that could end its short-term downtrend.

- If LUNC manages to flip the $0.000170 hurdle into the support floor, a 50% upswing to $0.000257 is on the cards.

- A daily candlestick close below $0.000138 will invalidate the bullish thesis for the altcoin.

Luna Classic price action is at an interesting point that suggests the possibility of an upswing in the near term. However, this outlook is not as straightforward as it seems. LUNC needs to overcome a resistance confluence to kick-start this bullish move.

Luna Classic price needs to take the midpoint

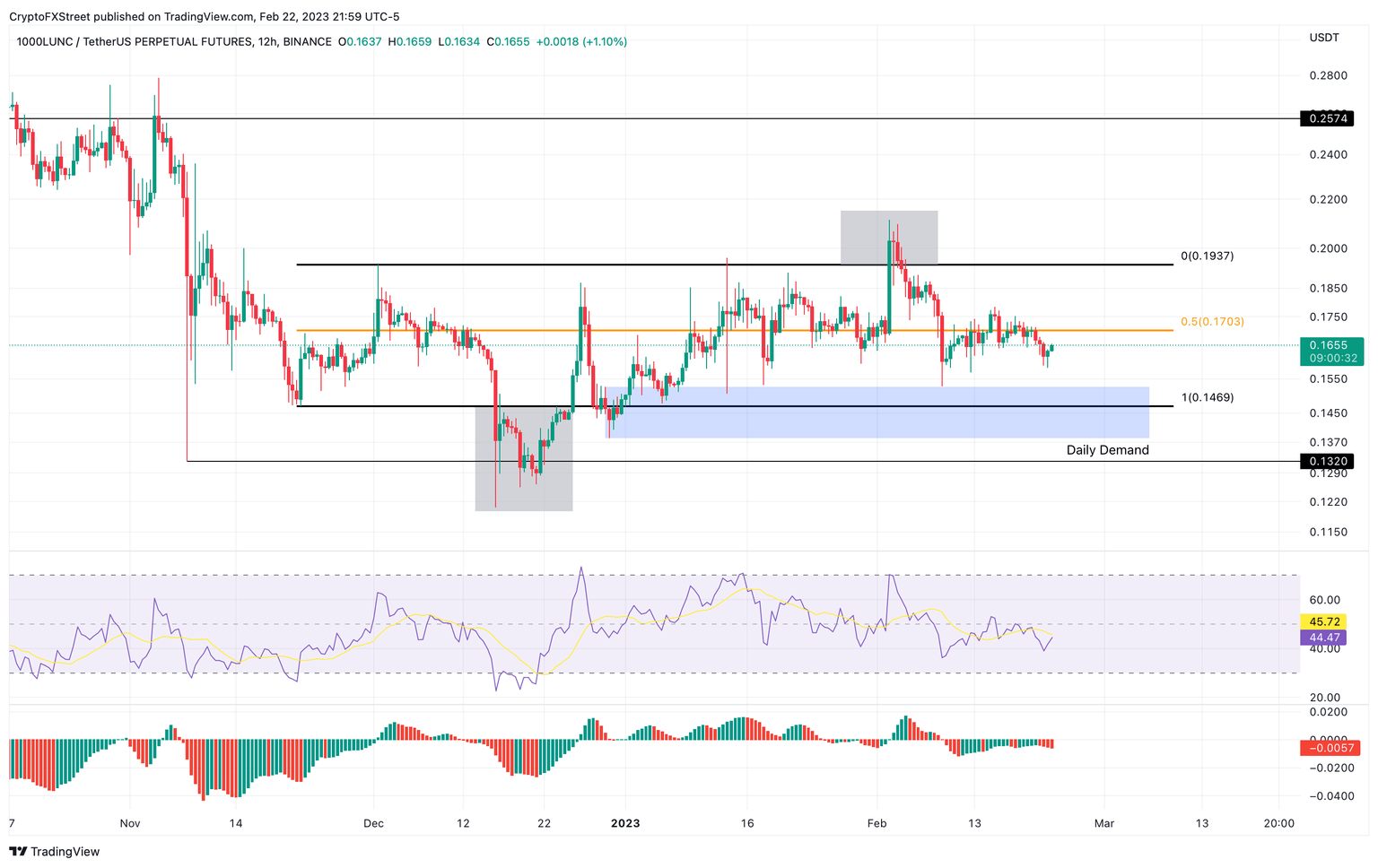

Luna Classic price created a 31% range between $0.000146 and $0.000193 in late November 2022. This range is where the altcoin still trades, with one deviation below the range low and another one above the range high.

These deviations were perfect places to open range-bound trades. Currently, Luna Classic price trades below the midpoint of this range at $0.000170 but above the $0.000138 to $0.000152 demand zone formed on a daily timeframe.

A bounce off this level could provide LUNC bulls the necessary oomph to kick-start its upswing. But for the uptrend to start on a good note, investors need to wait for a flip of the range’s midpoint at $0.000170. A daily candlestick close above this level would be the first confirmation. Beyond this level, the Luna Classic price will target the range high at $0.000193.

If the bulls can overcome the range high and flip it into a foothold, LUNC could then target the $0.000257 resistance level, which is roughly 50% from the range’s midpoint.

LUNC/USDT 12-hour chart

While the upswing outlook for Luna Classic price seems plausible, making a move before the confirmation would be risky for involved players. If LUNC fails to overcome the $0.000170 level, it would denote weakness among participants.

In such a case, if Luna Classic price produces a daily candlestick close below the daily demand zone’s lower limit at $0.000138, it would create a lower low and invalidate the bullish thesis for LUNC. This would be the final nail in the buyers’ coffin and could potentially trigger a quick 5% correction to $0.000132 or the December 16 swing low at $0.000120.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.