What's next for Terra Luna Classic price after LUNC sheds 20%?

- LUNA Classic price declined by 17% in the last two weeks to trade at $0.000170

- All price indicators suggest a bearish outlook for LUNC which could result in a 25% decline in price.

- A daily candlestick close above $0.000189 would invalidate the bearish outlook for the altcoin.

LUNA Classic price fared well until two weeks ago, as the altcoin had noted a 55% increase in value over the month. But the changing market conditions might push LUNC and many other cryptocurrencies into the bears' hands.

LUNA Classic price charts red candles

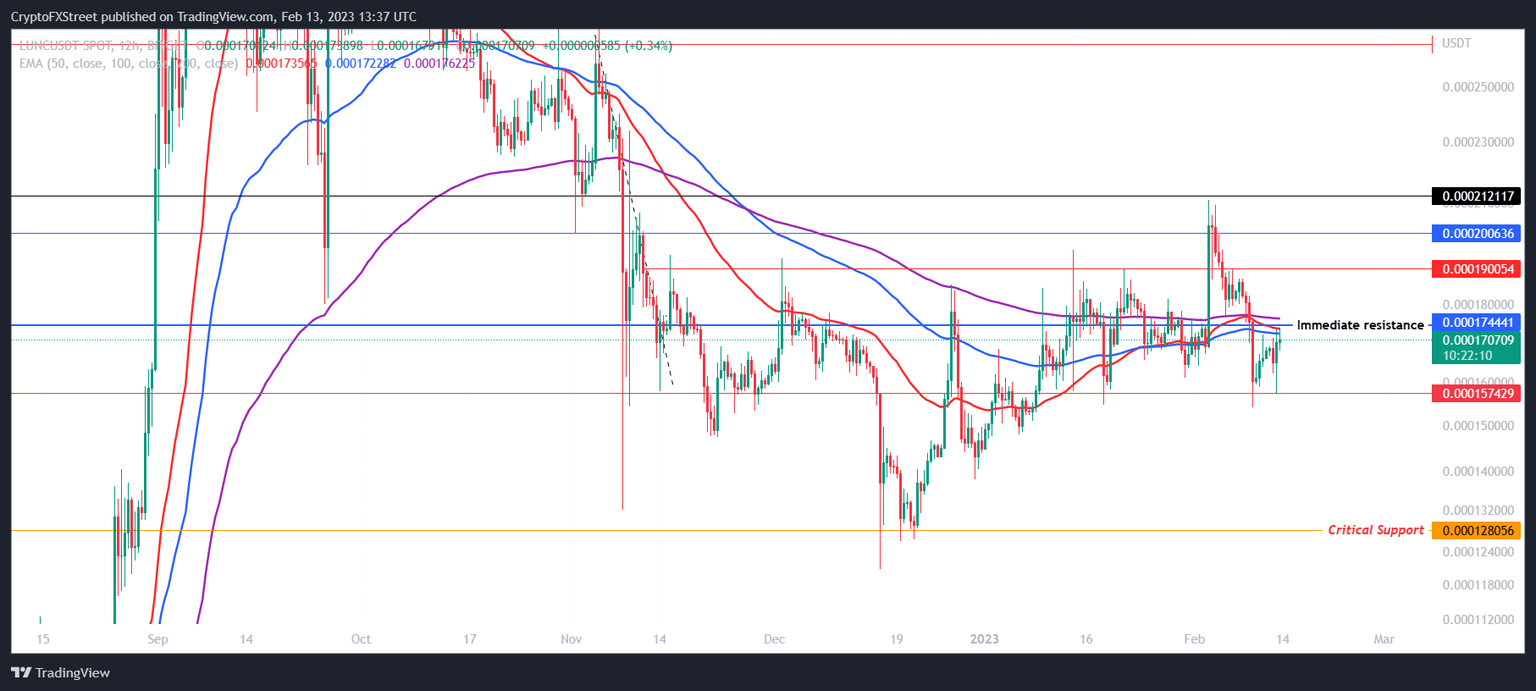

LUNA Classic slipped by more than 20% over the last ten days to fall from $0.000200 to trade at $0.000170. After marking a six-month high, the altcoin fell back to tag the immediate support level at $0.000157. This decline in price was the result of the market cooling down following the rally, which might extend if the bears dominate the momentum.

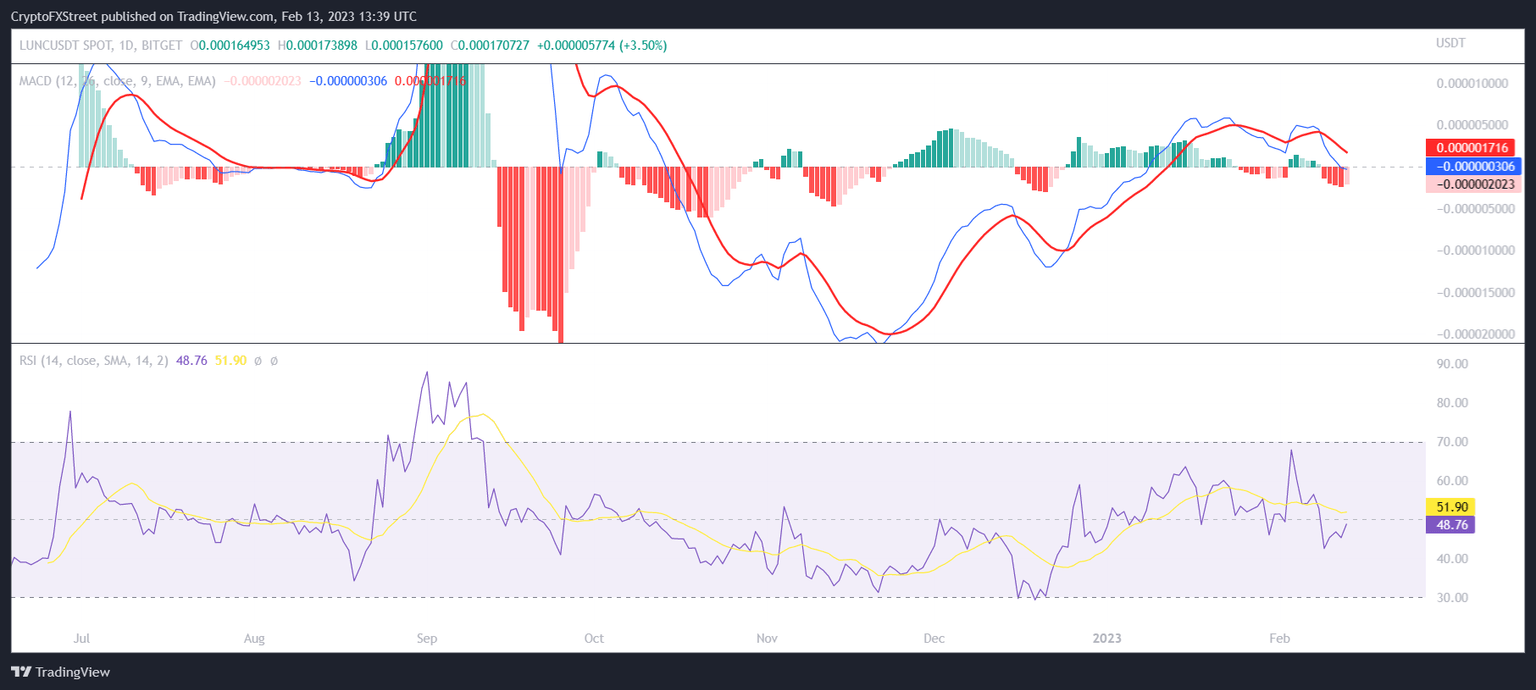

The Moving Average Convergence Divergence (MACD) indicator highlights bearish sentiment building up. As per the indicator, the LUNA Classic price underwent a bearish crossover nearly a week ago when the indicator line (blue) moved under the signal line (red).

A similar observation can also be made on the Relative Strength Index (RSI), which fell below the neutral mark of 50.0 into the bearish zone.

An excessive drawdown in prices might be out of the question for LUNC, however, as it is still far away from the deep bearish zone around the oversold region below 30.0.

LUNC MACD and RSI

If LUNA Classic price follows these signs and selling supersedes buying, the altcoin could end up tagging the immediate support level at $0.000157. Falling through this line would bring LUNC to the year-to-date lows of $0.000128, marking a 25% decline in value. Losing that support level would push the price below the $0.000120 mark.

LUNC/USDT 12-hour chart

However, if buyers pull through and push the price above the immediate resistance of $0.000174, it would flip the 50, 100 and 200-day Exponential Moving Averages (EMA) into support. Bouncing off of this support would bring the price up to tag $0.000190, and a daily candlestick close above it would invalidate the bearish outlook. Flipping it into support would bring LUNA Classic price near the six-month high of $0.000200.

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.