Terra Classic community ends minting of USTC tokens, opens doors to token burn

- Terra Classic community votes in favor of a proposal to end the minting and reminting of USTC tokens.

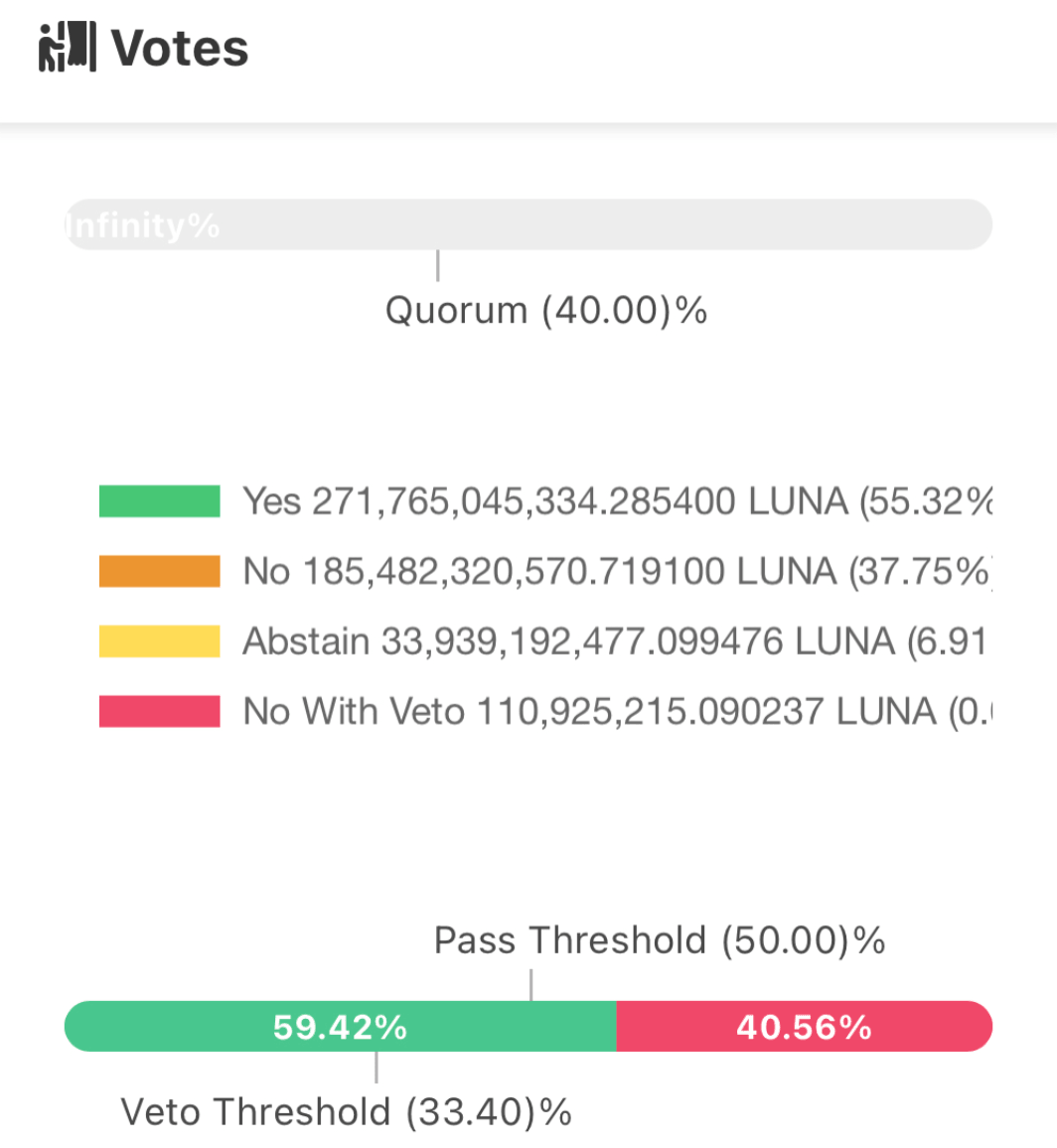

- 59% of voters favor a proposal that paves way for USTC token burn, similar to LUNC.

- LUNC prints 6% gain for holders over the past week.

Terra Classic community recently concluded the voting process for a proposal that helps determine the future of Terra Classic USD (USTC) tokens.

With 59% of the community’s voters in favor of the proposal, USTC minting and reminting will be done only with the permission of the community. This sets the foundation for reestablishing USTC peg.

Also read: Top 5 cryptocurrencies in the buy zone ARB, ADA, PEPE, SHIB, COMP: Santiment analysts

Terra Classic community gears up to re-establish USTC peg

Nearly a year after the collapse of the Terra LUNA tokens, the community of Terra Classic LUNC has voted on a proposal to take charge of the minting and reminting of the stablecoin USTC.

Centralized exchanges like Binance took up the initiative of burning Luna Classic tokens in the past, on a monthly basis, to reduce the circulating supply. This supported a recovery of LUNC tokens. The community has now agreed upon a similar course of action for USTC tokens.

Exchanges can now take up the initiative to burn existing USTC supply, since minting and reminting of the stablecoin will require permission from the LUNC community.

59% of the voters are in favor of the proposal with 7% of the community members refusing to vote.

Voting process concludes with majority in favor

Why the community is likely to favor re-establishing USTC peg

Until May 2022, Terra ecosystem users seamlessly swapped between USTC and LUNA tokens. When the events unfolded, the network crumbled and the sister tokens suffered a negative impact.

USTC lost its 1 USD peg, and mass minting of LUNA tokens to restore stability in the ecosystem resulted in a major oversupply of the stablecoin. This increased pressure on USTC price and pushed it far below its intended $1 peg.

At the time of writing, 1 USTC is the equivalent of $0.0125. LUNC price is up 6% over the past week, however, and it is exchanging hands at $0.000061 on Binance.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.