Top 5 cryptocurrencies in the buy zone ARB, ADA, PEPE, SHIB, COMP: Santiment analysts

- Arbitrum, Cardano, Pepe, Shiba Inu and Compound have notably low activity in their tokens, according to on-chain analysts at Santiment.

- Analysts state that cold assets with low levels of activity in the past 90 days are in the buy zone.

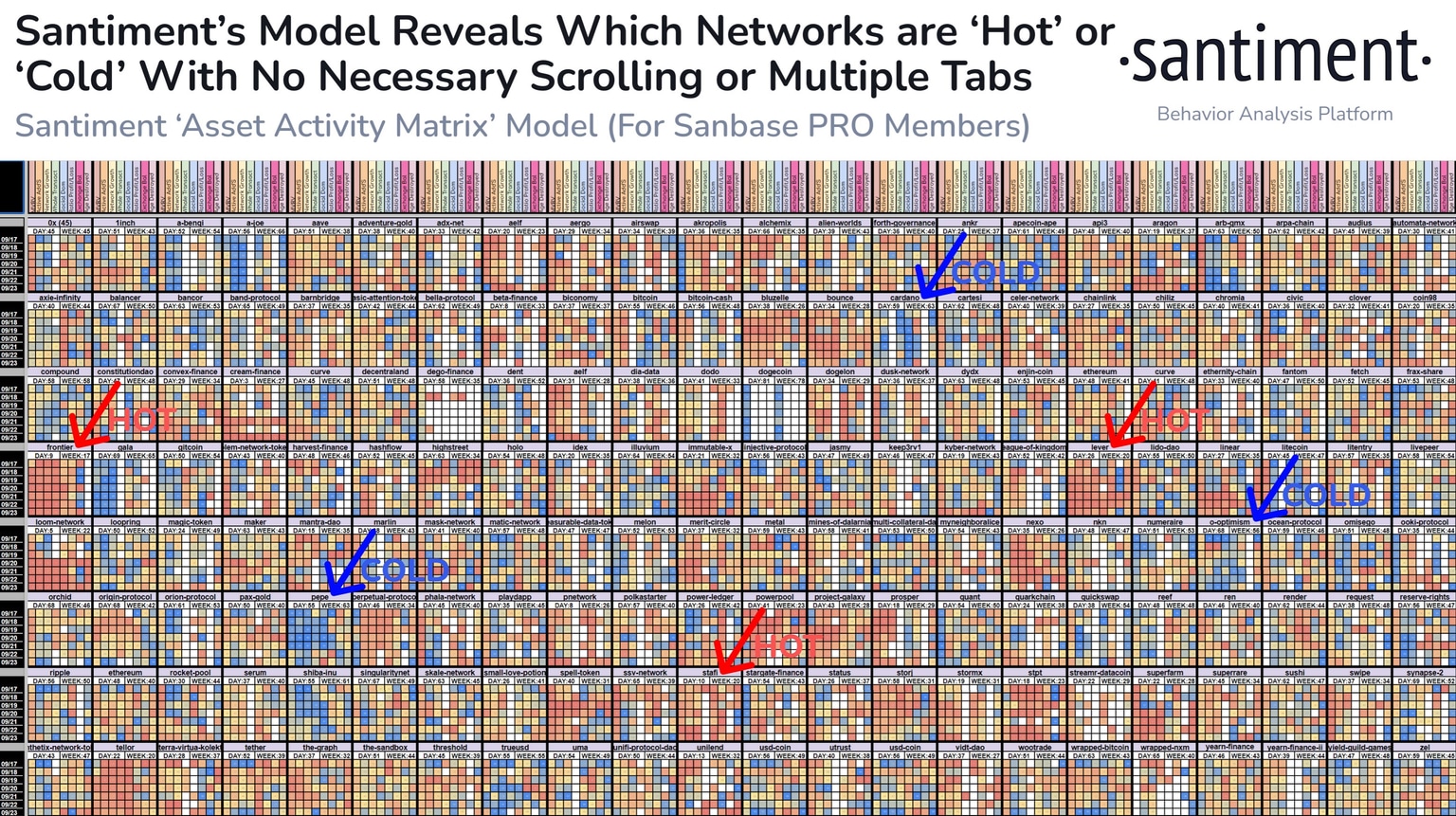

- Among 180 altcoins, ARB, ADA, PEPE, SHIB and COMP stood out as the coldest assets, as seen in the asset activity matrix.

Bitcoin price tumbled to $26,110, early on Monday, traders are likely to shift their attention to altcoins, looking for price gains. On-chain intelligence tracker Santiment, developed an “Asset Activity Matrix,” a tool that compares over 180 altcoins, to identify assets with high and low activity.

The tool can be used to identify altcoins that are in the buy zone and likely have the potential to yield gains for holders. Based on data for the past 90 days, Arbitrum (ARB), Cardano (ADA), PEPE meme coin, Shiba Inu (SHIB) and Compound (COMP) are the top five altcoins in the list.

ARB, ADA, PEPE, SHIB and COMP are in the buy zone

Analysts at Santiment classified altcoins as hot and cold, based on the activity in the protocol. Higher activity assets are associated with profit-taking and “selling,” similarly cold assets are in the “buy zone.”

Altcoins ARB, ADA, PEPE, SHIB and COMP, stand out in the asset activity tracker, as cold assets. These tokens have recorded notably low levels of activity from users, in the past 90 days.

In the chart below, a higher density of blue squares is an easy way to identify cold assets, similarly yellow, orange and deep orange squares help define hot assets.

Santiment Asset Activity Tracker

Notable developments in the cold assets are Chainlink mainnet rollout on Arbitrum One, Cardano’s consistent development activity on Github, PEPE price recovery after mass sell-off by former team members, and Shibarium relaunch, among others. These developments are likely to catalyze a recovery in the assets that are in the buy zone.

Bitcoin, altcoins, stablecoins FAQs

What is Bitcoin?

Bitcoin is the largest cryptocurrency by market capitalization, a virtual currency designed to serve as money. This form of payment cannot be controlled by any one person, group, or entity, which eliminates the need for third-party participation during financial transactions.

What are altcoins?

Altcoins are any cryptocurrency apart from Bitcoin, but some also regard Ethereum as a non-altcoin because it is from these two cryptocurrencies that forking happens. If this is true, then Litecoin is the first altcoin, forked from the Bitcoin protocol and, therefore, an “improved” version of it.

What are stablecoins?

Stablecoins are cryptocurrencies designed to have a stable price, with their value backed by a reserve of the asset it represents. To achieve this, the value of any one stablecoin is pegged to a commodity or financial instrument, such as the US Dollar (USD), with its supply regulated by an algorithm or demand. The main goal of stablecoins is to provide an on/off-ramp for investors willing to trade and invest in cryptocurrencies. Stablecoins also allow investors to store value since cryptocurrencies, in general, are subject to volatility.

What is Bitcoin Dominance?

Bitcoin dominance is the ratio of Bitcoin's market capitalization to the total market capitalization of all cryptocurrencies combined. It provides a clear picture of Bitcoin’s interest among investors. A high BTC dominance typically happens before and during a bull run, in which investors resort to investing in relatively stable and high market capitalization cryptocurrency like Bitcoin. A drop in BTC dominance usually means that investors are moving their capital and/or profits to altcoins in a quest for higher returns, which usually triggers an explosion of altcoin rallies.

Like this article? Help us with some feedback by answering this survey:

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.