SUI Price Forecast: Fresh all-time high likely, fueled by increased chain activity

- Sui hovers around $2.08 on Wednesday after bouncing from a key support level on Monday, signaling chances of hitting a new all-time high in the short term.

- TVL value is rising, indicating more users deposit or use assets within SUI-based protocols.

- SUI’s decentralized exchange trading volume is increasing, suggesting a surge in traders’ interest and liquidity in the SUI ecosystem.

Sui (SUI) price trades around $2.08 on Wednesday after retesting key support and rallying 17% on Tuesday, signaling the potential for a new all-time high in the short term.

This bullish momentum is further bolstered by rising Total Value Locked (TVL) and increased decentralized exchange (DEX) trading volume, reflecting heightened trader activity and usage of the SUI ecosystem.

SUI Price Forecast: Eyes for new all-time high

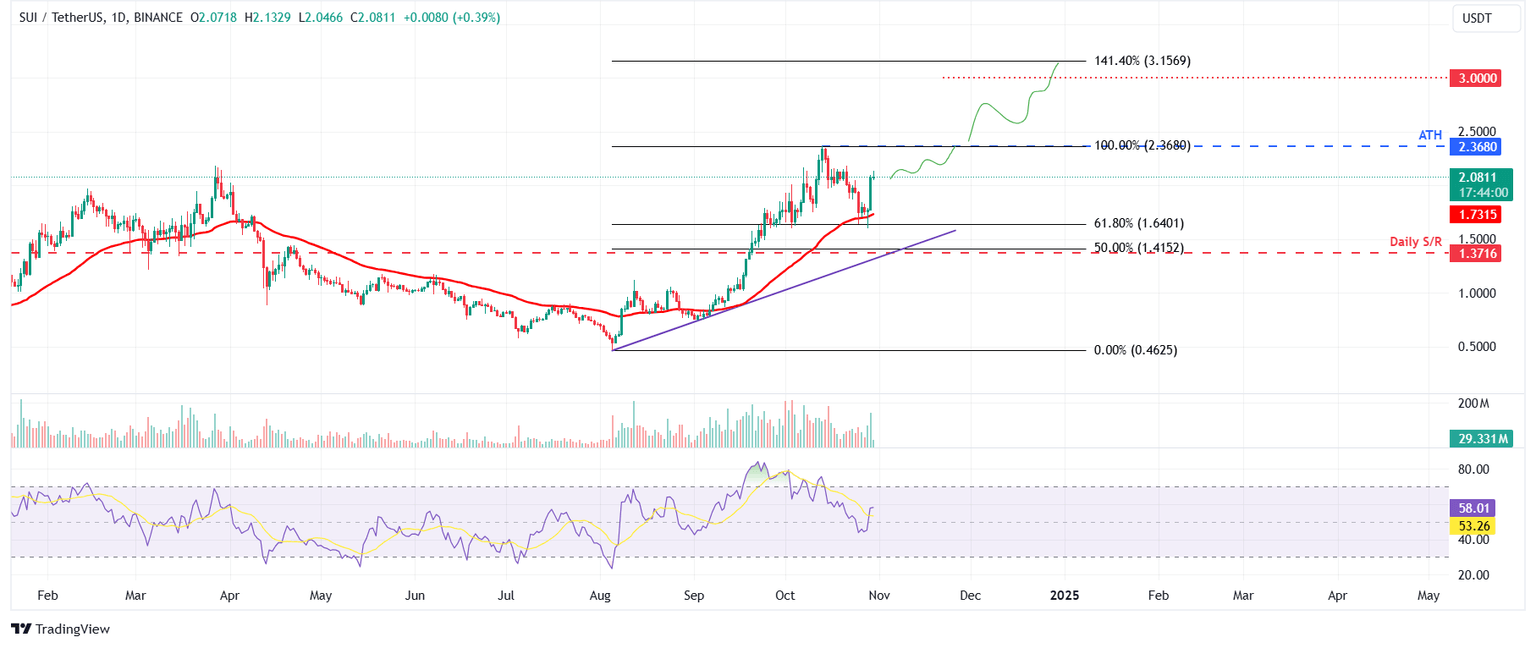

Sui's price crashed over 25% after reaching a new all-time high (ATH) of $2.36 on October 13. However, on Monday, it retested and found support around its 61.8% Fibonacci retracement level at $1.64, rallying over 17% on Tuesday. This level roughly aligns with the 50-day Exponential Moving Average (EMA) at around $1.73, making it a key reversal zone. As of Wednesday, it continues to trade higher around $2.08.

If SUI maintains its upward momentum, it may soon rally to retest its next key barrier of $2.36, the ATH. A successful close above this level could pave the way for SUI to target the 141.40% Fibonacci extension level at $3.15. However, traders could opt to book some profit around its key psychologically important level of $3.00.

The Relative Strength Index (RSI) on the daily chart reads 58, above its neutral level of 50 and pointing upwards, reflecting that bullish momentum is gaining traction.

SUI/USDT daily chart

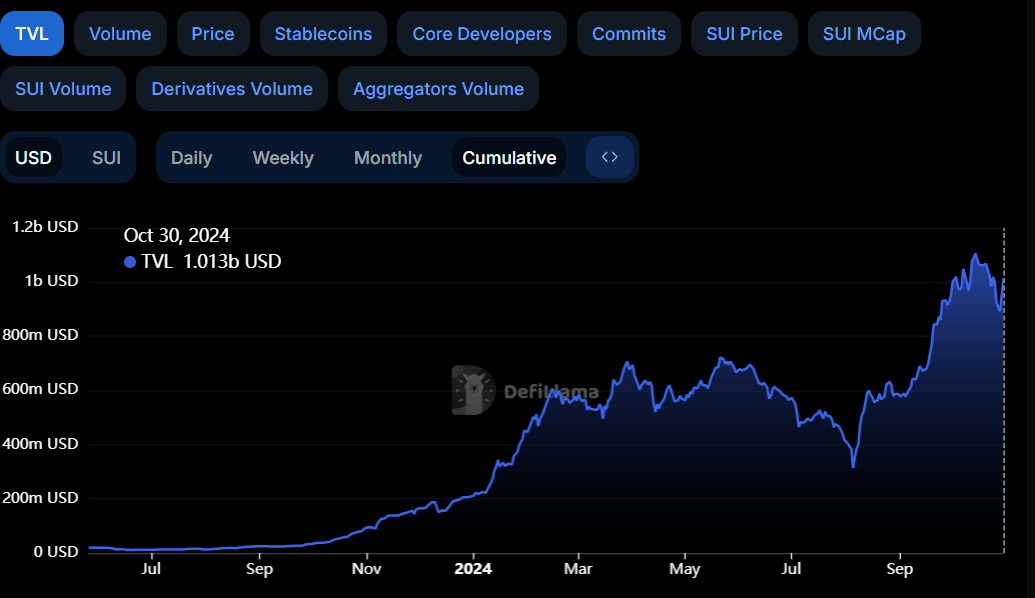

Crypto aggregator platform DefiLlama data shows a bullish outlook for Sui. The data shows that Sui’s TVL increased from $892 million on Monday to $1.01 billion on Wednesday, the highest level since October 24 and close to an all-time high.

An increase in TVL suggests that the Sui blockchain ecosystem is becoming more active for users. It supports the bullish view by indicating that more users deposit or use assets within SUI-based protocols.

SUI TVL chart. Source: DefiLlama

Another aspect bolstering the platform’s bullish outlook is a recent surge in traders’ interest and liquidity in the SUI ecosystem. Artemis Terminal data shows that SUI’s decentralized exchange (DEX) trading volume rose from $96.6 million on Sunday to $204.9 on Tuesday, the highest since October 16.

-638658740125866853.jpg&w=1536&q=95)

SUI DEX Trading Volumes chart. Source: Artemis Terminal

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.