Three reasons why SUI could continue its ongoing rally

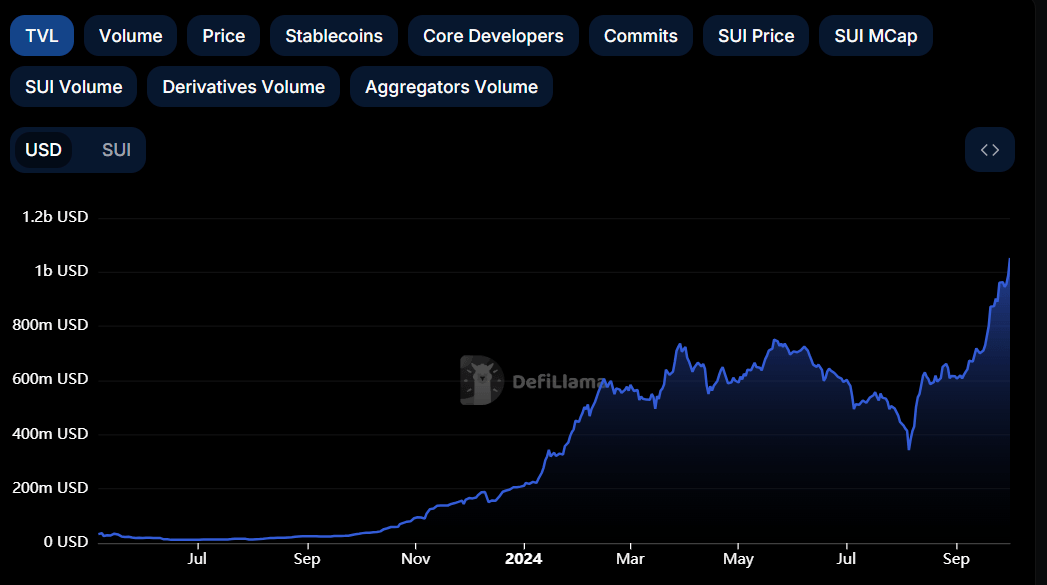

- DefiLlama data shows that SUI TVL reached a new ATH of $1.05 billion.

- SUI’s open interest is also rising, suggesting that new buying is occurring.

- Sui’s daily active addresses increased, indicating greater blockchain usage.

Sui (SUI) is extending its gains, trading at $1.9 at the start of the new month after a sharp rise last month. This bullish momentum could continue, driven by a new all-time high in Total Value Locked (TVL), rising open interest, and an uptick in daily active addresses.

Sui bulls remain strong as on-chain metrics indicate sustained momentum

Crypto aggregator platform DefiLlama data shows a bullish outlook for Sui. The data shows that Sui’s TVL increased from $663.87 million in mid-September to $1.05 billion on October 1, making a new all-time high (ATH).

An increase in TVL suggests that the Sui blockchain ecosystem is becoming more active and interesting to users. It supports the bullish view by indicating that more users deposit or use assets within SUI-based protocols.

SUI TVL chart

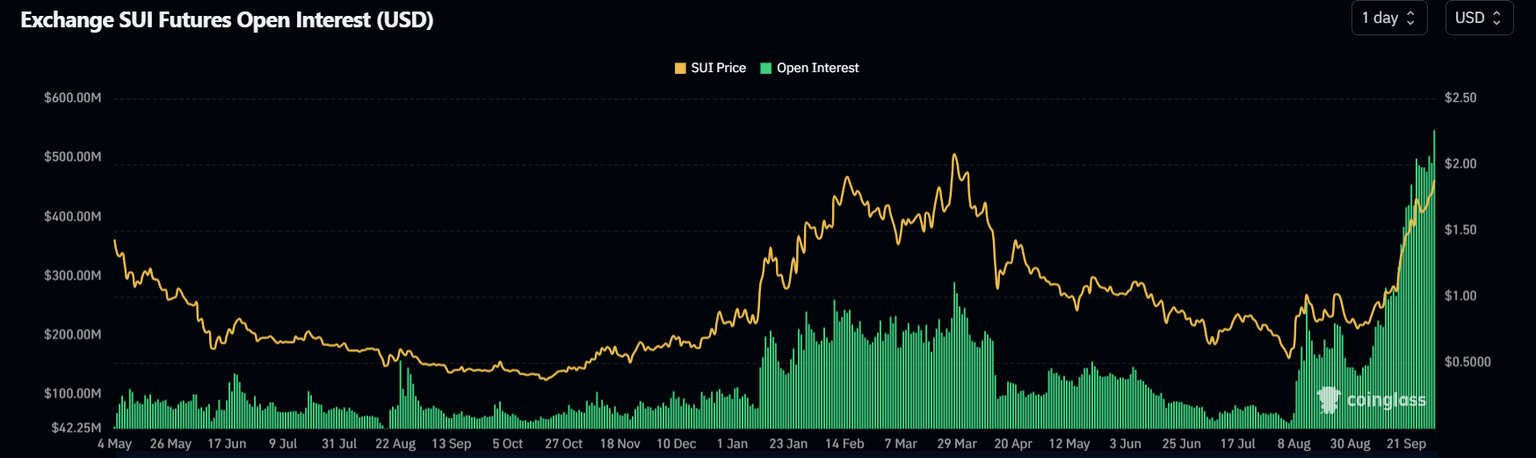

Sui’s Open Interest (OI) data further supports the bullish thesis. Coinglass’s data shows that the futures’ OI in Sui at exchanges has reached the highest level since May. The OI indicates the total number of outstanding derivative contracts that have not been settled (offset by delivery) and whether money flows into the contract are increasing or decreasing.

Increasing OI represents new or additional money entering the market and new buying, which suggests a bullish trend. On the contrary, when OI decreases, it is usually a sign that the market is liquidating, more investors are leaving, and prices may decrease.

The graph below shows that Sui’s OI increased from $418.73 million on September 24 to $553.82 million on Tuesday, the highest level since May. This rise indicates that new or additional money is entering the market and new buying is occurring.

SUI Open Interest chart

Artemis’s Daily Active Addresses data, which tracks network activity over time, paints a bullish picture for Sui. A rise in the metric signals greater blockchain usage, while declining addresses point to lower demand for the network.

In SUI’s case, Daily Active Addresses rose from 804,400 on September 11 to 1.6 million on September 24, the highest level since the end of May. This indicates that demand for Sui’s blockchain usage is increasing, which bodes well for Sui's price.

-638633545895483532.jpg&w=1536&q=95)

SUI Daily Active Addresses chart

Author

Manish Chhetri

FXStreet

Manish Chhetri is a crypto specialist with over four years of experience in the cryptocurrency industry.