Solana upside potential hanging by a thread on support going into next week

- Solana price is on the verge of falling another leg towards $61.44.

- SOL price could be set to shed another 35% next week.

- If SOL price closes the week below the monthly S2 at $90.23, expect more downside next week.

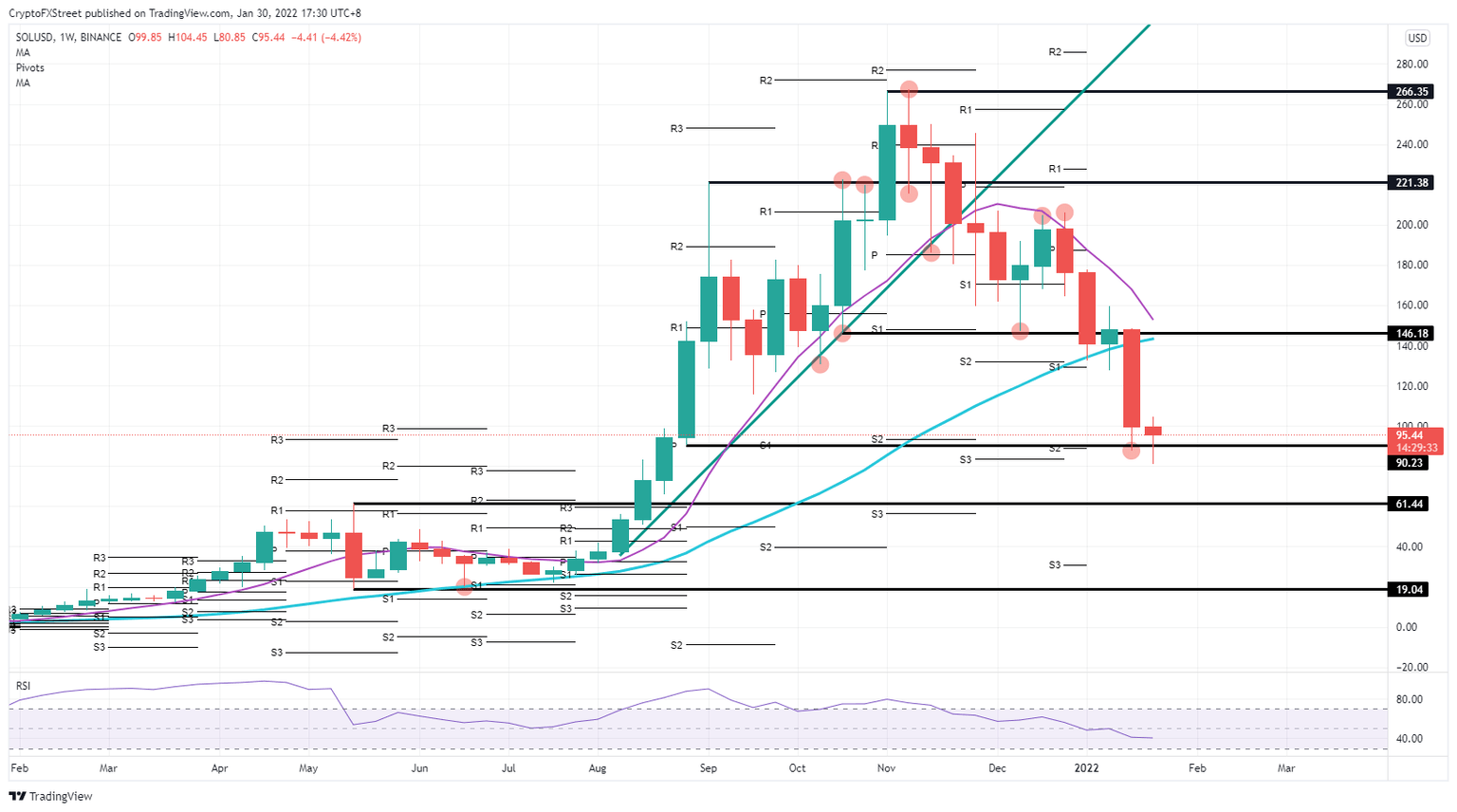

Solana (SOL) is on the verge of opening another can of losses as the price looks set to close the trading week below the monthly S2 at $90.23. This close would set the scene going into next week for another leg lower, with first support at $61.44, almost 35% away. It all depends on the weekly close and the appetite of bulls to get involved at the moment.

Solana has its RSI still holding more potential for bears, which in turn scares bulls

Solana price is on the verge of breaking and closing below last week's low. With that, it stands to close below the S2 support level and the low of the last week of August last year. All quit bearish signals that are signalling another leg lower. It does not come as a surprise after a very volatile week with plenty of geopolitics and central bank decisions that make investors worried about the risk sentiment.

SOL price thus looks not containable at these levels. Should SOL close below the level mentioned above, expect the price action to nudge further lower next week and find its first test of support at $61.44. That level was the high of mid-May and got broken to the upside into the summer rally of 2021 and has not been tested for support since.

SOL/USD weekly chart

A close above the monthly S2 support would stem bulls more positive and see no hesitation in joining the price action. It would signal healthy interest from market participants to support price action at these levels and would be able to shake off the dark mood of the global markets. Although the level is quite stretched, and depending on the number of tailwinds, to the upside, the level at $140 looks very interesting with the 200-day Simple Moving Average (SMA)as a cap on the price action.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.