Solana price shows reversal signs but bears still maintain control

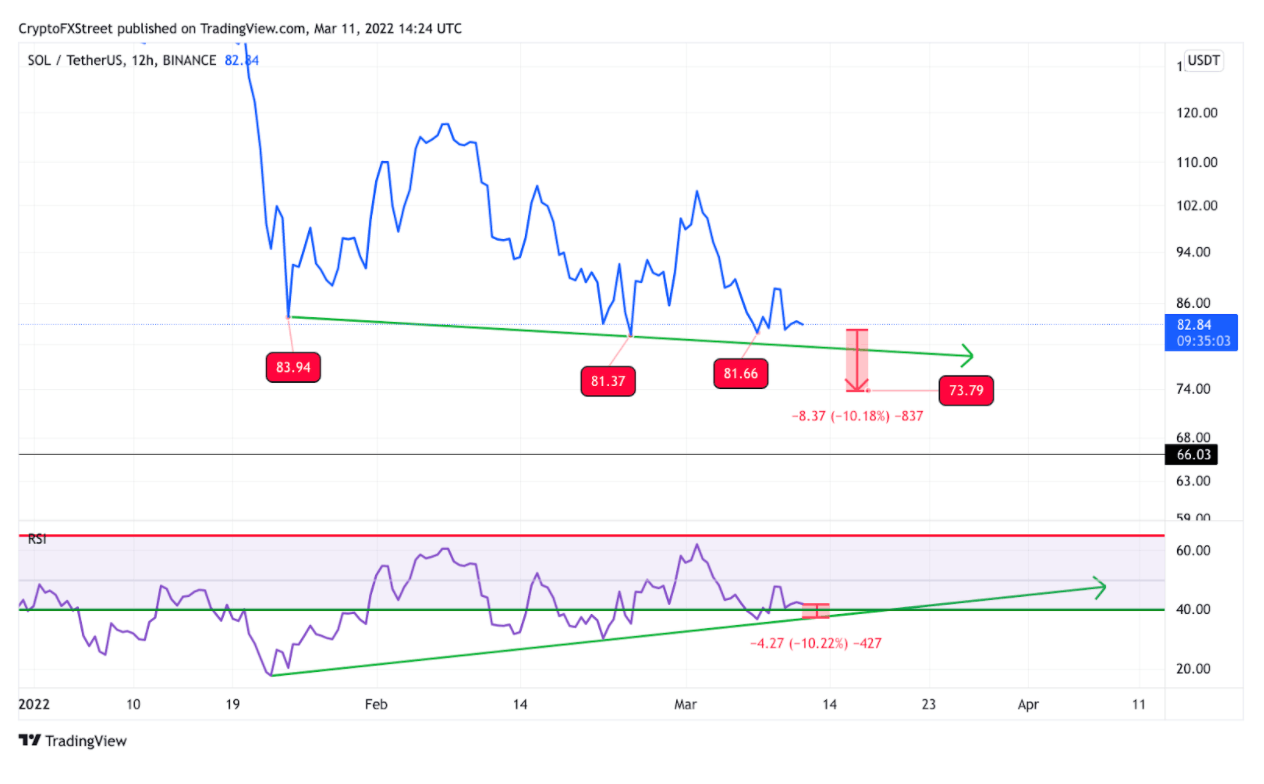

- Solana price action is currently printing a triple bottom.

- There is potential for bears to push SOL price 10% lower.

- A decisive close below $71 could lead to further losses.

Solana price has been one of the more volatile digital assets in the crypto market lately after opening and closing market sessions between $80 and $100 for several weeks. Still, bullish traders may want to consider playing it safe as SOL price hints that a market bottom could occur in the low $70 range.

Solana price must be approached with caution

Solana price could be leaving investors feeling optimistic as it has been able to maintain support for the third time in weeks at $80. Secondly, the Relative Strength Index displays bullish divergence with SOL price on the 12-hour chart, which should add more confidence that a market bottom is near.

SOL/USDT 12-Hour Chart

Before Investors start adding into their positions, it is worth noting that the RSI still has about 10% of space to fill from Solana price of $80. A sell-off into the low $70s should be one to watch very closely.

Solana investors should also be aware that RSI divergence is derived from opening and closing prices, which is why this thesis is based on the 12-hour line graph chart.

Any wicks on Solana price below $71 should be considered buying opportunities. But a 12-hour close below $71 will be the first key invalidation for SOL’s bullish outlook. Should a close below $71 occur, then it is likely Solana price will challenge the $65 and $60 zones shortly after.

Author

FXStreet Team

FXStreet