Solana price prepares for a 20% breakout as SOL consolidates

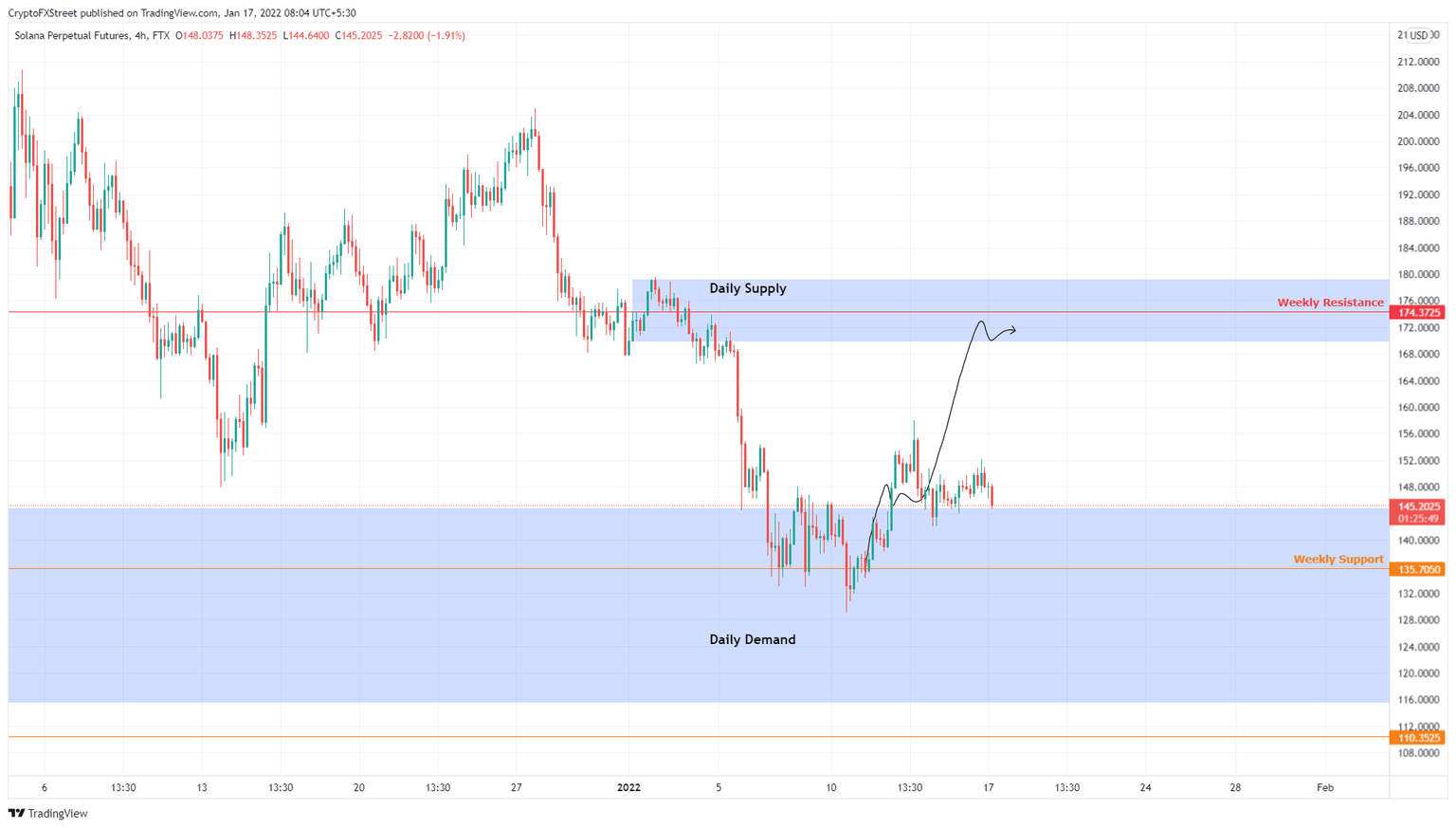

- Solana price is revisiting the $115.51 to $144.70 demand zone, hoping for an uptrend.

- A bullish reaction from this barrier will likely result in a 20% ascent to the weekly resistance barrier at $174.37.

- A four-hour candlestick close below the $115.50 barrier will invalidate the bullish thesis for SOL.

Solana price has been consolidating close to a daily demand zone, suggesting a lack of buying pressure despite the obvious. The lack of volatility suggests accumulation or a genuine lack of buyers. If it is the former, investors can expect SOL to break out from this consolidation and kick-start a massive run-up.

Solana price contemplates a move higher

Solana price has traded close to the daily demand zone, extending from $115.51 to $144.70 for more than three days. This price action has created a consolidation that suggests that buyers are either accumulating or lack the momentum to kick-start an uptrend,

As mentioned above, if it is the former, there is a good chance Solana price will break out from this sideways movement and trigger an uptrend.

The resulting bull rally will eye a retest of the daily supply zone, stretching from $169.79 to $179.19. However, market participants can expect SOL to pierce this resistance area and tag the weekly resistance barrier at $174.37.

In total, this run-up would constitute a 20% ascent from the current position - $145.20. Proof for further uptrend is not available, so one can assume that $174.37 is likely where Solana price will form its local top.

SOL/USDT 4-hour chart

On the other hand, if the consolidation fails to break out, it would indicate a lack of buying pressure from the participants. This failure to act from the bulls’ part would signal weakness, allowing sellers to take control, triggering a downtrend to the weekly support level at $135.70.

If the bulls fail to respond here and SOL produces a four-hour candlestick close below the $115.50 barrier, it will create a lower low, invalidating the bullish thesis. In this case, Solana price will likely retest the $110.30 support floor. Here the bulls could give the uptrend another go.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.