Solana Price Prediction: Is SOL the altcoin to buy this bull cycle?

- Solana price maintains its gains despite a broader market crash.

- SOL could climb 7% to the $200 psychological level last tested in December 2021.

- A break and close below $133.80 support level would invalidate the bullish thesis.

While the bullish outlook prevails in the cryptocurrency market, the journey has been tumultuous since the fourth quarter of 2023. Bitcoin (BTC) price has led the volatility with altcoins following close behind. Through it all, however, Solana has been the outlier, resisting the trends and forging a path for itself.

Also Read: Solana-based MYRO is an outlier, soars almost 70% despite meme coins crashing

Solana shows resilience despite market crash

Solana has made headlines many times since Q4 of 2023, riding on multiple themes starting with its contention against Ethereum. Solana’s competitive edge over Ethereum was the low transaction fees, which made SOL dominate major Ethereum Virtual Machine (EVM) chains for daily decentralized exchange (DEX) traders.

$SOL dominates major EVM chains for daily DEX traders.

— Kyledoops (@kyledoops) March 14, 2024

Thanks to low fees and a thriving memecoin community, it's the go-to choice! pic.twitter.com/nPRzXXATLp

The narrative eventually transitioned to meme coins on the Solana blockchain, because it became the base atop which multiple projects were built.

Myro (MYRO), Bonk Inu (BONK) and Dogwifhat (WIF) are among the meme coins that made the trend on Solana, making it impossible to ignore SOL.

Solans meme coins $SOL

— Crypto Banter (@crypto_banter) March 12, 2024

$WIF

$BONK

$MYRO

$SAMO

$DUKO

$PONKE

$HARAMBE

$STAN

$WEN

$POPCAT

$LOAF

$CHONKY

$SMOG

$SILLY

$SOLAMA

$HONK

$PENG

Holding any? pic.twitter.com/Lvmf2GOecu

With these two fundamentals, the whole Solana ecosystem has found itself trending on DEX Screener. For the layperson, this means that SOL is experiencing a significant level of trading activity or price movement relative to other assets listed on the DEX.

With such elevated market interest and attention, the network is bound to experience more active participation from traders and investors. This could influence Solana price as well as broader market dynamics.

SOL on DEX Screener

Solana weighted funding rate drops

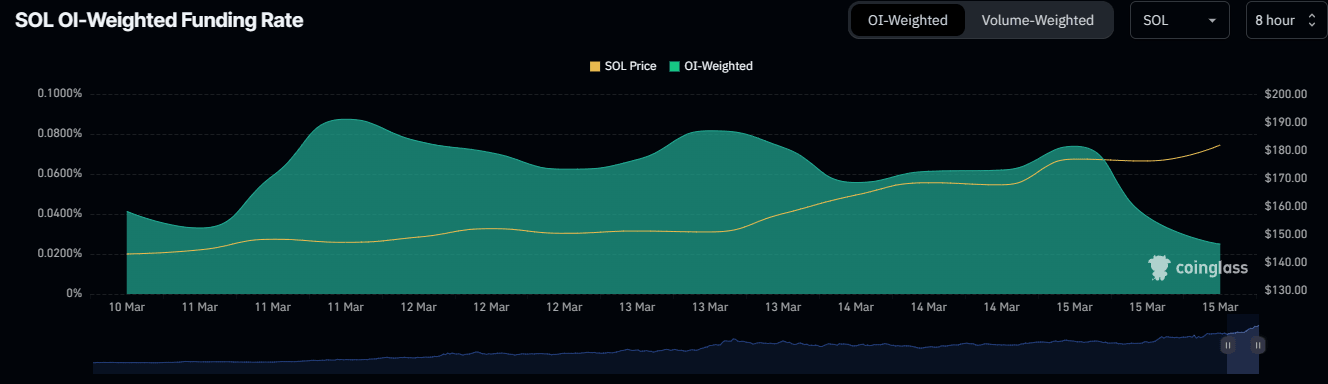

Data according to Coinglass shows a significant drop in the weighted funding rate of Solana, moving from $191 to around $145 between March 11 and 15. This drop indicates that the overall cost of funding long positions in the Solana market has decreased.

Implications for this are such that traders holding long positions in Solana perpetual futures contracts will pay lower funding fees. This is beneficial for long traders as it lowers their overall cost of maintaining their positions.

Notably, this could also play in favor of bulls as dwindling funding rates also allude to decreased demand for long positions or increased availability of funds for lending, influencing the funding rate to decrease.

SOL funding rate

Open Interest, funding rate FAQs

Higher Open Interest is associated with higher liquidity and new capital inflow to the market. This is considered the equivalent of increase in efficiency and the ongoing trend continues. When Open Interest decreases, it is considered a sign of liquidation in the market, investors are leaving and the overall demand for an asset is on a decline, fueling a bearish sentiment among investors.

Funding fees bridge the difference between spot prices and prices of futures contracts of an asset by increasing liquidation risks faced by traders. A consistently high and positive funding rate implies there is a bullish sentiment among market participants and there is an expectation of a price hike. A consistently negative funding rate for an asset implies a bearish sentiment, indicating that traders expect the cryptocurrency’s price to fall and a bearish trend reversal is likely to occur.

Solana price outlook amid dwindling funding rate

Solana price is attempting to reclaim the December 2021 peak around $200 with the market leaning in favor of the upside. The volume indicator is recording large histogram bars, which shows that the predominant trend is gaining strength.

Also, the histograms of the Awesome Oscillator (AO) are flashing green while holding above the midline. The ascending Relative Strength Index (RSI), showing momentum is rising, accentuates this. Increased buying pressure could see Solana price reach the $200 psychological level, 7% above current levels.

In a highly bullish case, Solana price could clear this roadblock, before extending a neck higher to the $258.93 range high, a level last tested in November 2021.

SOL/USDT 1-day chart

On the flipside, if traders start booking profits after the nearly 40% gains witnessed since early December, Solana price could extend the fall.

For the bullish thesis to be invalidated, however, SOL price must break and close below the $133.80 support level, which coincides with the 50% Fibonacci placeholder. Such a move would constitute a 30% drop below current levels.

Read More: Solana, meme coins and AI tokens post daily gains, withstanding crypto market retreat

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.