Solana, meme coins and AI tokens post daily gains, withstanding crypto market retreat

- Bitcoin price dipped below the $68,000 mark for the first time since March 8, triggering a crypto market bloodbath.

- Solana and Solana-based meme coins rallied on Friday despite the decline seen in other altcoins.

- Traders are weighing the risk of buying the dip in Bitcoin and altcoin prices, according to on-chain metrics.

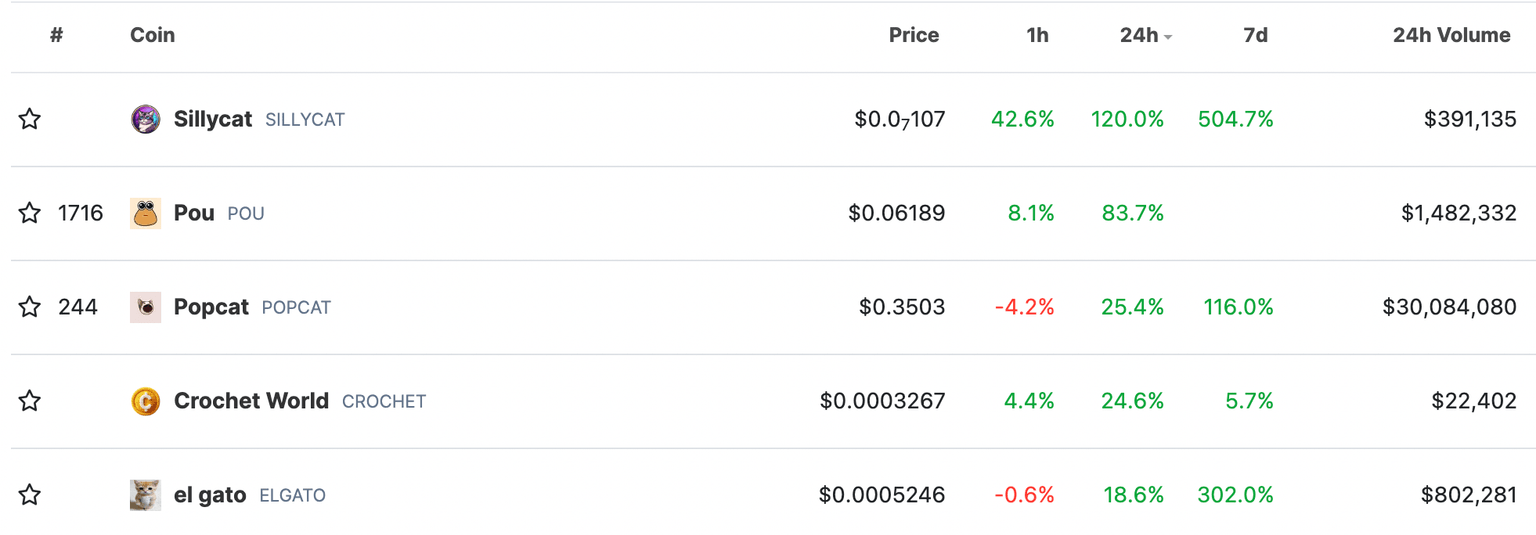

Solana (SOL) and Solana-based meme coins such as Dogwifhat (WIF), Sillycat (SILLYCAT) or Popcat (POPCAT) observed an increase in price on Friday. Bitcoin (BTC) price correction triggered a market-wide crash and most altcoins wiped out their weekly gains on the daily time frame.

Also read: Solana based tokens make comeback riding on potential airdrops and meme coin frenzy

Solana and meme coins beat crypto market decline

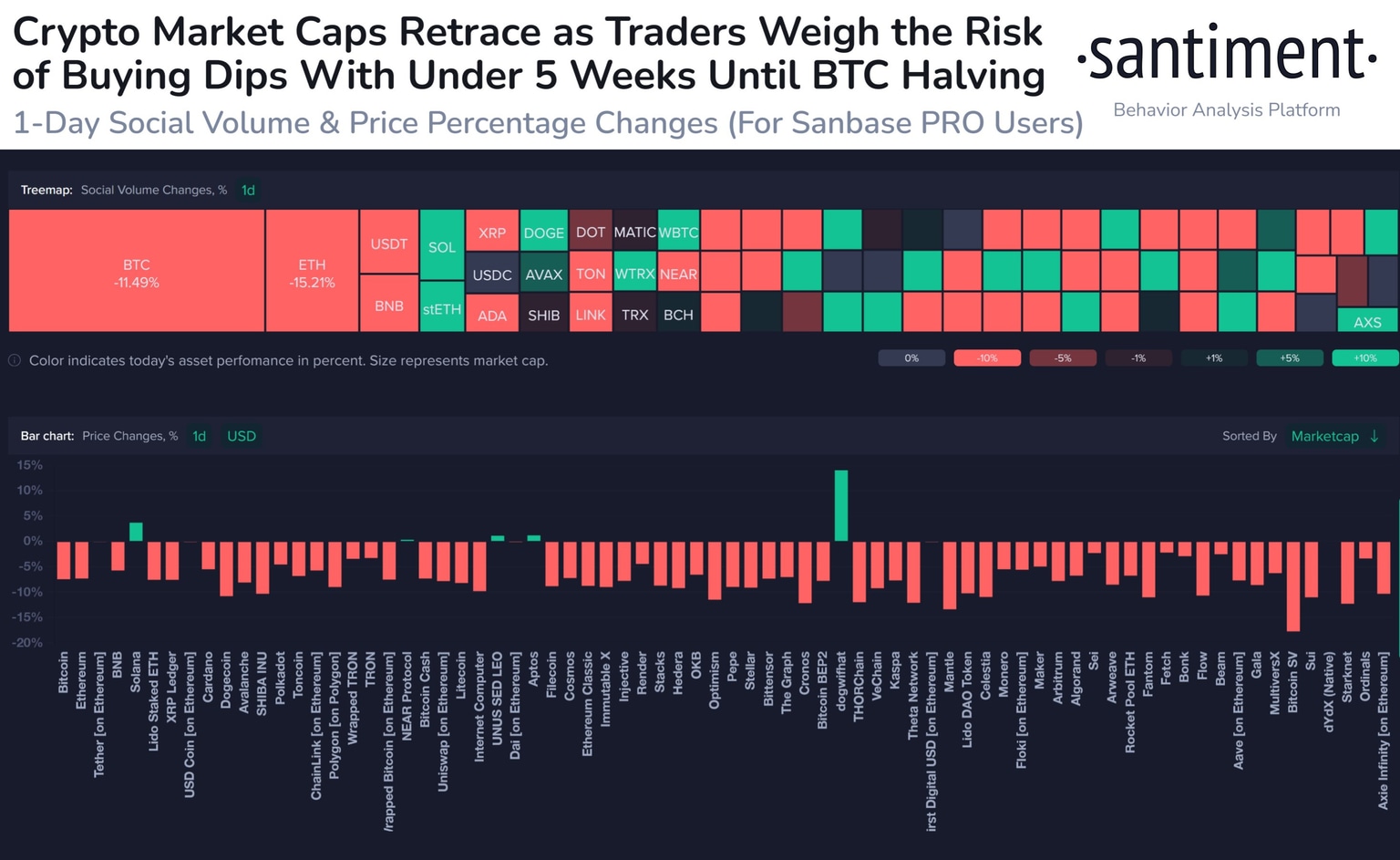

Friday marks the first day since March 8 that Bitcoin price dropped to a low of $66,699. This likely catalyzed a meltdown in the crypto market, and most altcoins in the top 30 suffered a price correction. In this marketwide bloodbath, Solana and meme coins from the SOL ecosystem emerged as outliers, data from Santiment shows.

Crypto market bloodbath and Bitcoin price decline. Source: Santiment

SOL-based meme coins like WIF, SILLYCAT and POPCAT, climbed despite the market-wide correction in the crypto.

Solana based meme coins. Source: CoinGecko

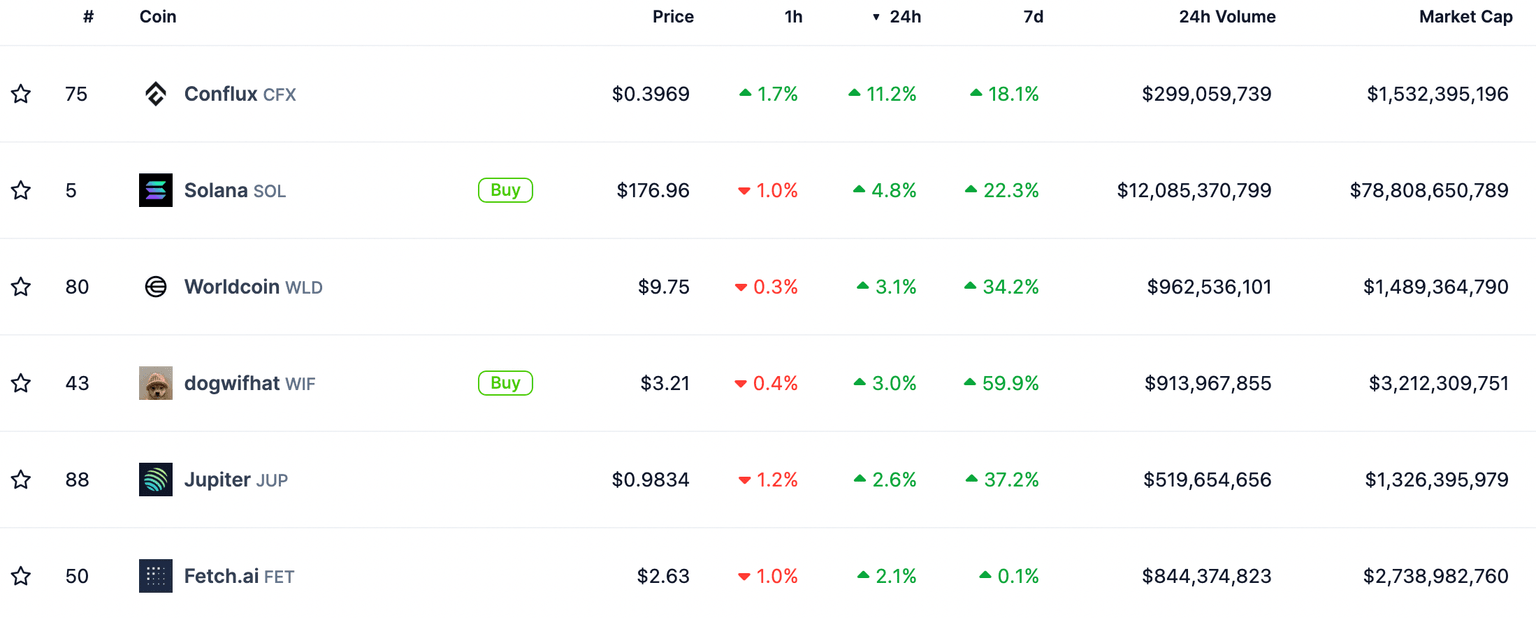

Solana and the AI token category seem unaffected by Bitcoin’s recent correction. CoinGecko data shows between 2% and 11% gains in Conflux (CFX), Solana (SOL), Worldcoin (WLD), Jupiter (JUP), and Fetch.ai (FET).

AI tokens, Solana, Solana-based meme coin prices. Source: CoinGecko

Santiment analysts note that except for these anomalies in the market, most notable assets that rank in the top 30 by market capitalization, are being discussed for the prospect of “buying the dip” or “panic selling,” according to on-chain data tracked by the firm. Analysts state that a fair amount of uncertainty could trigger a crypto market bounce, as seen in previous instances.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.