Solana price is on its way to $100

- Solana price action is on the cusp of making a solid recovery as tailwinds have grown exponentially since yesterday across markets.

- Cheerful tones set the mood as investors jump on the occasion to be part of the possible turnaround.

- Expect to see at least 20% gains in the coming days with at least a test and a possible break to the upside above $100.

Solana price has brought back the bulls after a long absence since the excursion of Russia in Ukraine started. With bulls very active on the buy-side, absorbing almost every offer in sight, expect to see a continuation into the US session where the third wave of buying will be triggered. Expect that uplift to trigger a 15% profit at $95 for today, with a test of $100 by tomorrow or Friday, returning 20% to investors.

Solana price will not fade until it reaches that three-figure-quote

Solana price has refound the trick to shrug off current negative news and look beyond it towards what’s to come. Markets are starting to perceive that the future looks bright as peace talks are moving along, and Zelensky is speaking less harshly, with a commitment to give up some regions in Ukraine to preserve the rest of Ukraine from war. With a breakthrough not there yet, but more on the cards, investors are prepositioning already for the relief rally.

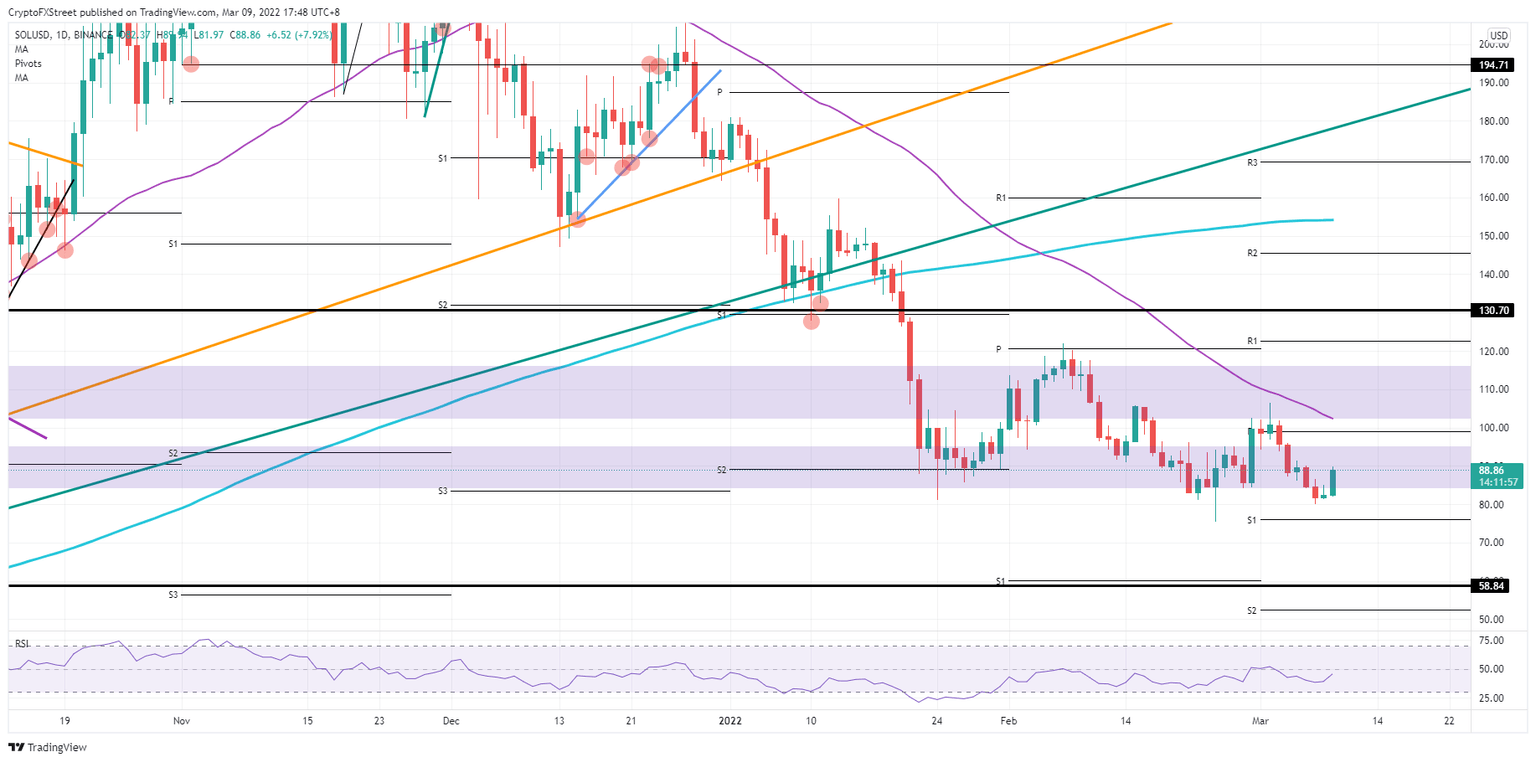

SOL price action will hit $95 today, probably once the influx of US traders starts adding more fuel to the current bullish motor. This will set up Solana price action for another pop higher towards $102 where the 55-day Simple Moving Average, and a former bandwidth range will come into play and provide a near-term cap on price action. The $100 barrier has been broken in the process, and that should signal another buy-opportunity to the markets.

SOL/USD daily chart

The rally could be short-lived as no truce or other definitive decisions have been made. There is a chance any upside move could bounce off $100 and the monthly pivot and get a firm rejection to the downside. SOL price would quickly retrace its gains and break below $80 towards $76, at the monthly S1 support level.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.